Fundamental analysis:

Hong Kong's Hang Seng Index closed down 650.07 points, or 2.69%, at 23,520.0 points on February 22 (Tuesday). The situation in Russia and Ukraine continued to stir the global market. Hong Kong stocks fell sharply again. Heavy technology stocks and major financial stocks fell together, dragging down market sentiment. Meituan fell by more than 5%, and fell by 22% on the 3rd. JD.com, Alibaba, Xiaomi all fell, and five major listed insurance companies including Ping An all fell; Hong Kong bank stocks fell sharply, and Hang Seng Bank fell by more than 10% after the performance. Worst of all, Foreign Ministry spokesman Wang Wenbin said at a regular press conference held today that State Councilor and Foreign Minister Wang Yi had a phone call with US Secretary of State Blinken at request this morning to exchange views on the nuclear issues in Ukraine and the Korean Peninsula. Wang Yi said that China is concerned about the evolution of the situation in Ukraine. China's position on the Ukraine issue is consistent. The legitimate security concerns of any country should be respected, and the purposes and principles of the UN Charter should be jointly safeguarded.

The evolution of the Ukraine issue so far is closely related to the delay in the effective implementation of the new Minsk agreement. China will continue to make contact with all parties based on the merits of the matter. The situation in Ukraine is getting worse. China once again calls on all parties to exercise restraint, recognize the importance of implementing the principle of indivisibility of security, ease the situation and resolve differences through dialogue and negotiation.

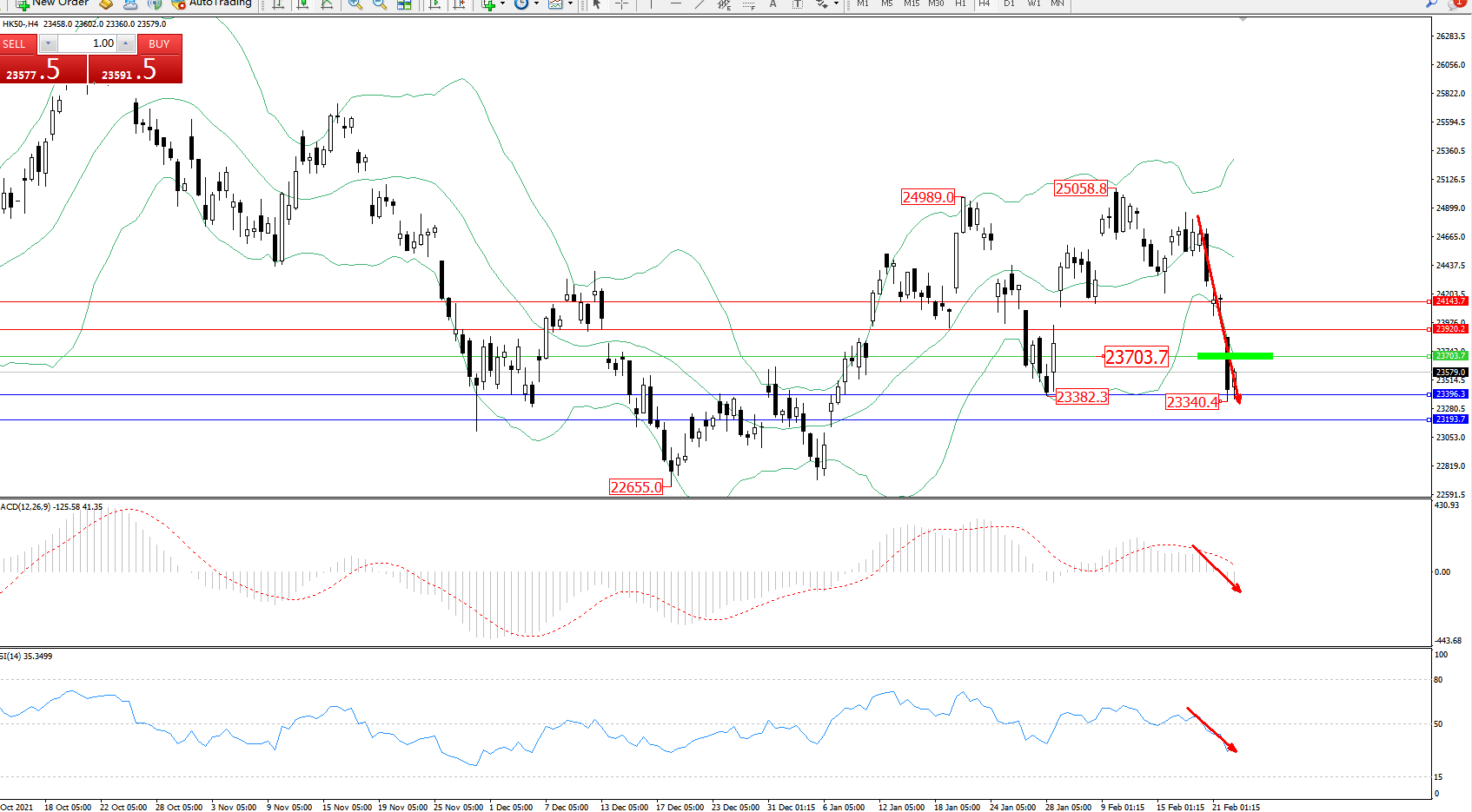

Hang Seng Index HK50 - 4-hour K-line chart shows:

Technical comments: The bearish momentum fell sharply, fell below the lower track of the Bollinger Bands indicator to 23340 and began to organize. It may remain at a low level in the short term, but the overall downward trend is good. The Bollinger Bands indicator continues to open and the MACD indicator is below the 0 axis. The bearish area continues to decline, and the RSI indicator is below the 50 equilibrium line and continues to move downward;

Long and short turning point: 23703

Suppression bit: 23920, 24143

Support level: 23396, 23193

Trading strategy: bearish below 23703, target 23396, 23193

Alternative strategy: bullish above 23703, target 23920, 24143

The above analysis is a personal opinion and is for reference only.

2022-02-23

2022-02-23

1144

1144

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia