Fundamental analysis:

The pound remained volatile against the yen at around 156.322. British official data showed that fast-rising inflation significantly pushed up the British government's debt interest payments in January, reducing the seasonal budget surplus in the public finances at the beginning of the year. The January surplus, excluding state-owned banks, totaled 2.9 billion pounds ($3.9 billion), compared with analysts' average estimate of 3.5 billion pounds; January is typically a season of influx of income tax revenue. This is the first time since the outbreak of the pandemic two years ago that the monthly budget figures are not in deficit, but the surplus is smaller than in previous Januarys. UK inflation is at a 30-year high and looks set to hit 7% in April, pushing government debt interest payments to £6.1bn in January, up £4.5bn from the same month last year.

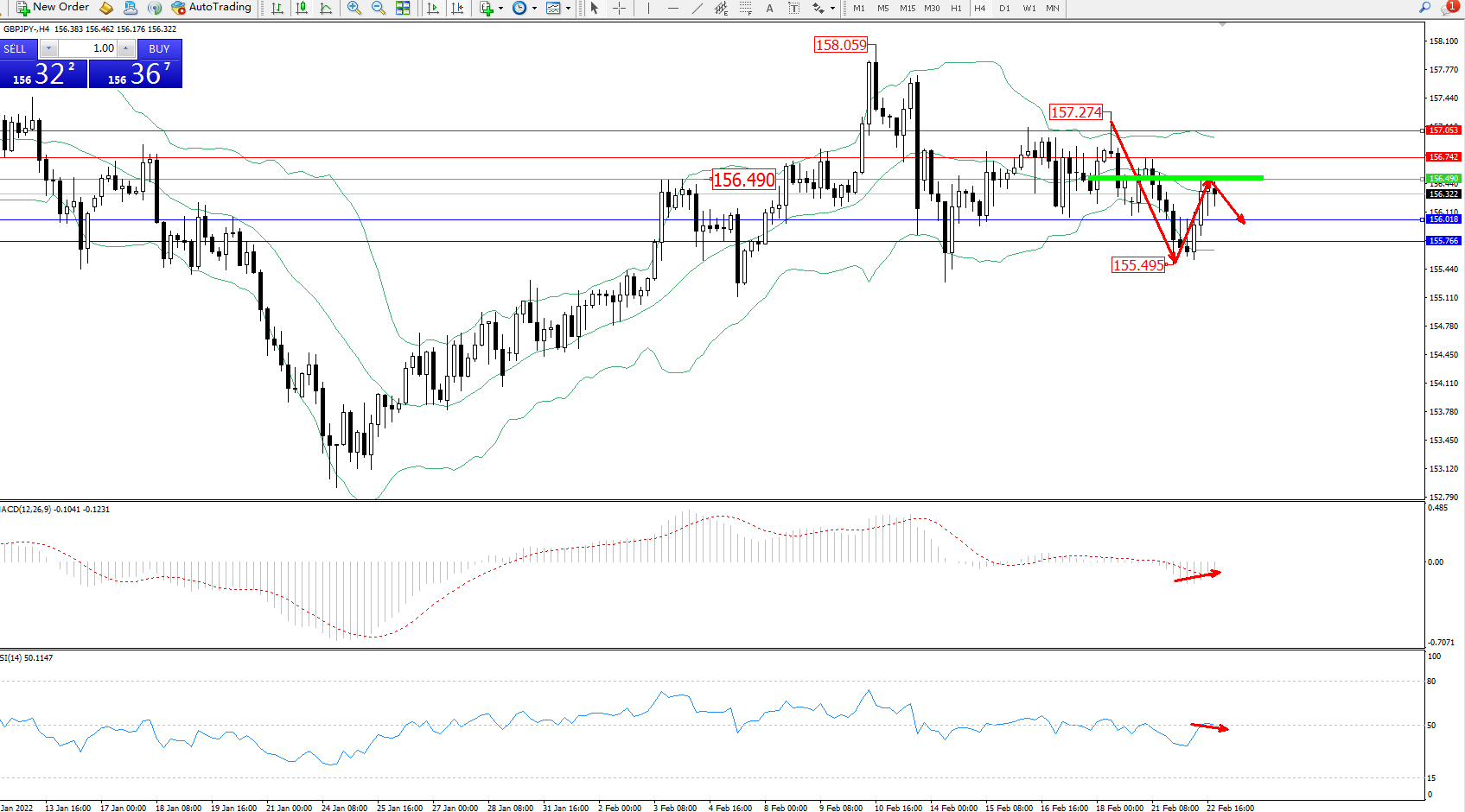

GBPJPY - 4-hour candlestick chart shows:

Technical Comments: It has remained in a narrow range within the Bollinger Bands indicator channel for a long time, the low level touched around 155.495 and got support and reversed and moved up. After reaching the node near the middle rail in the short term, the suppression was relatively strong near this level, and the Bollinger Bands indicator was slow. After opening the mouth, it began to move, the MACD indicator was in a weak position below the 0 axis, and the RSI indicator was in a narrow range around the 50 balance line;

Long-short turning point: 156.490

Suppression position: 156.742, 157.053

Support: 156.018, 156.766

Trading strategy: bearish below 156.490, target 156.018, 156.766

Alternative strategy: bullish above 156.490, target 156.742, 157.053

The above analysis is a personal opinion and is for reference only.

2022-02-23

2022-02-23

1121

1121

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia