FAQ

- Open an account for processing

- Deposit and withdraw funds

- Account transactions

- Software Operation

- Trading Terms

- Other Questions

What is the difference between account types for platform users?

What is the difference between account types for platform users?

There are three main types of platform account levels: Mini, Standard and Premium. Different levels of users enjoy different spreads, trading services and benefits.

What currency is the platform billed in?

What currency is the platform billed in? The settlement currency of this platform is USD, but RMB can be used for deposits and withdrawals, and the exchange rate is based on the exchange rate announced by the payment channel.

Is there an analog account trial?

Is there an analog account trial? Yes, you can log in to the official website to register. After successful registration, you can get an analog account by contacting customer service.

What if I forget my account password?

What if I forget my account password? You can click "Forgot Password" on the "PC/M Client Center" or APP login page, and follow the page prompts to reset the password with the mobile phone number you opened an account.

What if my profile is incorrect?

What if my profile is incorrect? In order to ensure the safety of customer funds, if your personal information is incorrectly filled in, please contact the online customer service to apply for modification. The processing time is about 1 working day.

What should I do if I cannot receive the SMS verification code when opening an account?

What should I do if I cannot receive the SMS verification code when opening an account? You can click "Get Verification Code" again after 60 seconds on the account opening interface to obtain a new verification code. If you still cannot receive the verification code, you can contact the online customer service for assistance in opening an account.

What information do I need to open an account?

What information do I need to open an account? Just fill in your real name, mobile phone number and ID number.

After successful account opening, what other supporting materials do I need for real-name authentication and payment authentication?

After successful account opening, what other supporting materials do I need for real-name authentication and payment authentication? A. For the security of your account, you need to do the following after opening an account:

a. Identity authentication

b. Add a bank card

c. Deposit/deposit

You can use your mobile phone to take a picture and upload the front and back of the ID card to the customer center by yourself.

* The above information is only for completing the real-name verification of the account, and the platform promises not to disclose any information of the user.

Is there a fee for opening an account?

Is there a fee for opening an account? Opening an account with is completely free.

Deposit (deposit)

Deposit (deposit)Customers can make online deposit (deposit) operations through PC website, mobile website or APP.

After the customer enters the amount, the system automatically converts it into the corresponding currency according to the exchange rate of the day, such as New Taiwan Dollar, Thai Baht, etc.

Please note that only debit cards owned by the customer are supported.

Please note the card single and daily payment limits.

Withdrawal (withdrawal)

Withdrawal (withdrawal)Before withdrawing money (withdrawal), you should complete the real-name authentication. The bank card in the real-name authentication is the receiving bank card. If you need to modify the receiving bank card, please contact customer service. According to the anti-money laundering rules, the withdrawal operation must be reviewed, and in principle, the review time should not exceed 24 hours.

Trading bonus

Trading bonusWhen opening an account, depositing money and trading, customers may receive bonuses from the platform according to the level of deposit. Such bonuses can only be withdrawn after meeting a certain number of trading lots.

Withdrawal (withdrawal) Notes

Withdrawal (withdrawal) NotesUnder normal circumstances, withdrawal fees are free of charge. The company only charges fees for withdrawals under the following circumstances: The company generally does not charge withdrawal fees, except for the following special circumstances:

(1) If 50% of the deposit amount has not been used for opening a position, a 6% handling fee will be charged when withdrawing.

(2) If the customer withdraws less than 50 dollars in a single time, a unified handling fee of 3 dollars will be charged.

(3) If there are more than 4 withdrawals per month, 5% of the withdrawal amount will be deducted from the 5th withdrawal as a handling fee.

Does the platform support manual closing by phone?

Does the platform support manual closing by phone? Not currently supported.

How is profit and loss calculated?

How is profit and loss calculated? Total Profit and Loss = (Ask Price – Bid Price ) x Contract Unit x Lots ± Rollover ( If available )

Can I set a stop-loss and take-profit level when making a trade?

Can I set a stop-loss and take-profit level when making a trade? Yes, you can set the stop-loss and take-profit level when opening a position, or select the position product to set the stop-loss and take-profit level. When making this setting, it is recommended that you refer to the value range provided by the product.

What is the maximum offset when trading?

What is the maximum offset when trading? Refers to the maximum allowable deviation between the actual transaction price and the preset transaction price. Due to the continuous changes in market prices, if your transaction price fluctuates due to the exchange of instructions between the client and the server, the order cannot be filled. It is recommended that you set the offset value to prevent the order from being unable to be filled when the market fluctuates rapidly.

What are the requirements for unlocking?

What are the requirements for unlocking? Unlocking needs to make up the margin amount of the original order.

For example: buy 1 lot of GBPUSD and sell 1 lot of GBPUSD, the margin for each GBPUSD lot is $400, and the lock-up margin at this time is (400+400)*50%=$400. If one of the positions is closed, you need to make up the margin amount of the open position (1 lot GBPUSD), that is, increase the margin to 400 USD, and then the system can unlock it.

What is hedging margin?

What is hedging margin? The lock-up margin is 50% of the total margin of the lock-up order, or one-sided margin is charged.

For example, buying 1 lot of GBPUSD and selling 1 lot of GBPUSD is a lock-up operation. The margin for each lot of GBPUSD is 400 US dollars. At this time, the lock-up margin is (400+400)*50%=400 US dollars.

What is hedging?

What is hedging? The so-called lock-up generally means that traders open positions of the same product in equal quantities but in opposite directions, so that no matter where the price goes (or rises or falls), there will be no profit or loss in the position. Then there is a method of operation that greatly increases or decreases.

How is rollover calculated?

How is rollover calculated? The formula for calculating overnight interest varies for different products.

The exchange rate of the benchmark currency to USD in the currency pair: the exchange rate of the benchmark currency * contract unit * lot number * days of holding positions * interest rate / 360 days (take the exchange rate of the currency in the first position in the currency pair / USD, because the settlement is in US dollars)

Among the currency pairs, the US dollar is used as the benchmark currency pair (USDJPY/USDCHF/USDCAD/USDCNH): 1 USD * contract unit * lot * position days * interest rate / 360 days

HKDCNH: (1/7.8 HKD exchange rate)*Contract unit*Lot*Position days*Interest rate/360 days; CADJPY: (1/USDCAD exchange rate)*Contract unit*Lot*Position days*Interest rate/360 days

Stock index, crude oil, gold, silver calculation method: closing price * contract unit * lot * number of days in the position * interest rate / 360 days

For example: sell 0.1 lot of gold, the opening price is 1330, the overnight interest on the position = 1330*100*0.1*(-0.75%)*1/360=-0.28 US dollars.

Why is 3-day rollover charged on Wednesday?

Why is 3-day rollover charged on Wednesday? According to international banking practice, foreign exchange transactions are delivered after 2 trading days, and the overnight interest is calculated according to the delivery day. Positions are held on Wednesday to Thursday, and the delivery day is from Friday to next Monday. Therefore, all foreign exchange products are held on Wednesday. Overnight needs to be calculated for 3 days of overnight interest.

How is rollover charged?

How is rollover charged? Monday: 1 day overnight interest. Monday trading, Wednesday settlement, Monday to Tuesday, the settlement day is Wednesday to Thursday, so 1 day of interest is paid/charged.

Tuesday: 1 day rollover. The positions are held from Tuesday to Wednesday, and the settlement date is from Thursday to Friday, so one day interest is paid/charged.

Wednesday: 3-day rollover. Positions are held on Wednesday to Thursday, and the settlement date is from Friday to next Monday, so 3 days of interest must be paid/charged.

Thursday: 1 day rollover. Positions are held on Thursday to Friday, and the settlement date is from Monday to Tuesday, so 1-day interest is paid/charged.

Friday: 1 day rollover. The position is held on Friday to next Monday, and the settlement date is from Tuesday to Wednesday, so only 1 day of interest is paid/charged.

What is rollover?

What is rollover? When you hold a position past the settlement time, the rollover interest will be charged. If the position is closed before the settlement time, the rollover interest will not be charged. The rollover rate is different when buying and selling different products.

What is leverage?

What is leverage? Leverage is the ratio between the value of the contract controlled by the client and the margin paid. Leverage on the one hand enlarges the client's funds, and on the other hand reduces the client's investment funds. The leverage of the platform can be up to 833 times, and the leverage of different products is different.

The calculation formula of leverage: leverage = contract value / margin.

For example: USDJPY leverage=1 lot contract value/1 lot margin=100,000/400=250 times.

What is occupied margin?

What is occupied margin? Occupied margin is the margin required to hold a current position.

What is net worth?

What is net worth? Equity is the sum of your account balance and floating profit and loss, which can specifically show the value of your current account.

What is a forced liquidation?

What is a forced liquidation? A risk control service is established for customers. When the account equity is lower than the margin requirement for forced liquidation, the system will perform forced liquidation. The forced liquidation margin for different products is different. For more details, please refer to the product contract transaction details.

For example: when the margin ratio is less than or equal to 40% during the trading period, the current closing price and the closing price of the day will be partially or completely forced to close the position in accordance with the principle of maximum loss priority.

There are 1,000 US dollars in the customer's account, and 1 lot of USD and JPY is bought, and 400 US dollars are occupied, so the available margin in the account is 600 US dollars. When you buy in the wrong direction, you will lose from the available margin of $600. After the loss of $600, you will lose 40% of the initial margin of $400, that is, $160 or less. forced liquidation.

Will the weekend/holiday margin increase the margin?

Will the weekend/holiday margin increase the margin? The margin will not be increased, and the weekend/holiday margin will be the same as the usual margin.

How is the deposit charged?

How is the deposit charged? Platform products can be traded with a minimum deposit of $4. Different trading products have different margin requirements. For the data on the margin of various products, please refer to the product trading contract details.

When are the platform trading hours?

When are the platform trading hours? The trading time period of the platform is 7*24 hours. The trading hours of various products can be viewed in the product contract transaction details.

What is the minimum lot size?

What is the minimum lot size? The minimum trading lot for platform products is 0.01 lot.

How is the product spread charged?

How is the product spread charged? Different account levels and different products have different spreads, such as high-end accounts, the EURUSD spread is as low as 0.7, the GBPUSD spread is as low as 0.9, the US crude oil spread is as low as 4.5, the HK50 Hang Seng Index spread is as low as 5, and the higher the account level, the spread The greater the discount, the details can be viewed in the spread rules.

What products can be traded on the platform?

What products can be traded on the platform? The platform can invest in global trading products, including 30+ investment products such as foreign exchange, precious metals, crude oil, and global indices.

What is the margin for one lot?

What is the margin for one lot? The trading margin of each product is divided into: immediate margin, market margin, weekend and holiday margin. For details, check the contract details of the corresponding product.

Do I need to notify the company after making a deposit?

Do I need to notify the company after making a deposit? If you deposit online, you do not need to notify the company after the deposit. You can log in to the online trading platform and check your deposit status in the statement. The company does not currently support deposits via remittance (TT).

What does "alarm" mean?

What does "alarm" mean? "Alert" means that after the customer has set a certain condition, as long as the trading platform is turned on, when the market price meets the set condition, the trading platform will issue a sound prompt. This function can remind customers to pay attention to the price development trend, so as to consider the investment transaction at the appropriate price.

MT4 installation and usage tutorial

MT4 installation and usage tutorialFirst, how to download the MT4 platform?

The MT4 platform has become one of the must-choice trading platforms for foreign exchange traders because of its comprehensive functions. Its convenient operation mode allows traders to focus more on the improvement of trading skills rather than the complex use of the platform.

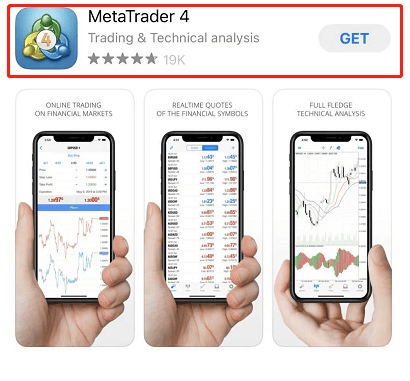

iOS mobile download:

In the APP Store, search

MetaTrader4, click "Get" to complete the installation. As shown below:

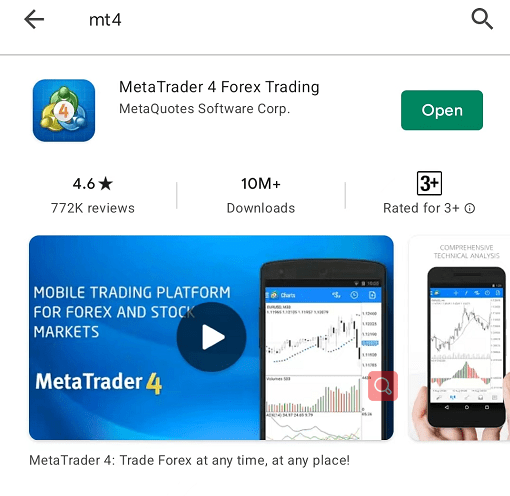

Android mobile download:

In the Android app store (eg App Store), search for

MetaTrader4, click "Download" to complete the installation. As shown below:

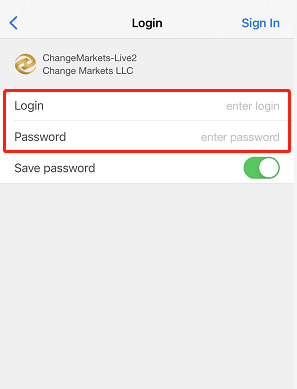

Second, how to use the trading account to log in to the MT4 mobile terminal?

1. After downloading and installing successfully, open the MT4 trading software:

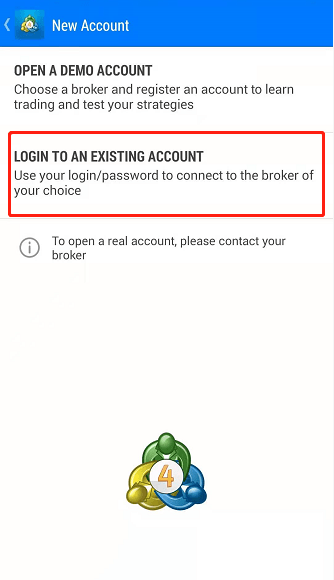

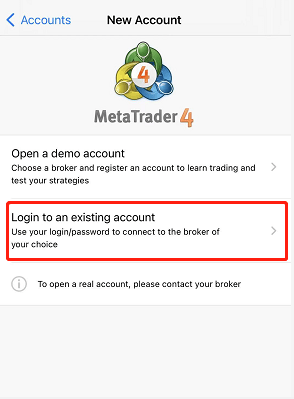

2. Open the MT4 client and select login to an existing account:

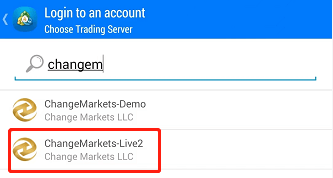

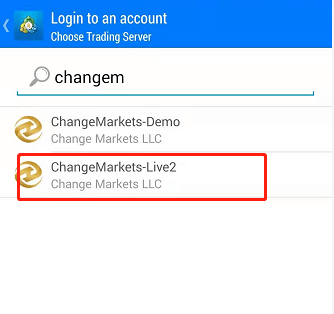

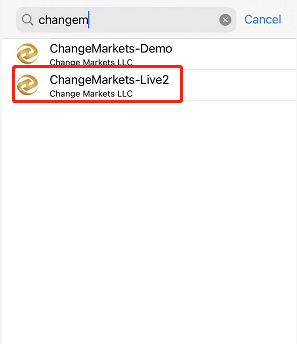

3. Type in the search box, CHANGEMarkets-Live2server:

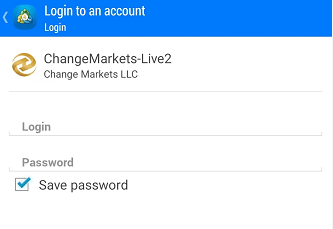

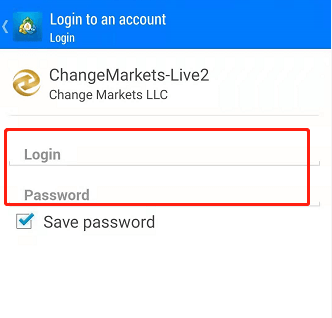

4. Enter trading account number and login password, click to log in

5. trading account successfully logged into MT4

3. How to use the trading account to log in to the MT4 computer?

1. After downloading and installing successfully, open the MT4 trading software:

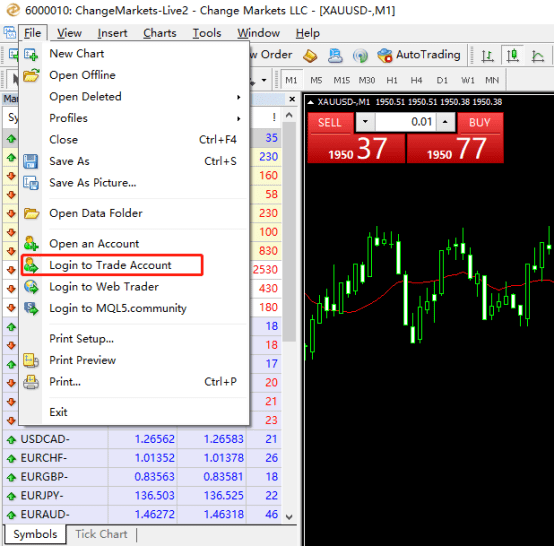

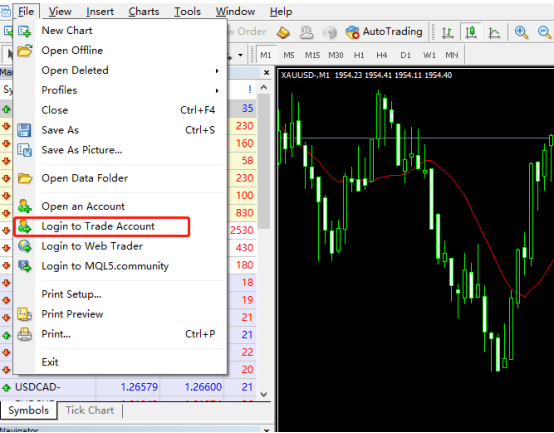

2. For customers who have opened a real account, please select "Login to the trading account" and click Next:

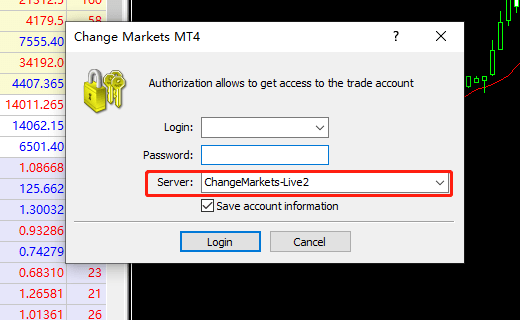

3. Select [Use existing trading account], and enter trading account number and login password, what is the login password?

4. Can the account registered through the APP log in to the MT4 trading software?

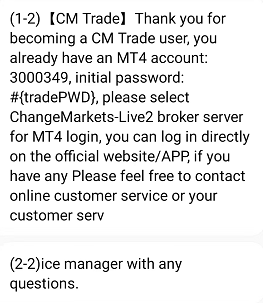

Answer: Accounts registered through the APP are common to MT4. Customers need to enter a login password to log in to MT4. This password will be sent to the customer's mobile phone in the form of a text message after the account is successfully opened, as follows icon.

5. How to change the login password of MT4 on the PC side?

Answer: You can log in to the computer user center, click [Account Management] in the list on the left and select [Change Password], then click Password can be reset.

6. What should I do if the MT4 login reminder authorization fails?

Answer: If the authorization fails, it is because the account or password is entered incorrectly. Please go to the User Center to reset the password.

MT4-Android version trading software tutorial

MT4-Android version trading software tutorial1. Log in to the trading account

1. After successfully installing MT4, click the MT4 icon on the mobile phone desktop to open the application. The page appears as follows when it is first opened.

2. Select "Login to an existing account", enter the server "CHANGEMarkets-Live2" of in the search input box, as shown in the figure.

3. After entering the user name and password, click the "Login" button at the bottom.

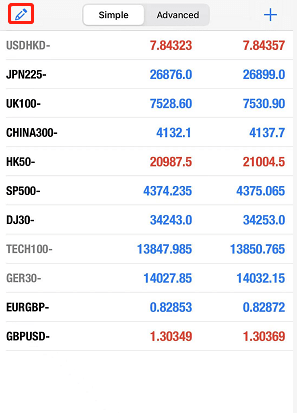

Second, View Quotes

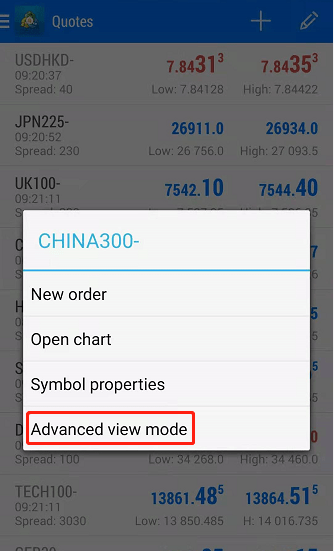

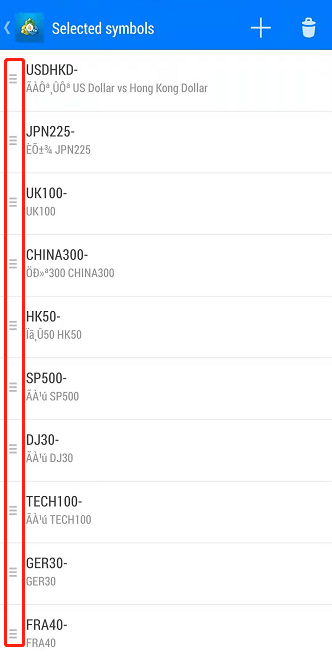

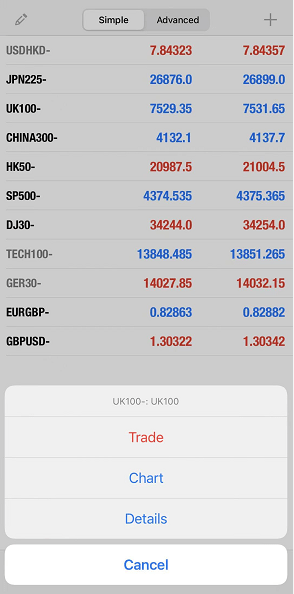

1. Select Quotes in the menu, click any product to open the shortcut menu.

In simple viewing mode, you can select "Advanced viewing mode" to switch to advanced viewing mode; in advanced viewing mode, you can select "Simple viewing mode" to switch to simple viewing mode.

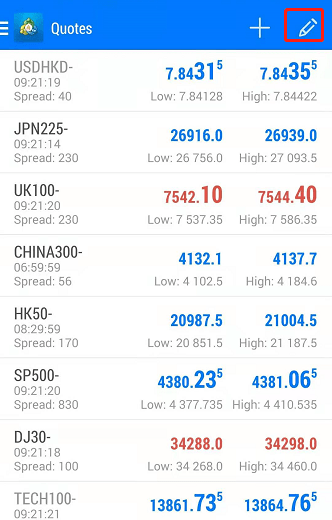

2. Click the [+] in the upper right corner of the market page to add a trading variety.

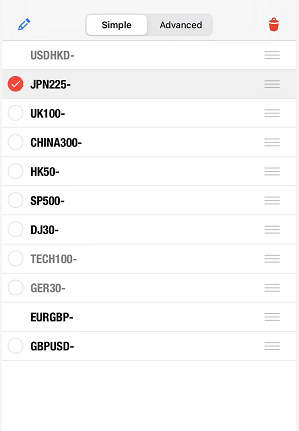

3. Click the edit button in the upper right corner of the quotation page to enter the product edit page.

●Press and hold "" on the right side of the item to move up and down. Editable item display order position.

●Click the delete button  , then check the product, click the upper right corner Delete button

, then check the product, click the upper right corner Delete button  to delete the item. Click the Edit button to return to the Quotes page.

to delete the item. Click the Edit button to return to the Quotes page.

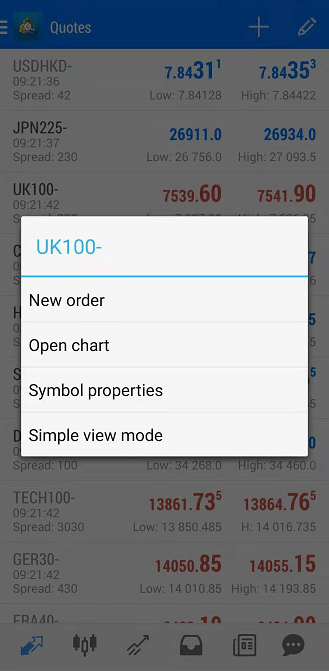

4. Click on any product , the submenu as shown below will be displayed.

●New Order: Displays the New Order window.

●Open Chart: Displays the chart window.

●Transaction Type Properties: Display the details of the product.

●Simple View Mode: Switch from Advanced View Mode to Simple View Mode.

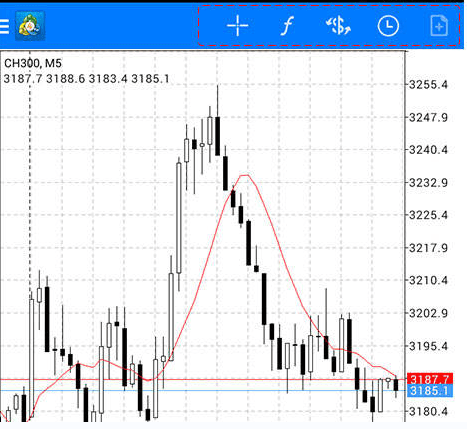

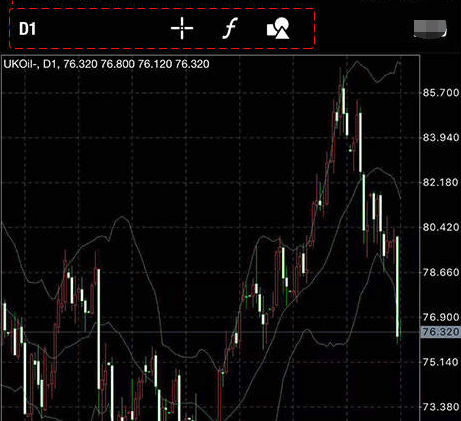

3. View Chart

Click the "Chart" icon in the menu bar to enter the chart page. You can zoom in or out on the chart, and you can slide horizontally to view historical prices.

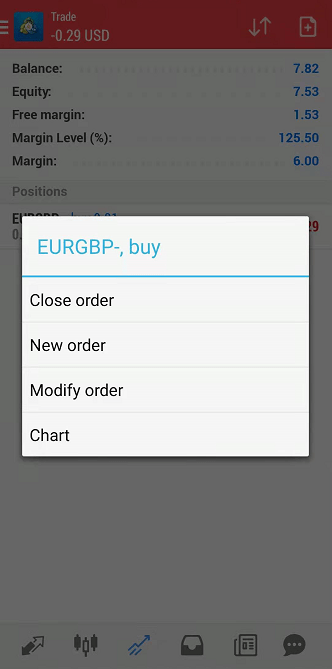

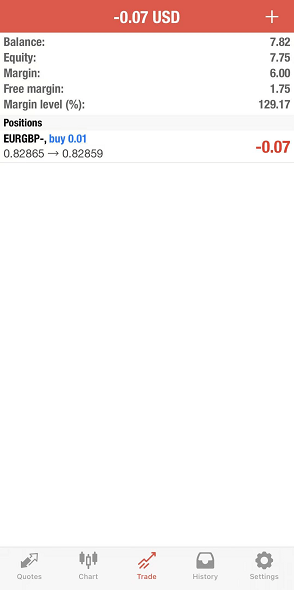

Fourth, transaction operation

1. Click the "Transaction" icon in the menu bar to enter the transaction page. Account information is displayed at the top of the page, and open trade orders are displayed at the bottom.

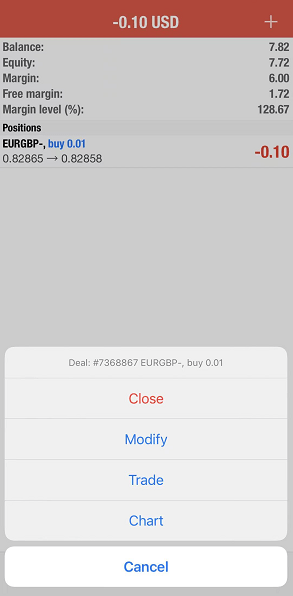

2. On the trading page, long press the trading order, and the following window will pop up. You can choose to close the order, modify the order, new order or chart.

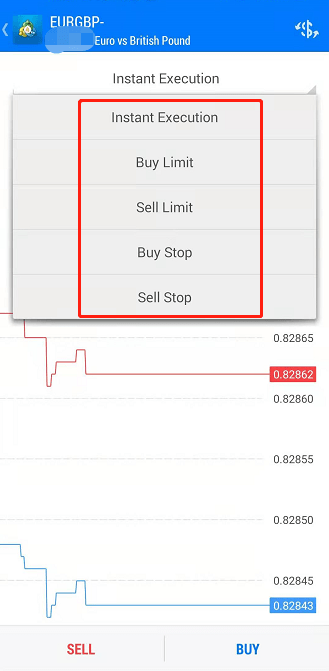

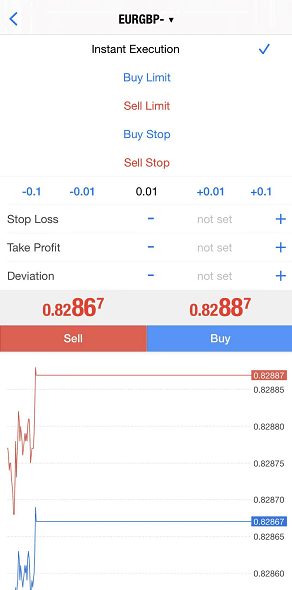

3. Click [+] in the upper right corner of the page to enter the new order window. Click  you can choose to trade items.Order types include Instant Execution, Buy Limit, Sell Limit, Buy Stop, and Sell Stop.

you can choose to trade items.Order types include Instant Execution, Buy Limit, Sell Limit, Buy Stop, and Sell Stop.

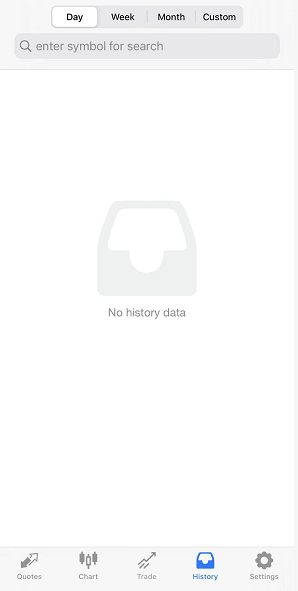

V. History query

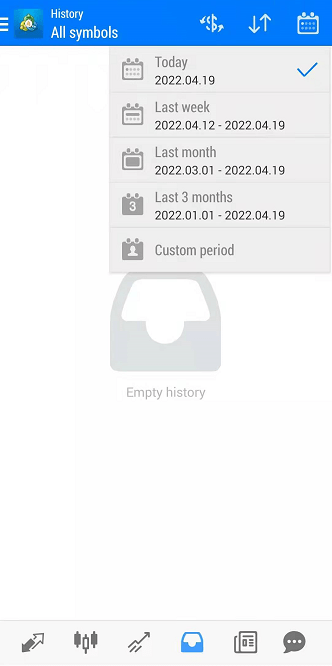

Click the "History" icon in the menu bar View transaction history orders in the last month, the last three months, and a custom period.

MT4-IOS version trading software tutorial

MT4-IOS version trading software tutorialFirst, log in to the trading account

1. After successfully installing MT4, click the MT4 icon on the phone desktop to open the application . The page appears as follows when it is first opened.

2. Select "Login to an existing account", enter the server "CHANGEMarkets-Live2" of in the search input box, as shown in the figure.

3. After entering the user name and password, click the "Login" button in the upper right corner.

2. View Quotes

1. Click "Simple" and "Advanced" in the Quotes interface to switch.

2. Click the [+] in the upper right corner of the market page to add a trading variety.

3. Click on the upper left corner of the quotation page Click the Edit button to enter the product edit page.

●Press and hold "" on the right side of the item to move up and down. Editable item display order position.

●After selecting the product, click the delete button in the upper right corner to delete the product. Click the Edit button to return to the Quotes page.

4. Click on any product to display the submenu as shown below.

●Trade: Displays the new order window.

●Chart: Displays the chart window.

●Details: Display the details of the product.

III. View Chart

Click the "Chart" icon in the menu bar to enter the chart page. You can zoom in or out on the chart, and you can slide horizontally to view historical prices.

Fourth, transaction operation

1. Click the "Transaction" icon in the menu bar to enter the transaction page. Account information is displayed at the top of the page, and open trade orders are displayed at the bottom.

2. On the trading page, long press the trading order, and the following window will pop up. You can choose to close the order, modify the order, new order or chart.

3. Click [+] in the upper right corner of the page to enter the new order window. Click  you can choose to trade commodities, click to switch order types.

you can choose to trade commodities, click to switch order types.

Order types include Immediate Execution, Buy Limit, Sell Limit, Buy Stop, Sell Stop,.

V. History query

Click the "History" icon in the menu bar View transaction history orders with custom cycles.

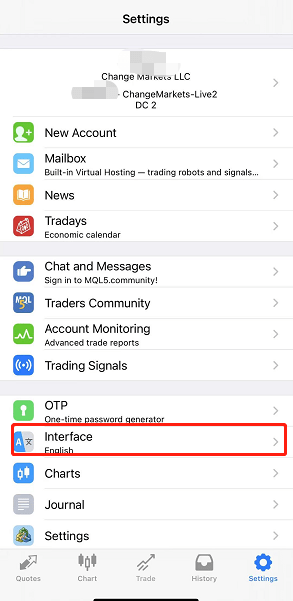

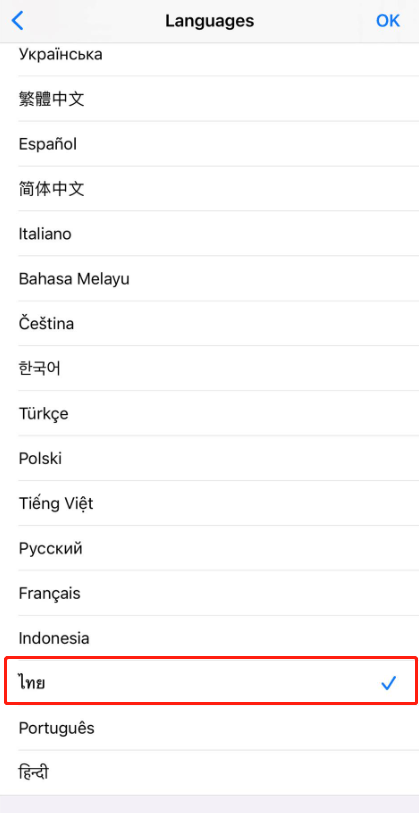

Six. Language settings

If the MT4 software displays garbled characters or English, please click Settings→Interface to enter After the page is set to Simplified Chinese, or set to your desired language

Note: After setting to Simplified Chinese, click OK in the upper right corner to save.

How to change password on MT4 mobile terminal

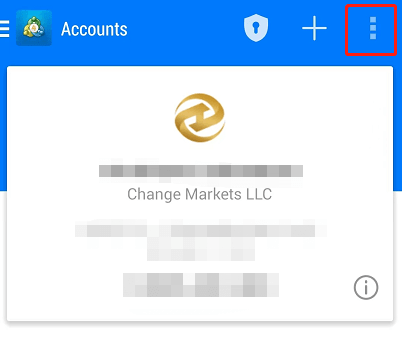

How to change password on MT4 mobile terminalFirst, the Android version of the password change process

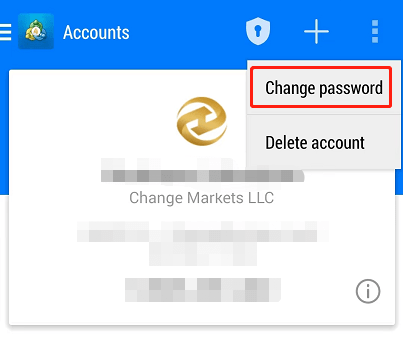

1. Enter the account management interface, click [ ]Button

]Button

2. Select [Change Password]

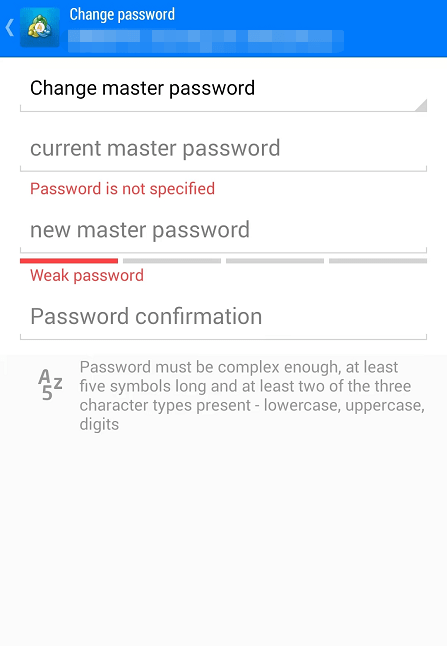

3. Enter the corresponding passwords in the current password, new master password, and password confirmation boxes, and then click [Next] at the bottom to submit the modification.

Second, IOS version password modification process

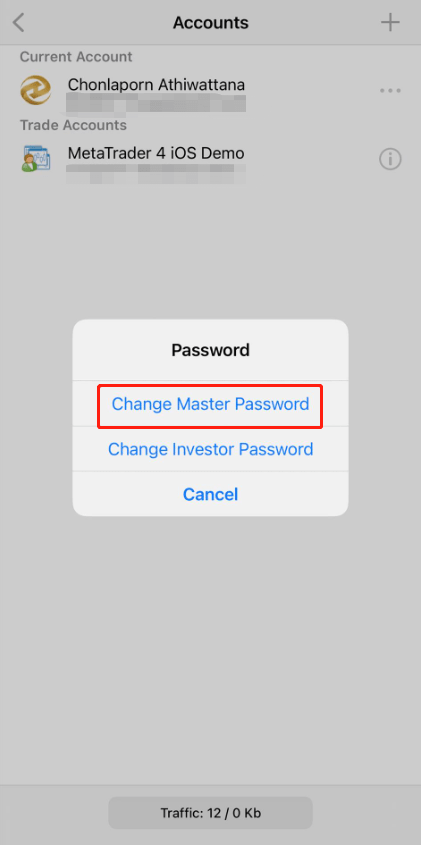

1. Enter the account management interface, click [ ] button

] button

2. Select [Change Password]

3. Select [Change Master Password]

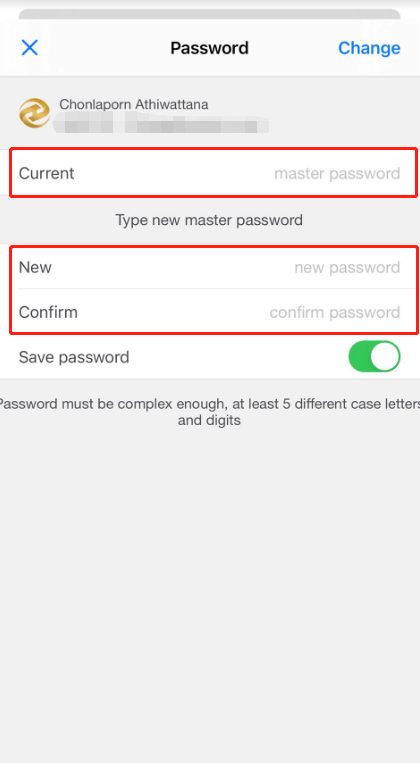

4. Enter the corresponding password in the current, new and confirmation boxes respectively, and then click [Change] in the upper right corner to submit the modification.

MT4 computer version trading software tutorial

MT4 computer version trading software tutorialFirst, open the MT4 computer version trading software

Second, log in to the real account

Note: To log in to the real account, you need to select a serverCHANGEMarkets-Live2Login

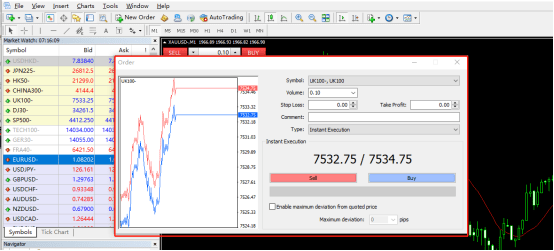

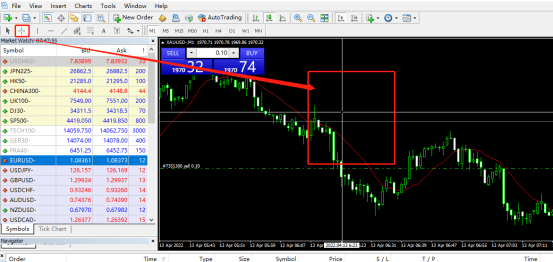

Three and three ways to place orders

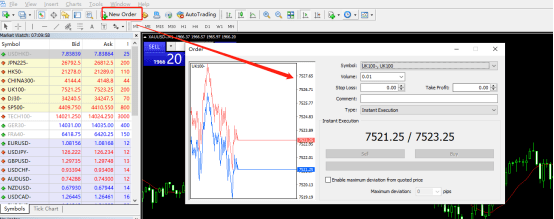

1. Toolbar → [New Order]

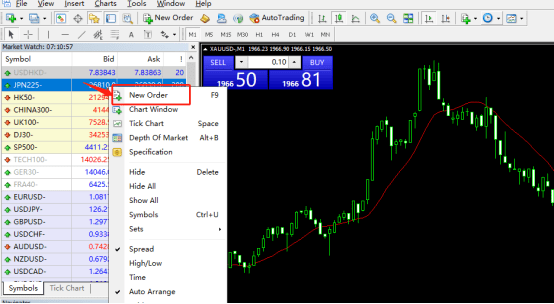

2.[Market Price]→Trading Symbol→[New Order ]

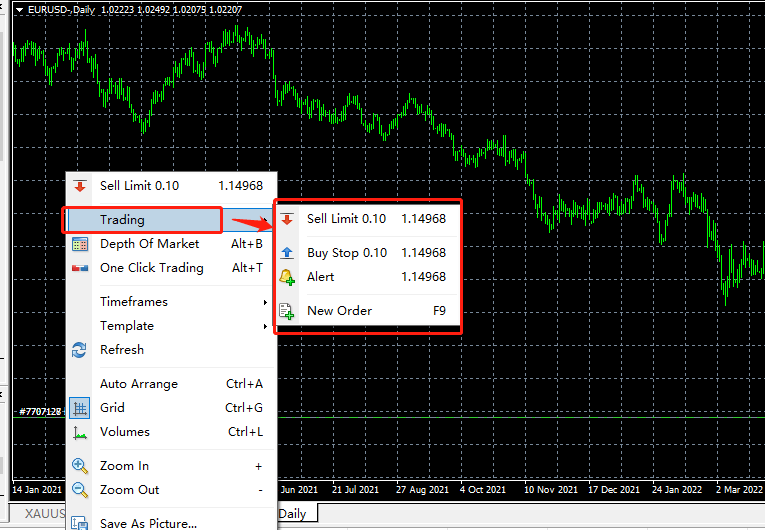

3. Right-click on the disk → Trade → [New Order]

4. Detailed description of the order interface (buy up or buy down)

1. Select the order lot size according to the capital situation (minimum 0.01 lot can be traded, maximum 30 lots can be traded)

2. Set the stop loss price and take profit price (you can choose to set or not set it, it is recommended to set it to control risks and guarantee returns)

3. Select the transaction type for instant transaction or pending order transaction

4. Choose the trading direction, choose to buy if you are long, choose to sell if you are short

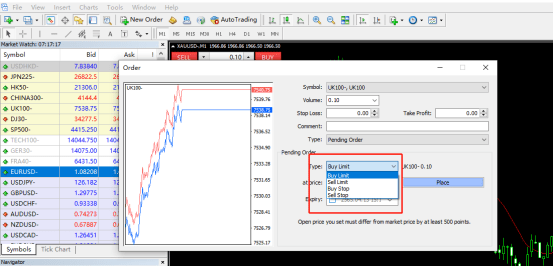

V. Detailed description of pending order transactions

Select the pending order transaction type, enter the price of the pending order, and click [Place Order]. The pending order can also set the stop loss price and take profit price.

Buy Limit: A pending buy order below the current price (usually used to buy near support below)

Sell Limit: A pending sell order above the current price (usually used to sell near an upper pressure level)

Buy Stop: A pending buy order above the current price (usually used to buy when the upper pressure level is broken)

Sell Stop: A pending sell order below the current price (usually used to sell on a break below a support level)

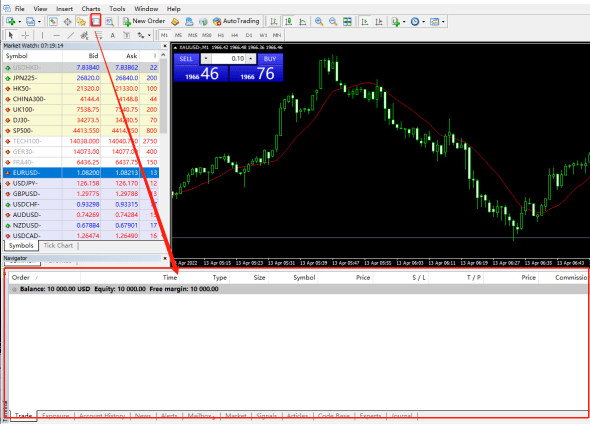

Six. Status View of Current Order

Click the toolbar [Terminal] or press the shortcut key Ctrl+T, it will display the current order and account status

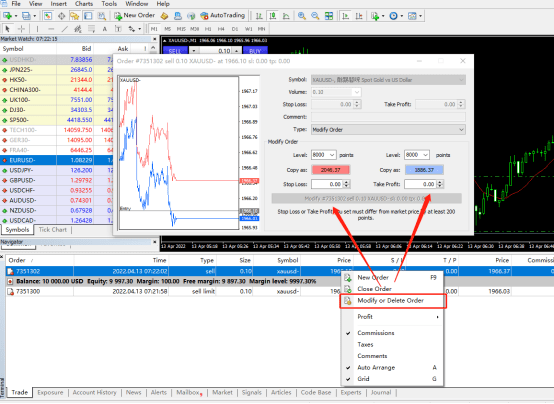

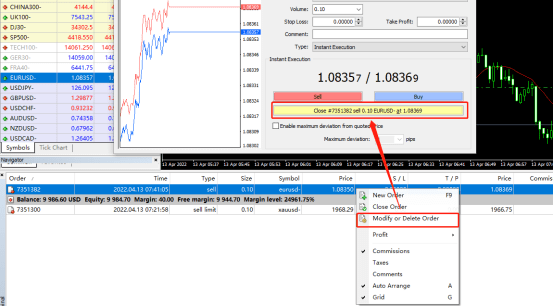

VII. Modify stop loss, take profit and close position

1. Stop Loss, Take Profit modification method (order right click → [Modify or delete order]→appear as follows Windows)

Click to copy to quickly set stop loss or take profit price

2. Closing: Right-click on the selected order → [Close] p>

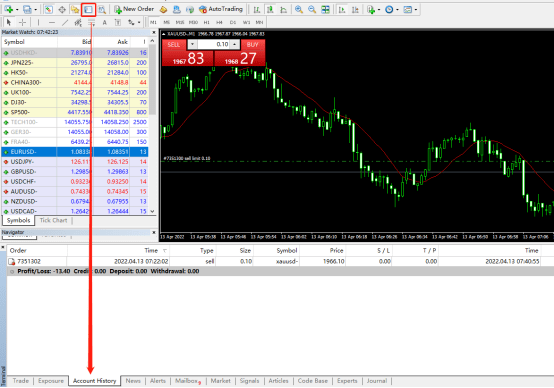

VIII. How to view closed orders

Click the terminal icon →[Account History] (also known as delivery order)

Nine, how to change the disk

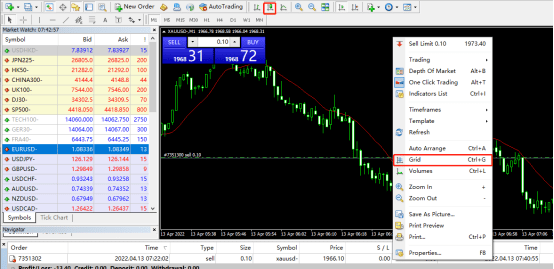

1. Candle Chart

2. Cancel the grid (right-click on the panel and click on the grid to cancel)

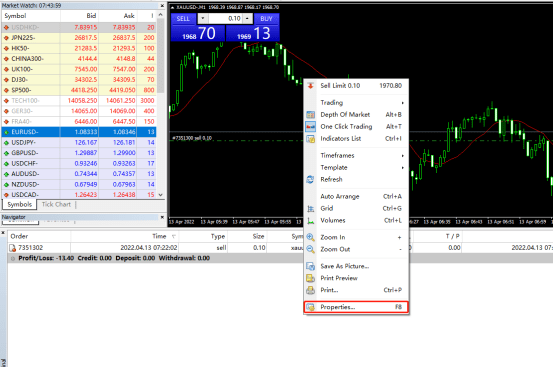

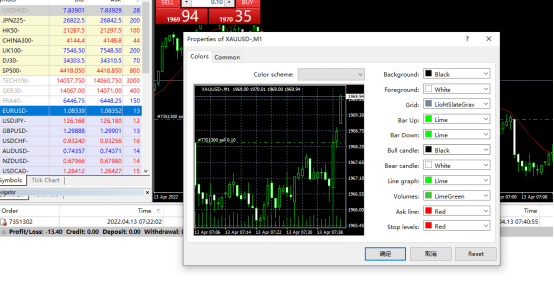

3. Change the color of the candlestick candlestick chart (right click on the disk [Properties])

4. Set the color of the white candlestick and the black candlestick according to the usage habits, for example, the white candlestick is red and the black candlestick is green

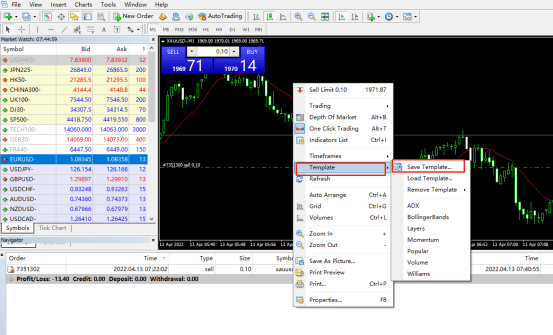

5. Save the template: Template on the right side of the panel → [Save the template]

Choose a good name to facilitate reuse of templates, such as K-line, Bollinger

6. Change several other currencies to the saved template (you can find the template with your saved name and click)

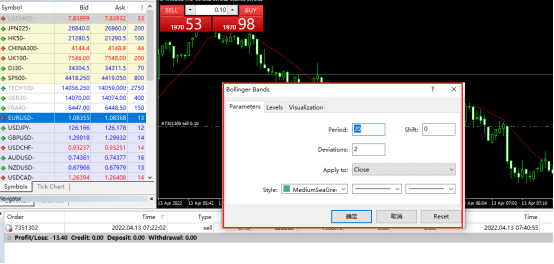

X. Add technical indicators (there are four ways to add)

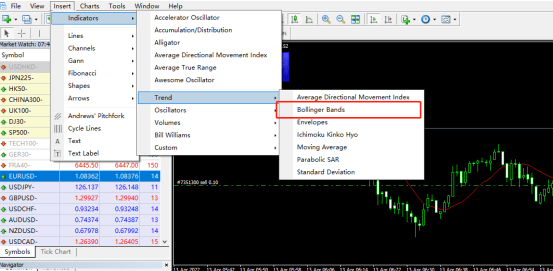

1. Click the Insert menu →【Technical Indicators】→click an indicator; p>

2. Click the operation in the "Common" toolbar;

3. Double-click an indicator in the technical indicators and custom indicators in the navigator window or drag it to the chart window. In the pop-up indicator properties window, you can modify indicator parameters and line types (double-click the left button to modify ), color, application time period range and adding level line, etc. After setting, click the OK button to take effect, and click the Reset button to restore the default settings.

You can customize and modify the indicator parameters according to the operating habits

4. To add MACD double line, please Click to download the file, copy it to the folder\MQL4\Indicators, and insert the custom indicator in MT4.

Eleven, other basic operations

1. The crosshair (used to measure the number of candles, the number of points and the price in the toolbar) can also be operated by directly clicking the mouse center axis

The value measured by the crosshair as shown in the figure: the number of candles in the first digit; the number of points in the second digit (the points in this section of the measurement, remove the last digit as the number of points, as shown in the figure below The number of points is 193); the third digit is the price corresponding to the horizontal axis measured to the current point.

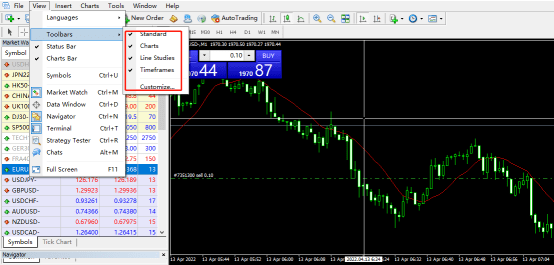

2. If the toolbar is not displayed, please click Display→Toolbar to add it accordingly

3. If the disk keeps beating when looking at the disk, please turn off [Auto scroll]. Yes

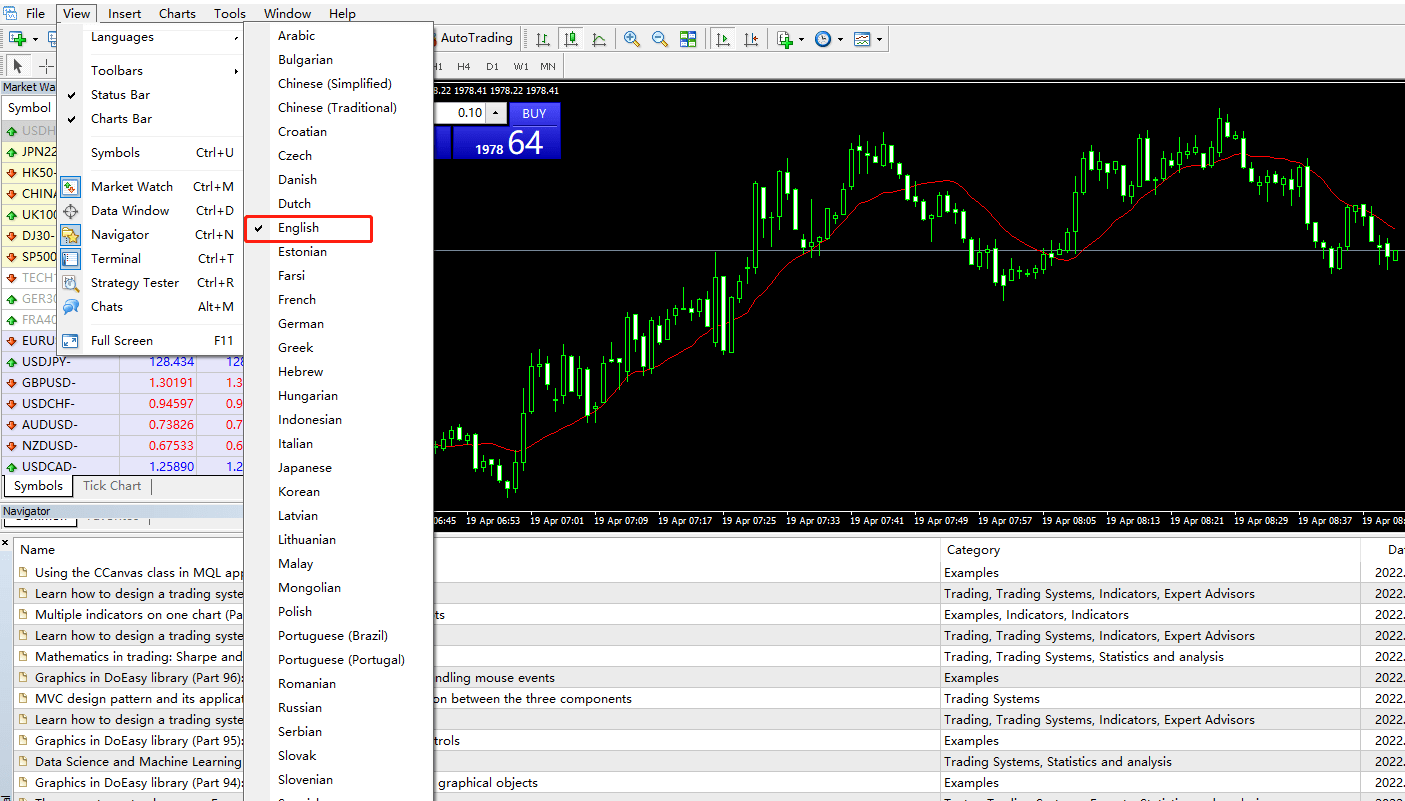

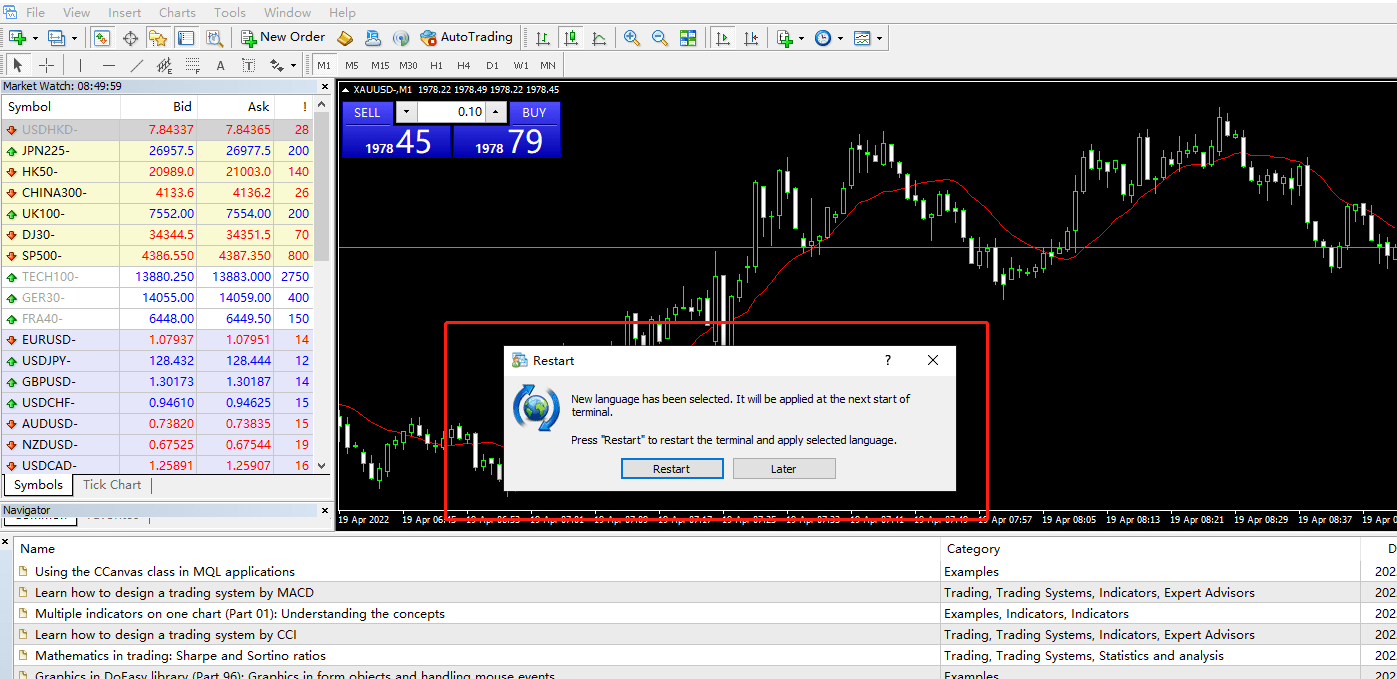

4. If the MT4 software displays garbled characters or English, please click Display→Languages→Chinese (Simplified) to set the language to Simplified Chinese, or set it to the language you want to use< /span>

Note: After changing the language, you need to click [Restart] to take effect. The operation is as shown below

How to install MT4 trading platform in MAC OS system

How to install MT4 trading platform in MAC OS systemInstallation of MetaTrader 4 / MetaTrader 5 platform on Mac OS requires two steps:

- Install Wine, then you can Run Windows programs on Mac OS systems.

- Install the MetaTrader platform with the help of Wine.

Please note: Wine is not a fully stable application. As a result, some features of the applications you run under it may not work properly or not at all.

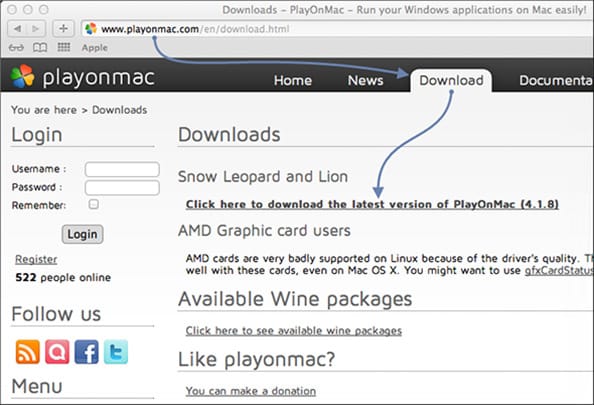

For installation on Mac OS, we recommend the free application PlayOnMac< /a>. PlayOnMac is a Wine-based software designed for easy installation of Windows applications into Mac OS.

PlayOnMac Installation

- To install PlayOnMac, open the product's official website and go to download< /span> (download), click the link to download the latest version.

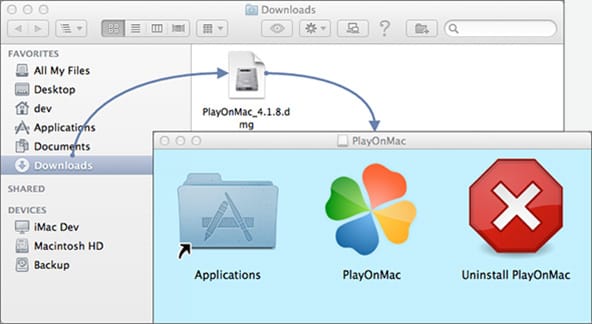

- After downloading the DMG package, launch it from your system's Downloads:

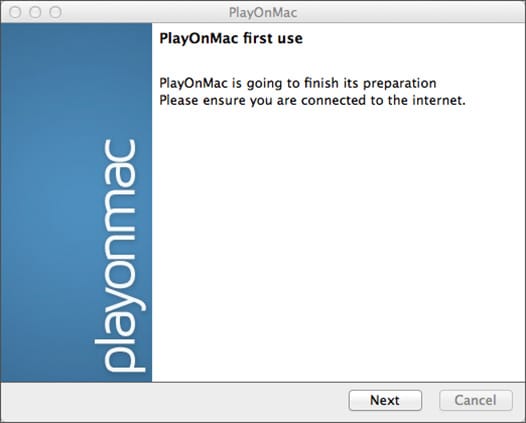

- The PlayOnMac window will appear the first time it is launched. After clicking "Next", the installer will start checking and installing the various components needed for the job.

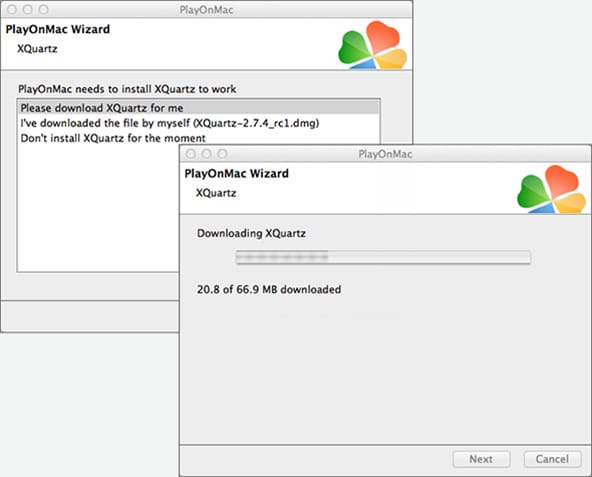

- The first required component is XQuartz. This is a tool for use on Mac OS X Window System software. If you already have XQuartz or want to install it later, choose "Don't install XQuartz for the moment" or "I've downloaded file by myself" respectively.

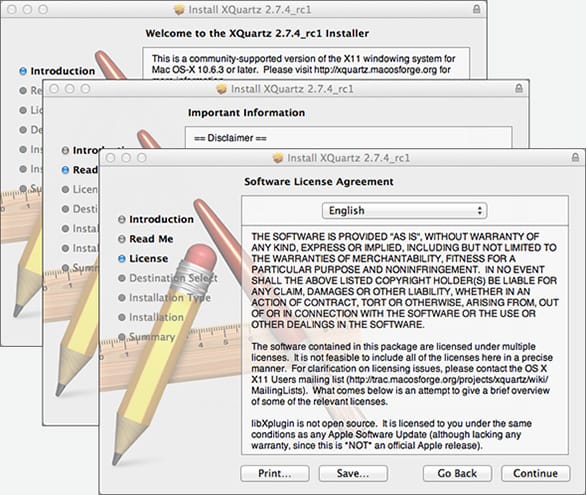

- XQuartz installation is done in multiple steps. First, you will read the Important Related Information (Read Me) and accept the license terms.

- Before installation, the Mac OS security system will ask you to enter your account password:

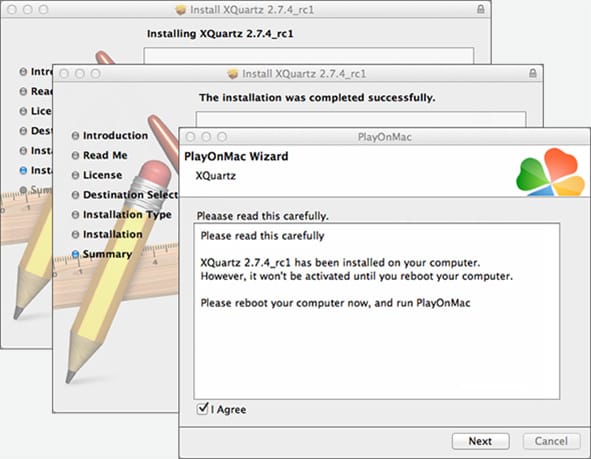

- Wait for the installation to complete. For the changes to take effect, you will need to restart your PC.

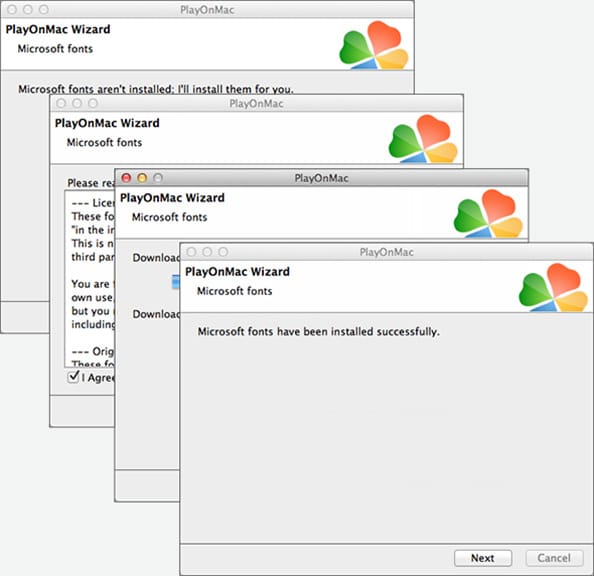

- After restarting the system, launch PlayOnMac again from the installation file in the Downloads folder. The first launch window will reappear. This time, the installer will install the Microsoft Windows fonts needed to run correctly.

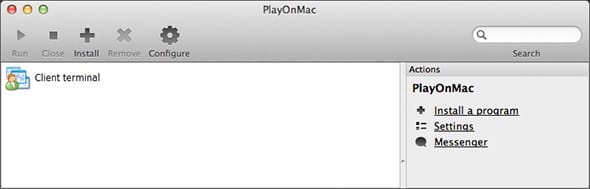

- Accept the license terms and wait for the installation to complete. After that, PlayOnMac is ready to use. Its main window appears:

MetaTrader 4 Installation

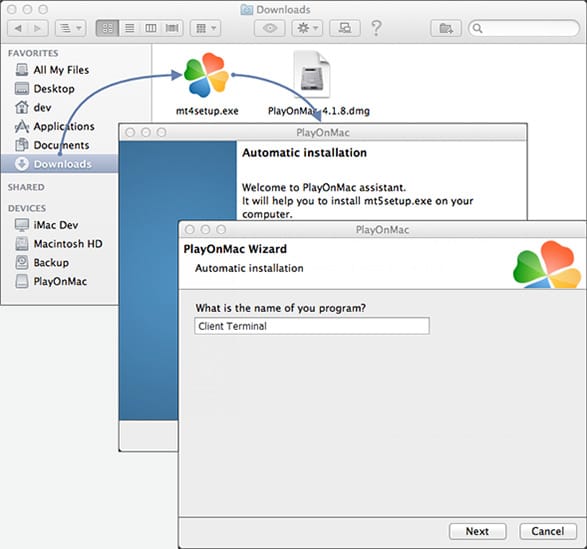

- 1To install MetaTrader on Mac OS, first download mt4setup.exe from myAlpari . After the download is complete, launch the installation file. PlayOnMac will automatically turn it on.

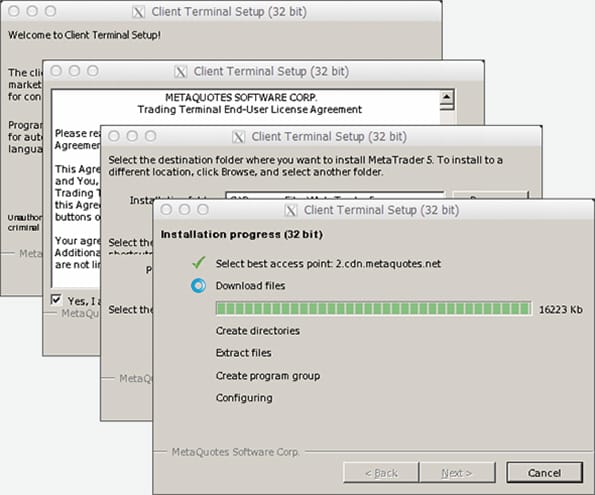

- 2The standard terminal installation process with all phases starts:

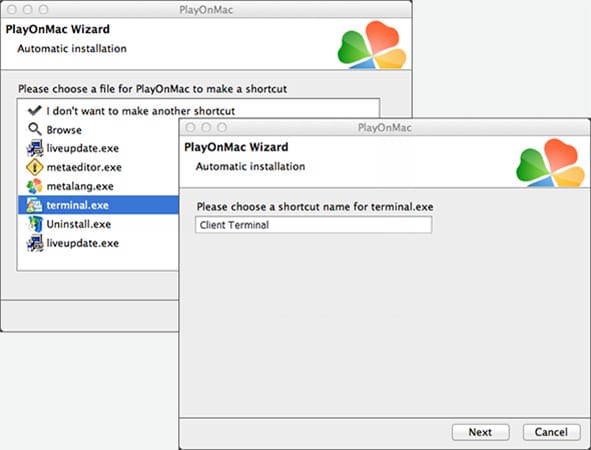

- 3 After installation, PlayOnMac will let you create shortcuts for MetaTrader terminal components - the client terminal itself, MetaEditor:

- 4After creating the necessary shortcuts, you can start using MetaTrader. Double-click it in the PlayOnMac window to launch this terminal.

Data directory

PlayOnMac creates a separate virtual logical drive with the necessary environment for each installed program. The default path of the installed terminal's data file folder is as follows:

Library\PlayOnMac\WinePrefix\Client_Terminal_\Drive C\Program Files\Client Terminal

Wine Upgrade

- 1 When you install PlayOnMac, Wine is also installed.

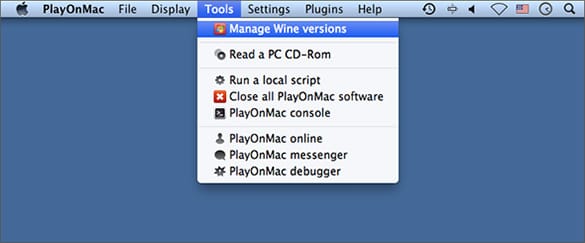

To upgrade Wine to the latest version, open the PlayOnMac top menu and select Manage Wine Versions:

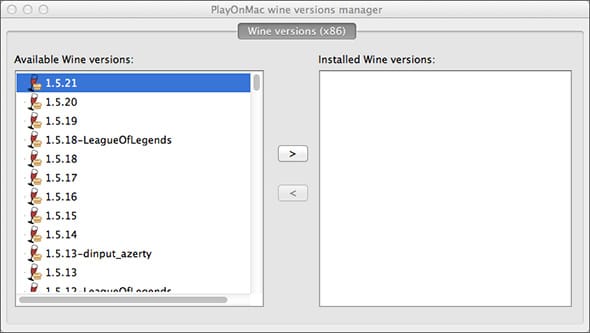

- 2 A window will open with an available installed version of Wine. Select the latest version and move it to the right side of the window. The installation will begin.

- 3 Once the installation is complete, the new version of Wine will appear on the left side of the PlayOnMac Wine version management window. After that, you can close this window and install the MetaTrader trading terminal.

Forgot password how to retrieve

Forgot password how to retrieveStep 1: Open app

Step 2: Click the login button in my module

Step 3: Click the Forgot Password button

Step 4: Enter the correct mobile phone number, enter the correct verification code after obtaining the verification code, and enter a new password (the password must contain numbers and letters and more than 6 digits)

MT4 PC and Mobile MACD Dual Line Settings

MT4 PC and Mobile MACD Dual Line SettingsOne, adding method on the computer side

To add a MACD double line, please click to download the file , copy it to the folder\MQL4\Indicators, and insert the custom indicator in MT4.

Second, the mobile terminal add method

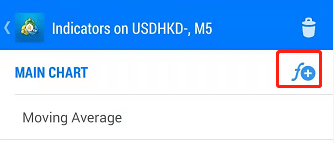

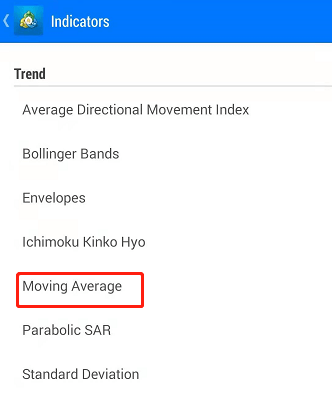

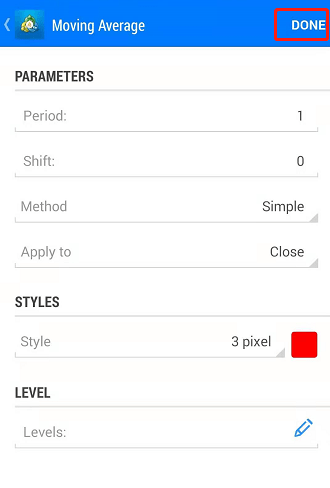

1. Click "" to add indicators

2. Click the "![]() " button on the right side of the main chart

" button on the right side of the main chart

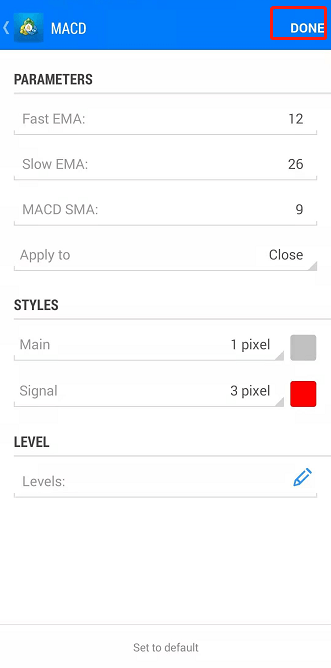

3. Select MACD to add

4. No need to modify the parameters, click on the upper right corner " "

"

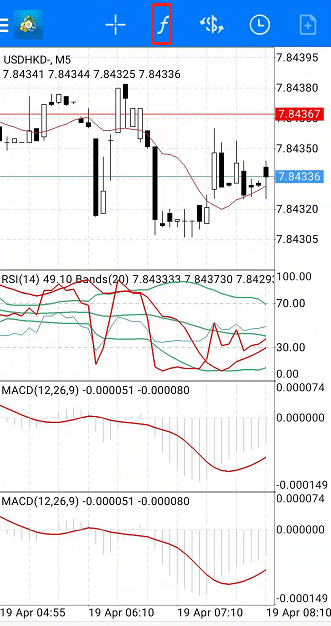

5. After the addition is successful, it will be displayed in the chart, you can continue to click " " to add indicators

" to add indicators

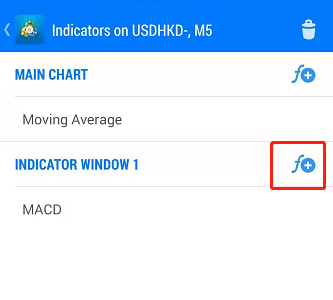

6. Click " on the right side of indicator window 1 ” icon

on the right side of indicator window 1 ” icon

7. Select the Moving Average indicator to add

8. Set the indicator parameters according to the picture below, and then click " ”

”

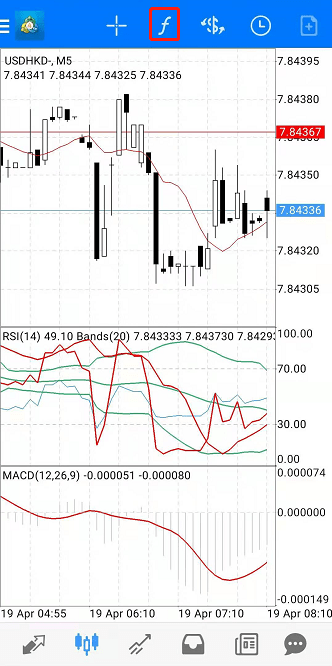

9. The set MACD is shown in the figure below

Remarks: Other indicators can be added through this method, and the indicator parameters can also be set and modified according to operating preferences

Exception Transaction Handling

Exception Transaction HandlingDefinition of Abnormal Transactions

1. During the review period, the closing order within 3 minutes exceeds 30% of the total trading lot, or the hedging and lock-up orders established within 5 minutes in the same account or different accounts exceed the total trading lot 30%.

2. Opening multiple internal trading accounts for hedging and arbitrage operations, or abusing the company's various offers through affiliated transactions, and seeking illegitimate gains.

3. Use external software (that is, any third-party software that is not the company's PO) to quickly open and close positions by taking advantage of the delay in quotation caused by network reasons, and seek illegitimate benefits.

4. In view of the endless emergence of abnormal transactions, the company will define all behaviors that disrupt the normal transaction order as abnormal transactions in order to ensure the principle of fairness and impartiality in online transactions.

How to handle abnormal transactions

1. Accounts defined as abnormal transactions will be immediately terminated from participating in current market activities and disqualified from participating in all future market activities of the company;

2. The company has the right to freeze the abnormal trading account for one month and review all transactions of the account. During the freezing period, it will suspend any business of the account. During the freezing period, all position receipts in the abnormal trading account will be regarded as Abnormal transactions will be processed together;

3. After the freeze period review, the account confirmed as abnormal transaction will be cancelled all abnormal transaction orders and 10% of the total capital injection will be charged as the cost of abnormal transaction, and the balance will be returned to the customer.

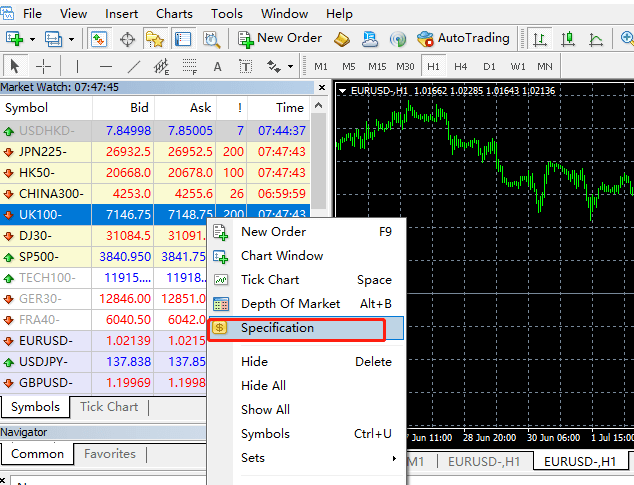

How to view the delivery date of crude oil and stock index

How to view the delivery date of crude oil and stock indexMT4 Desktop View:

1. Open MT4 computer version trading software< /span>

2. Right-click the trading symbol in the quotation window and select the specification to view the detailed contract details of the symbol, as shown below

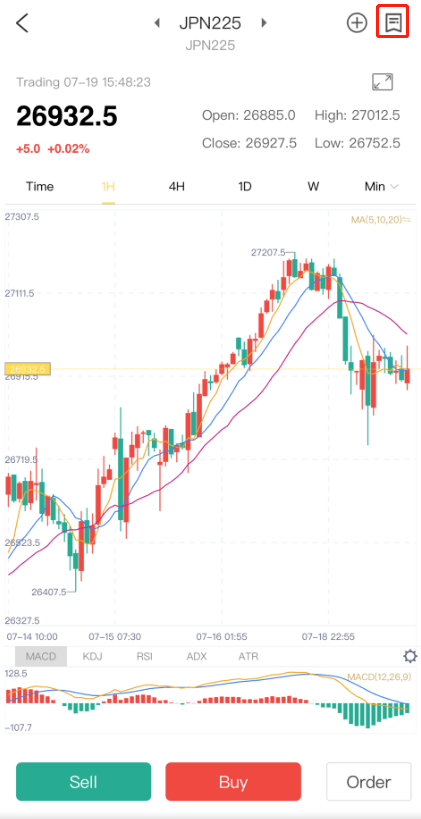

APP View:

1. Open APP

2. Enter the market page, select the trading product and enter the corresponding product market page for viewing, as shown below

Pending orders for non-agricultural transactions and experience without slippage

Pending orders for non-agricultural transactions and experience without slippageBefore I introduce you to the skills of frying non-agricultural market prices to double overnight, if you don't know what non-agricultural market prices are, you still don't understand why non-agricultural market prices are If the fluctuations will be so violent, please take a serious look at my operation skills. Generally speaking, if we want to double the funds in our account quickly in a short period of time, we must meet three conditions:

1. There must be A market with a volatility of $10 or more;

2. We must be able to correctly judge the direction of price movement;

3. We also need to have enough courage to operate the entire position and strictly execute the pre-planned trading orders;

Generally speaking, in 100 times leveraged foreign exchange trading, it is a big taboo to operate a full position or a heavy position, especially as a A professional trader should not take heavy positions and treat trading as gambling. Of course, I am very aware of this discipline, but I still think that if I place an order with a success rate of more than 95% and the risk is completely controllable to my own tolerance When it is within the expected range, I am completely brave to trade across the position. Of course, this is also my own trading experience in the non-agricultural market summed up in theoretical + practical trading. Many people may know this method, but they may just not dare to operate such a heavy position. The following is an actual example to analyze with you:

Earlier I talked about the three conditions that you need to have to quickly double your account in a short period of time. I believe it is not difficult for everyone to understand. Next, we will use the non-agricultural market to combine these conditions3 Let’s analyze the following conditions:

1. Markets with a volatility of more than 10 US dollars: Generally, the non-agricultural market will have a volatility of about 10 US dollars within a short ten minutes, and the data is different from the expected When it is large, there will even be a fluctuation of more than 20 dollars, and when the fluctuation is the smallest, there should be a fluctuation of more than 5 dollars. Therefore, in terms of market conditions, the night of non-agricultural data announcement can fully meet our condition.

2. Accurately determine the direction of the price movement: This is very difficult, because it is a heavy position operation, it is quite difficult to predict the impact of the real data on the market direction before the data is released; Once the non-agricultural data is released, there will be a rapid unilateral trend (whether it rises or falls) within a few minutes. In this rapid unilateral trend, it is the best time for us to fight. Of course, it is not for everyone to chase the bulls/shorts when the data is released. Because at that time, it was very difficult for you to catch up with the transaction in the real big market, and even if the transaction was completed, it was still far from the price you saw at the beginning.

What we need to do is to place two orders 1 minute before the data is released, and use buystop and sellstop to place orders at the same time. The position of the dollar is enough, setting the distance too far will reduce the profit margin of this operation. If the set position distance is too low, it is also afraid that the stop loss order will be triggered by the disorderly bath sound fluctuations within 1 minute and will be executed before the non-agricultural data is released.

So don't panic at this time, one minute is enough for you to place two orders, just set the price correctly and set the stop loss level. The next step is to wait for the announcement of the non-agricultural data. Once the non-agricultural data is released, gold will fluctuate violently. At this time, whether it is bad or good for foreign exchange, buystop and sellstop will only trigger one of the orders. No matter which order is triggered, we will delete the other order in the fastest time. The filled order. Then immediately keep an eye on the market, use the trailing stop to keep the cost price, and immediately close the position decisively and take profit when the market is almost the same. That's how I usually close NFP trades in just a few minutes. Using this method, the market can be doubled when the market is large. It is very common for a prudent investment to make a profit of 30% to 60%.

Learn to open spot gold positions, liquidate and profit

Learn to open spot gold positions, liquidate and profit"Opening a position" means opening. Opening is also called exposure, which is the act of buying gold. Choosing an appropriate gold price level and timing to open a position is a prerequisite for profitability. If the time to enter the market is good, the chances of making a profit are great; on the contrary, if the time of entering the market is not right, it is easy to lose money.

"Liquid position" is a stop-loss measure taken to prevent excessive losses when the price of gold suddenly falls after a position is established. For example, when the price of gold was sold at 157, the price of gold fell to 150, and the nominal loss had reached 7 yuan. In order to prevent the gold price from continuing to fall and causing more losses, he sold gold at the price of 150 and ended the exposure with a loss of 7 yuan. Sometimes traders do not admit losses, but insist on waiting, hoping that the price of gold will come back, so that when the price of gold continues to decline, they will suffer huge losses.

The timing of "profiting" is harder to grasp. After opening a position, when the price of gold has moved in its favor. You can profit by flat. For example, buy gold at 145 yuan; when the gold price rises to 150 yuan, there is already a profit of 5 yuan, so the gold is sold to make a profit. It is very important to grasp the timing of profit. If the trade is closed too early, the profit will not be much;

1. Learn to establish positions in spot accounts, stop losses and close positions at profit: "establishing a position" means opening a position. After the opening, the purchased spot varieties become long, and the sold spot varieties become short. Choosing an appropriate spot product to establish a position is the premise of making a profit. If the timing of entering the market is good, the chance of making a profit will be great; on the contrary, if the timing of entering the market is not right, it is easy to lose money.

"Stop-loss cut-out" is a stop-loss measure taken to prevent excessive losses after a position is established. For example, the current price of Pu'er tea is 235 yuan, and 100 lots were bought at this position. After that, the tea fell to 230 yuan. In order to prevent the tea from continuing to fall and causing greater losses, the position was closed and sold at 230 yuan, with a loss of 5 per lot. Yuan closed the position. Sometimes traders do not admit losses, but insist on waiting, hoping to rise back, so that when the tea goes down, they will suffer huge losses.

The timing of "profiting" is harder to grasp. After opening a position, when the tea has moved in its favour, it can be profitable to close the position. For example, if you buy 100 lots of tea at 230 yuan, when the tea rises to 235 yuan, there is already a profit of 5 yuan, so you sell it and make a profit; it is very important to grasp the timing of profit. Too much; too late in the draw may delay the opportunity, and the spot trend will reverse, and instead of winning, it will lose.

2. The principle of buying up and not buying down: the principle of spot trading is exactly the same as that of stock trading. It is better to buy up than to buy down (this is a long-term homeopathic transaction). Because there is only one point in the price rise that is wrong, and that is when the price rises to the top. Anything other than this one is right to buy. Buying when the spot is down, only one thing is true, that the spot has hit its lowest point. Other than that, all other point buys are wrong. Since buying when the price is rising is only one point wrong, but buying when the price is falling is only one point right, buying when the price is rising has a better chance of making a profit than buying when the price is falling is much more likely. (When the price falls, it is mainly to sell, it is very important to correctly judge the trend, and trade with the trend)

3. The principle of "Pyramid" overweight: "Pyramid" overweight means: after buying a certain variety for the first time, the variety has risen, and the investment is correct. If you want to increase your investment, you should abide by " The number of each addition is less than the last time" principle. In this way, the number of incremental purchases will be less and less, just like a "pyramid". Because the higher the price, the more likely it is to be near the peak of the uptrend, and the more dangerous it is. At the same time, buying when it is rising will cause the average cost of the longs to increase, thereby reducing the yield, so be careful when adding more!

4. The principle of not overweight when losing money: After buying or selling a variety, when the market suddenly advances in the opposite direction, some people will want to overweight, which is very dangerous of. For example, after a certain variety has been rising for a period of time, traders chased high and bought the variety. The market suddenly reversed and fell down. Seeing that they were losing money, traders wanted to buy one more order at a low price, in an attempt to lower the average price of the first order. When the market rebounded, they would close their positions together with the second order to avoid losses. Be especially careful with this type of coding. If the spot has been rising for a period of time, you may be buying a "top". If you buy more and more as it falls, and continue to overweight, but the spot price never turns back, then the result is undoubtedly a vicious loss. It was under this mentality that Lisson brought down the famous Barings Bank.

5. Do not participate in uncertain market activities. When you feel that the market trend is not clear enough and you lack confidence, it is advisable not to enter the market. Otherwise, it is easy to make wrong judgments.

6. Don't blindly pursue integer points: In spot trading, sometimes people make mistakes in order to force a few points. After establishing a position, some people set a profit target for themselves, such as earning Enough RMB 1,000, etc.; waiting for this moment in my heart. Sometimes the price is close to the target, and the opportunity is very good. It is only a few pips away. We could have closed the position and collected money, but due to the original target, we missed the best price while waiting and missed the opportunity.

7. Establish a position when the market breaks: The market refers to the bull market, and the volatility is narrow. The game is a situation in which buyers and sellers are evenly matched and are temporarily in balance. Regardless of whether it is a rising process or a falling process, once the market is over, the spot price will break through and go up or down, showing a breakthrough forward. This is a good time to enter the market and open a position. If the market is a long-term cow, the position established when the market is broken and consolidated will have a greater chance of profiting.

What are the skills of one-minute foreign exchange trading? Experts do this

What are the skills of one-minute foreign exchange trading? Experts do thisSimply put, there are traces of everything. Although the operation of speculating in foreign exchange is simple, it is also skillful to make orders within one minute of speculating in foreign exchange. Generally, forex masters who are stable and profitable will have their own fixed rules. Do single mode.

But for many foreign exchange novices, the one-minute market is also difficult to judge. Here foreign exchange experts have summarized some order-making skills to help friends with less profit to increase more income:< /p>

One.Analyze before trading

Only by understanding the rules and techniques related to foreign exchange trading can you avoid losses as much as possible. Therefore, for beginners, it is necessary to observe the market conditions and related technical analysis before placing an order.

Two. Find a good time to place orders

Generally speaking, the foreign exchange market fluctuates less in the afternoon, it is easy to grasp the market, and it is more suitable for new investors to enter the market. Investors can choose the time that suits them according to their own characteristics. The advantage of making a single order, eliminating unnecessary risks and hidden dangers.

Three. Initial small order

Although small trades in foreign exchange are not as profitable as large trades, the risk is relatively small. For inexperienced novice traders, small trades are the most suitable. At present, regular foreign exchange trading platforms all provide mini-lot trading, with a minimum of 0.01 lot to trade. On the one hand, it can help investors to familiarize themselves with and understand the market under low-risk conditions. The role of large returns.

Four. Setting a stop loss is important

Although it is a one-minute order, it is also necessary to make a stop loss. Even experienced foreign exchange speculators attach great importance to this point. The foreign exchange market is changing, and sometimes people panic at the moment of the market, and setting a stop loss can reduce losses as much as possible and avoid the expansion of losses.

Five. Control the order frequency

It is very important to make money by speculating in foreign exchange. The one-minute order cycle is also very fast, and it does not mean that it is enough to make more orders. It supports trading at any time, 24 hours a day, and the fastest time is 0.01 seconds to buy and sell orders. There are many trading opportunities every day. You only need to choose the most favorable opportunities to place an order.

Forex trading is not difficult to judge the ups and downs, but it is not enough to just rely on the ups and downs. The key to achieving stable profits is to place an order well.

How to operate forex pending orders?

How to operate forex pending orders? Forex pending order transaction refers to placing a transaction order at a point far away from the current market price, and the platform automatically trades when the market changes reach the preset price. There are generally the following four modes:

1. Buy Limit (buy limit) - establish a long position (buy) when the bid price in the real-time market quotation reaches or is lower than the pending order price. The price of the pending order should be lower than the market price at the time of placing the order;

2, Buy Stop (buy with stop loss) - establish a long position (buy) when the bid price in the real-time market quotation reaches or exceeds the pending order price. The price of the pending order should be higher than the market price when placing the order;

3. Sell Limit (Sell Limit) - establish a short position (sell) when the ask price in the real-time market quotation reaches or exceeds the pending order price. The price of the pending order should be higher than the market price when placing the order;

4, Sell Stop (Sell Stop) - establish a short position (sell) when the ask price in the real-time market quotation reaches or falls below the pending order price. The price of the pending order should be lower than the market price at the time of placing the order.

Special reminder: Beginners should use pending orders with caution.

Forex pending order trading skills Daquan Forex pending order trading details

Forex pending order trading skills Daquan Forex pending order trading detailsForex trading is now being used by more and more people. There are many foreign exchange trading technical explanations, which are very good for beginners, but there are also many people who do not know how to analyze the fluctuations of foreign exchange. For investors who often speculate on foreign exchange, the fluctuation of exchange rate is the core problem in foreign exchange trading. It is very important to learn to analyze the k-lines of foreign exchange fluctuations.

1. Look at the size of the entity. The larger the body, the more obvious the up and down trend of the forex chart, and the less obvious the trend. For example, there is a closed and open part above the body of the sun line. The larger the body of the sun line is, the more sufficient it is, just like the greater the mass of a body, the faster the speed of the object. The inertial force is the same as the physical principle, the larger the body of the sun line is. Represents the greater the power to increase its internal rise, and its rising power will be greater than the small positive line

2. Look at yin and yang. The yin and yang of the foreign exchange chart are the direction of the trend. A positive line indicates that it will continue to rise, while a negative line indicates that it will continue to decline. Yang Xian is an example. After a period of long and short periods, closing at the opening shows that the bulls have the upper hand. According to Newton's laws of mechanics, the price will still run according to the original direction and speed without external force, so the positive line indicates the next stage. It will continue to rise, at least to ensure that it can rush upwards in the early stage of the next stage.

3. Look at the length of the shadow line. The shadow line in the foreign exchange trend chart represents a turning point. In one direction, the longer the shadow line for exchange rate changes, the more unfavorable the exchange rate is today, and therefore the more unfavorable it is. The drop in the exchange rate. Regardless of yin or yang K line, a part of today constitutes an upward resistance, and the probability of a downward adjustment of the exchange rate in the next stage is high.

Forex pending orders, how to place foreign exchange orders?

Forex pending orders, how to place foreign exchange orders? For example non-agricultural

Method One:

Enter a lock-up order before the non-agricultural comes. You can look at the 5-minute line for this lock-up order, and you can go long at a relatively low level and short at a relatively high level. If you can make a profit in this way, a handling fee will be charged. Wait, if you feel this is more troublesome, you can directly enter the lock-up order.

There are two methods for the first 3 minutes or so of the news to be announced:

Set a 15-point stop loss and a 40-point take profit for each of these two orders, and you can set more profit and loss, so that if the news passes, the two orders will be destroyed, and the procedures will be eliminated. You have about 19 points of space, method 2; both orders are only set to take profit in the range of 20-50 according to the expected situation of the news, when the news is over, one order is destroyed, and the other order can be closed according to the situation. , only when the data is very good and very bad is it possible to take a unilateral, even if it will go out of the unilateral market, there will be a callback.

Method Two:

Two-way pending order, 3 minutes before the non-agricultural data comes out, place a high-level long order of about 30 points and a low-level short order of about 30 points, and set a profit of 30 points before hanging up . (The points are set differently for different currency pairs) After one order is filled, another order that has not been filled will be deleted. What if the data is not so influential and can't reach a profit of 30 points? Then manually close the position when you feel that the upside is weak.

Method Three:

About 3 minutes before the announcement of the news, place an order according to the news expectations, and place an order in the same direction according to the news expectations, subject to take profit and stop loss, and the general profit and loss ratio is at least at least.

Using a small loss to make a big profit, this kind of non-agricultural success for three times can generally preserve the capital

Method Four:

According to the size of the impact of non-agricultural data, wait for the data before placing an order.

What does a position mean

What does a position meanWhat does a position mean. In simple and popular terms, it is actually "open interest", the total value of the things held, which is the meaning of "funds".

Source of position

The origin of positions is related to modern China. At that time, banks used "Yuan Datou" for daily payment, and ten "Yuan Datou" were exactly one inch, so it was named "Position".

Position use

Nowadays, this term is often used by banks. For example, the bank will call the situation where the income is greater than the expenditure in all the receipts and payments of the day as a "long position";

If the payment is greater than the income, it becomes an "open position";

The act of trying to transfer money everywhere is called "adjusting positions";

If the demand for funds is greater than the idle amount, it is called a "tight position".

The term position is also often used in securities, stock and futures trading. For example, the long and short positions often mentioned in stocks and futures are actually short positions for long positions and short positions. During the period of opening a position, the position held after buying a futures contract is called a long position, and the position held after selling a futures contract is called a short position. The difference between open long contracts and open short contracts in a commodity is called the net position.

How to expand profitable positions and reduce losses

How to expand profitable positions and reduce losses1. First of all, before trading, you should formulate a complete trading plan, including the expected entry price and profit target.

2. In most cases, the entry and exit points should be selected at the support and resistance levels in the price trend. Another way to enter the market is that at the beginning of the market trend, the retracement of the uptrend and the correction of the downtrend are all good opportunities to enter the market. The market doesn't just go up or down. The key is to determine whether it is a correction or a turning point in the market.

3. When there is a loss in the position in hand, when will you be out? There is a simple and easy way: strictly set the stop loss price. If you are long, you should set a sell stop; if you are short, you should set a buy stop. In this way, after you place an order, you will be mentally aware. No matter what happens to the market, your potential loss is fixed. Remember to set stop loss and take profit for any order! This way you won't be confused about when to leave the trade during the trade.

4. What should I do when the position in hand is profitable, and the profit part is relatively large? At this time, the best way is to use the "decreasing disk" method to expand the results. For example, after you establish a long position, the market runs to your expected profit level, but you think the market still has a certain profit space and do not want to be out of the market. At this time, you can set a stop loss at a certain price to lock in your profit. Once the market goes down, you can get out of the market with a profit.

What is a pending order in futures

What is a pending order in futures1. A pending order means an order, that is, you submit a buy (sell) order at a certain price. The earliest futures trading is that traders put the list with the price, quantity, and buying and selling direction on a board. When someone sees that your bid is suitable, they will open it and find you to make a deal.

2. "Stand up, can't hang up" refers to the activeness of the market. For example, the transaction is not active on a certain day, the selling price is 3002 and the buying price is 3001, and the number of buying and selling orders is not many, you are at the price of 3001 There are 5 lots of buy orders placed on the board, and there is no transaction after waiting for seven or eight minutes.

For example, someone said: "Today's market is too boring, I put down a price, and after a quarter of an hour, there is still no transaction!"

Or: "This market is too hot, I I closed yesterday's long order by two prices, and it was immediately eaten up. If I had known this, it would be better to hang it higher." This means that it can't be hung.

What does position mean in finance?

What does position mean in finance? Financial position is a commonly used term in the financial industry, and is often used in trading finance, securities, stocks, and futures.

Positions are funds, which refer to the sum of all funds currently available to the bank. It mainly includes the excess reserves in the central bank, the net amount deposited with inter-bank liquidation, bank deposits and cash. The goal of position management is to reduce position occupation as much as possible on the premise of ensuring liquidity, and avoid wasting idle funds.

Position (position), also known as "headliner", means money, and is a popular term in the financial and business circlespopular span>. If the bank receives more than the outgoing amount in all receipts and payments for the day, it is called "long position", if the outgoing amount is greater than the income amount, it is called "short position".

The act of anticipating more or less of this type of position is called "rolling". The act of trying to move money in everywhere is called "adjusting positions". If the temporarily unused funds are greater than the required amount, it is called "loose position", and if the demand for funds is greater than the idle amount, it is called "tight position".

How are Forex profits and losses calculated?

How are Forex profits and losses calculated?Profits and losses

As mentioned above, "Forex Quotes" are expressed in the form of "Currency Pairs". In every transaction, one currency is sold in exchange for another. A "currency pair" reflects how much one currency can be exchanged for another currency.

When buying a currency, the trader expects the currency to appreciate in value compared to another currency; when he sells the currency, he expects the currency to depreciate.

When EUR/USD is quoted at 1.3705, it means that 1 euro can be exchanged for 1.3705 US dollars. If he buys ten "standard lots" of EUR/USD, it is equivalent to buying one million euros, and at the same time he sells USD at 1.3705. If EUR/USD rises by 200 pips, traders can profit by selling the euro at 1.3905. But if EUR/USD drops 200 pips to 1.3505, it's a loss.

The settlement currency is USD

Trading profit and loss = (selling price - buying price) * lot size * contract unit

Example: EUR/USD, a standard lot contract of 100,000 units. After selling 2 lots of EUR, close the position to buy 2 lots of EUR.

Bid: 1.4350 Bid: 1.4300

Profit and loss calculation method: (1.4350-1.4300)*2*100,000

Profit and loss=(0.0050)*2*100,000

Profit=$1,000

With 1 standard lot as the trading unit, all currency pairs whose settlement currency is USD, the value of each point is 10 USD. For example, EUR/USD, 1 point X1 standard lot X100,000 EUR=10.00 USD.

Settlement currency is non-USD

The base currency is USD

Trading profit and loss = (selling price - buying price) / closing price x trading lot x contract unit

Example: USD/JPY, a standard lot contract of 100,000 units. Sell 10 lots of USD/JPY first, and then close the position to buy 10 lots of USD/JPY, that is, sell first and then buy to close the position.

Bid: 116.00 Bid: 114.50

Profit and loss calculation method: (116.00-114.50)/114.5*10*100,000

Profit and loss=0.0131004*10*100,000

The trading unit is 1 standard lot. When a currency other than USD is the settlement currency, the value of each point is 10 units (1000 units for Japanese yen) of the settlement currency.

For example, when a trader buys 10 standard lots of USD/CHF, the USD/CHF exchange rate is 1.1665, and when USD/CHF rises to 1.1666, the trader's position value will be changed by 1,166,500 rose to CHF 1,166,600, earning CHF 100. Convert 100 CHF to USD based on the current USD/CHF exchange rate of 1.1666:

CHF 100/1.1666=$85.72.

When the base currency is non-USD, that is, when the currency pair is crossed

Trading profit and loss = (selling price - buying price) x "cross settlement currency/USD exchange rate" x trading lot x contract unit

Example: EUR/GBP, a standard lot contract of 100,000 units. First sell 10 lots of EUR/GBP, and then close the position and buy 10 lots of EUR/GBP, that is, sell first and then buy to close the position.

Ask: 0.9136 Bid: 0.9036 Close GBP/USD: 1.6320

Profit and loss calculation method: (0.9136-0.9036)/1.6320*10*100,000

Profit and loss=(0.9136-0.9016)x1.6320x10x100,000

Profit=$16,320

The trading unit is 1 standard lot. When a currency other than USD is the settlement currency, the value of each point is 10 units (1000 units for Japanese yen) of the settlement currency.

Profits and losses are already calculated for you

Do you want to make a profit in foreign exchange investment? Then you need to learn these tricks!

Do you want to make a profit in foreign exchange investment? Then you need to learn these tricks! The foreign exchange market is a place where you can bend over to pick up gold bars, and it is also a battlefield where you will lose everything if you turn around. Many newcomers to the foreign exchange market will devote themselves to the foreign exchange market with a relatively small initial capital and experience the ups and downs of the foreign exchange market.

Small funds also enjoy the benefits of foreign exchange leverage, but because of the small amount of funds, the risks that can be taken are also very small, so for small funds In terms of capital, making money is not the first priority, but survival is the first priority. Accumulating a good sense of the market in the life cycle and truly feeling the pulse of the foreign exchange market are the greatest value that small capital brings to you< /strong>. Surviving in the foreign exchange market is the cornerstone of making substantial profits in the future.

The foreign exchange market generally fluctuates more than 100 points every day, and it is also very considerable to be able to grasp the profit. Small funds have a way of making orders for small funds. Efforts to extend the life cycle can make small funds become larger funds, so that funds can grow like a snowball. The precautions and strategies for making orders with small funds are as follows:

Strengthen your investment principles

1. Survival first, development second.

2. Only do short-term intraday trading.

3. Do not operate more than 5 times a day, and try not to make orders after the daily profit exceeds the target set by yourself.

4. Only do one variety per day.

?

Find a few guiding ideas for yourself

1. Establish the idea that opportunities come every day, wait patiently, and wait for the rabbits.

2. Establish the concept of fighting a protracted war and overcome the impatience of rushing to win.

3. Establish the concept of winning if you don't lose, and use stop loss reasonably.

4. Establish the concept of keeping the pocket safe, and turn the floating profit into the real profit in due time.

Use a fixed set of profit tactics

1. Find a moving average that you are most familiar with as a guide, and grasp the direction of the day.

2. Only do one trading direction, only long above your moving average, and only short below your moving average.

3. Find the time period when you make the most profit every day, and try to give full play to your advantages during this time period.

4. Summarize experience every day and constantly improve your tactics.

If you want to make a profit in the foreign exchange market, don't make these mistakes!

If you want to make a profit in the foreign exchange market, don't make these mistakes! As we all know, there is a "28 rule" in the investment market, which means that 20% of the people in the market are making money, while the remaining 80% are losing money.

The foreign exchange market is no exception, the reality is so cruel. If you want to make money, don't make these 10 mistakes!

One, blind and bold

Some investors have never seriously and systematically learned investment theory skills, nor have they undergone any analogy training, and even do not even understand the most basic knowledge, so they rush into the market, although sometimes they can earn Some money, but as long as the transaction continues, the rapid depreciation of the funds in its account will be inevitable.

Second, contrarian trading

I always like to rebound in a big drop. This is a very hurtful trading habit. This is how the quilt happens. In fact, a big drop will not stop immediately. You need to be patient and wait until it stops. It is not too late to enter the trade, grabbing the rebound is equivalent to licking blood on the knife.

Three, full warehouse operation

Even if you're right ninety-nine times, just one accident is enough to blow your position instantly. The tragedy of many masters in the world happened like this, and even Gann, whom everyone admired, did not escape. Such bad luck.

Fourth, do not set stop loss

Afraid of losing money and not setting a stop loss, the result is that the more you lose, the more you lose. This is how liquidation happens. In foreign exchange trading, you must set a stop loss. If the market is at the end of the consolidation, you enter the market without setting a stop loss. Once the general trend is opposite to your position, liquidation will occur.

Five, like to guess the top and find the bottom

As if the market were its own. Short-term trading does not require prediction, because the long cycle has already told us the direction, as long as we operate in this direction, we must not be subjective before the operation, and operate according to the actual market trend.

Six, Greed and Fear

Be greedy when you should be greedy, and when you should not be greedy, you must leave the market quickly, and learn when to be greedy and when not to be greedy. Never enter the market greedily when peaks and declines have not stabilized. However, when greed turns into deep losses, comes fear. Even a seasoned investment veteran can become stupid when fearful.

In the markets, fear often drives our investment levels out of whack, making repeated mistakes and ultimately failing. Therefore, fear is one of the biggest obstacles to profitable trading. To be successful in the market, we must overcome fear. Don't forget this sentence: I am greedy when others are fearful, and I am fearful when others are greedy.

Seven, anxious and anxious

The foreign exchange market is unpredictable, and it is inevitable that we will sometimes get angry. This kind of anxiety is a taboo in trading. It will greatly reduce our trading skills, and it will also lead us to make irreversible wrong decisions because we cannot think calmly. Psychological urgency and anxiety often lead to bad entry points, and profits are lost. Repeatedly doing this, not only is the transaction the most likely to fail, but also the most likely to be discouraged. Too often we fail miserably in transactions that are full of anxiety.

Eighth, lack of patience

Some investors hope that as soon as they enter the market, the price will move in their favor. However, the probability of such a situation is very small. In most cases, after entering the market, the market seems to be against itself and moves in the opposite direction of itself. This is the time when investors’ endurance is tested. They must strictly follow the original operation plan. Don’t lose watermelon if you get sesame seeds. If you see other varieties are good, you should change positions immediately, or make a small profit. Throwing it out in a hurry is often more than worth the loss.

Nine, unwilling to give up everything

There are countless trading opportunities in the market, but our time, energy and funds are limited, it is impossible to seize all investment opportunities, which requires us to make trade-offs, through various investment opportunities The priority of opportunities, the size of hot spots, etc. are measured in many aspects, and small investment opportunities can be selectively abandoned in order to better grasp larger investment opportunities. We should invest our limited time, energy and funds into the market with certainty.

X. Frequent transactions

From early to late, I am afraid that I will miss the opportunity to make money, and I will not leave myself room to study and judge the market. As a result, if I make money in the morning, I will lose it in the afternoon. If I make it during the day, I will lose it in the evening. After learning to make a profit, leave it to the market, learn to rest, and recharge and wait for the next transaction.

Where does Forex profit come from? What is the market for foreign exchange profits? What is the foreign exchange profit?

Where does Forex profit come from? What is the market for foreign exchange profits? What is the foreign exchange profit? One.ForexWhere does the profit come from? What is the market for foreign exchange profits?

The foreign exchange marketis a zero-sum game in which investors from all over the world participate, and our trading orders are all through The dealers are issued to the bank or directly traded in the invisible foreign exchange market. It means that we are playing an intellectual game with traders around the world.

Where does the money in foreign exchange come from? When we trade profitably, the corresponding person must lose money. Likewise, if we lose money, other investors make money.

Forex is a 24-hour transaction, which can be bought and sold countless times on the day, which can be bought up or down, and has leverage.

Leverage means that 100 yuan can be used as 10,000 yuan, which is 100 times the leverage. There are also 500 times leverage and even 800 times leverage. But if you lose 1% with the so-called 10,000 yuan, that is, you lose the 100 yuan you invested, then the platform will force you to stop loss, because the 9900 is lent to you to make better money Yes, not to give you a loss.

1. The effect of leverage amplifies our greed and fear.

The foreign exchange market is full of sounds of liquidation every day. Liquidation means that you have lost all your money. StocksAs long as you hold it and the company does not collapse, you will not lose everything, but because of the leverage in foreign exchange, if you lose 1%, your position will be liquidated. One has nothing. The foreign exchange market is full of corpses and mourning.

2. Leverage is the main reason, but the spread cost paid by frequent exchanges is also an invisible huge expense.

Many people lose 2000dollars in one year, including The $800 is due to over-trading fees. Because it is 24 hours, because it is a two-way transaction, and because it is unlimited, many people can't control their hands and always come in and out frequently. Tragedy is prepared for these people.

Second, what is the foreign exchange profit?

1, Forex trading: Through the exchange rate fluctuations in the exchange between currencies, the act of arbitrage by buying low and selling high is called arbitrage. Foreign exchange trading, which is what we usually call foreign exchange.

2. "Point": Forex MarginIn the transaction, the smallest unit is "point".

For exampleEuroThe fluctuation of the currency pair against the US dollar from 1.1120 to 1.1121 is 1 point fluctuation, the dollar against the day The yuan currency pair fluctuates by 1 point from 129.11 to 129.12.

For example, a fluctuation of 50 points is a fluctuation of 50 points, such as EUR/USD 1.1120 to 1.1170 or 1.1120 to 1.1070.

3. "Point Value": In the case of a trading lot of 1 standard lot, the fluctuation of 1 point (regardless of the leverage multiple of the trading platform) is the fluctuation of 10 US dollars, so 50 points are in 1 standard lot In the case of a fluctuation of $500.

4. "Calculation of foreign exchange profit and loss": Since foreign exchange is a two-way trading mechanism, foreign exchange transactions can be bought up and down at the same time, so only when we see and make the right direction of the market, we can It is to make money, otherwise it is to lose money;

For example, if we choose to long EUR/USD, and EUR/USD goes from 1.1120 to 1.1170, we will make a profit of 50 pips, and 1 standard lot is 500 USD, and vice versa It is a loss of 50 points. For another example, say 1GBPexchange$1.7150, 1.7150 can be said to be 17150 points, and when the pound falls to 1.7050, it will drop 100 points . In the contract spotforeign exchange trading, the more points you earn more winsthe more profits, The less points you lose, the less you lose. For example, an investor buys a contract of GBP at 1.7150, and when the GBP rises to 1.8150, the investor sells the contract, earning 1,000 points of GBP and a profit of up to $10,000. And the contract bond invested, that is, the first-hand contract, is only $1,000. Gains reached 1000%.