The world is shaken by the frequent policies of major central banks

2022-09-23

2022-09-23

1341

1341

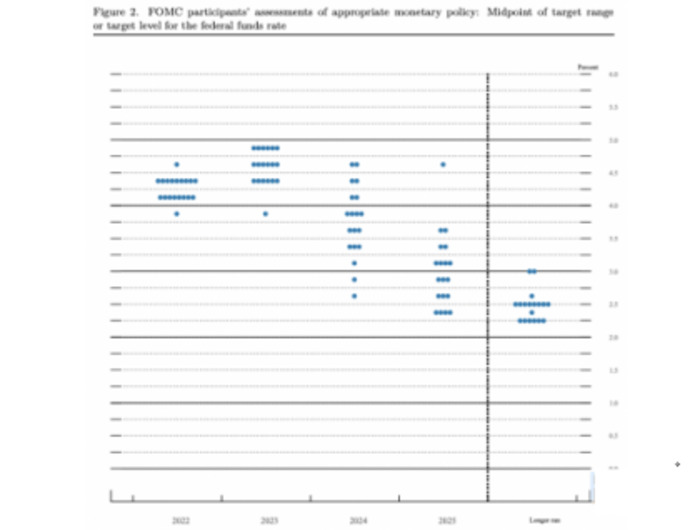

The Federal Reserve raised interest rates for the third time by 75 basis points at 2:00 am Beijing time on Thursday, and hinted that further large-scale interest rate hikes will be made at the next meeting. The U.S. dollar index surged to a fresh 20-year high and the Federal Reserve’s latest forecast showed its policy rate would rise to 4.4% by the end of the year before peaking at 4.6% in 2023 to curb uncomfortably high inflation.

Fed Dot Plot

The Federal Open Market Committee (FOMC) said in a statement after announcing its third consecutive rate hike of 75 basis points, the Fed typically raises rates by 25 basis points. The Fed "expects continued increases in the target range for policy rates to be appropriate," repeating language from a statement at its last meeting in July.

On Thursday (September 22), Beijing time, the Bank of Japan kept interest rates unchanged as scheduled, and the US dollar against the yen rose by about 80 points to 145.21 in the short-term, which was a new high since August 1998, with an intraday increase of 0.8%; Note: Federal Reserve After raising interest rates by 75 basis points overnight, the Bank of Japan kept interest rates unchanged, the interest rate gap between the United States and Japan further widened, the Bank of Japan said it would not hesitate to take additional easing measures if necessary, and the market expected the Fed to further raise interest rates sharply, The yen continues to depreciate.

The Bank of Japan remains a maverick amid global central banks withdrawing stimulus to fight a wave of soaring inflation and could become the last major central bank in the world with negative policy rates. Markets had focused on whether the Bank of Japan would show early signs of changing its approach by adjusting its commitments to keep interest rates at “current or lower” levels and expand stimulus if necessary to support the economy.

At 15:30 Beijing time on Thursday (September 22), the Swiss National Bank announced a new policy, raising interest rates by 75 basis points as scheduled. Economic growth forecast.

SNB: The need for a further increase in the SNB policy rate cannot be ruled out to ensure price stability in the medium term; this ensures that the guaranteed short-term CHF money market rate remains close to the SNB policy rate. The Swiss economy is expected to grow by around 2.0% in 2022, compared with the June forecast of around 2.5%. Inflation is projected to be 3.0% in 2022 (2.8% previously), 1.7% in 2024 (1.6% previously), and 2.4% in 2023 (1.9% previously).

At 19:00 Beijing time on Thursday (September 22), the Bank of England announced a new policy, raising interest rates by 50 basis points as scheduled, but three members requested a 75 basis point rate hike. The Bank of England's benchmark interest rate rose to 2.25% from 1.75%. The Bank of England said: The Monetary Policy Committee decided to raise interest rates by 50 basis points with a vote ratio of 5:4, and 3 members supported a 75 basis point increase in interest rates. The committee also voted to start Treasury sales from October 3, with a 9-0 decision to reduce Treasury holdings by £80bn to £758bn over the next 12 months.

Bank of England resolution: Wholesale gas prices have nearly doubled since May as Russia curbs gas supplies to Europe and risks further restrictions. This is passed on to retail energy prices, which will exacerbate the decline in real UK household income and push UK CPI inflation further in the short term. Sterling fell to $1.1211 on the day, its lowest level since the mid-1980s, largely on the back of a stronger dollar and concerns over Britain's economic outlook, Prime Minister Truss' plans to significantly increase government borrowing and potential intervention in the Bank of England's independence.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia