The latest report of the World Bank lowered its forecast for global economic growth in 2022 to 2.9%, and warned that the world will face the risk of stagflation, and the outlook for crude oil demand is not optimistic. Indicates the possibility of a "topping"

World Bank downgrades global economic growth in 2022

On Wednesday (June 7), the World Bank (The World Bank) released the latest "Global Economic Outlook Report", and lowered its forecast for global economic growth in 2022 to 2.9%, compared with last year's 5.7% growth rate and the World Bank's January forecast. Compared with 4.1% and the 3.2% forecast in April, the value continued to decline, and warned of the risk of stagflation globally.

The World Bank expects global growth to hover around 3% in 2023 and 2024, the economy will enter a protracted period of sluggish growth in the next few years, and sluggish economic growth may continue throughout the decade, with slow supply growth during periods of high inflation, inflation It is possible to remain at higher levels for a longer period of time. The global economy risks slipping into a stagflation similar to the 1970s, which could hurt middle- and low-income economies, mainly triggered by the conflict between Russia and Ukraine.

In addition, World Bank President David Malpass warned that if the U.S. accelerated interest rate hikes to bring strong financial pressure to emerging market and developing economies, the European Union suddenly banned the import of Russian energy, and China imposed a new epidemic-related blockade and other risks. , the global economy may experience a sharper downturn in 2022, triggering a global recession. Growth is nearly halved in 2023, to 2.1% and 1.5%, respectively.

In this regard, Malpass called on policymakers to work to coordinate Ukraine's aid, deal with soaring oil and food prices, strengthen debt relief, strengthen efforts to contain the epidemic, and accelerate the transition to a low-carbon economy. At the same time, the World Bank report predicts that the economic growth of the United States in 2022 is revised down by 1.2 percentage points to 2.5%, and the forecast of the euro zone is revised down to 2.5%, Japan's growth is 1.7%, China's 4.3%, and Russia's economic growth shrinks by 11.3%.

Under the impact of the epidemic and war, global economic growth has inevitably appeared a more pessimistic outlook, and the risk of stagflation has gradually emerged as major central banks tightened monetary policy, which is not conducive to the continued maintenance of high oil prices in the later period.

Major institutions raised their expectations for crude oil to rise

Under the circumstances that the situation in Russia and Ukraine has not eased for a long time, the EU has imposed sanctions on Russian energy, and major central banks have accelerated their tightening policies to control inflation, the global economy will face a shock. This is expected to eventually hit the oil demand side, which in turn weighs on prices. However, from the historical experience, the oil price downturn caused by economic recession often occurs in the later period, so this does not mean that the short-term downside risk of oil price has surged.

On the contrary, major institutions have recently raised their oil price expectations. The EIA short-term energy outlook report released on Wednesday (June 7) expects the 2022 WTI crude oil price to be $102.47/barrel, higher than the previous expectation of $98.20/barrel.

Goldman Sachs sees Brent at $140/bbl in Q3 (previously $125/bbl), $130/bbl in Q4 (previously $125/bbl), and $130/bbl in Q1 2023 USD/bbl (previously expected $115/bbl).

Citibank raised its forecast for Brent crude oil prices in the third quarter of 2022 by $12 to $99 a barrel;

Morgan Stanley expects the basic expected price of Brent crude oil to be $130/barrel in the third quarter, while the bullish price is expected to be $150/barrel;

Next, investors can focus on the ninth summit of the Americas to be held in Los Angeles, USA this Thursday. The summit will last for 5 days. It is expected that energy security will be one of the topics. In addition, the U.S. May CPI will be released on Friday (June 10), and Barclays Bank expects that rising energy and food prices may push up U.S. inflation in May, while core inflation pressures should also ease slightly.

Once there is more data showing that U.S. inflation will remain high for a longer period of time, it is expected that the Federal Reserve may still accelerate its tightening policy given the recent good performance of U.S. economic data, and there will be some pressure on crude oil in dollar terms.

Market Outlook

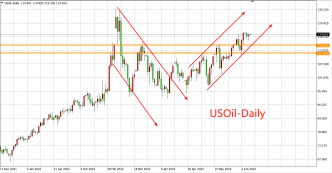

The daily chart of WTI crude oil shows that it is currently in an upward trend, with strong support below the 112-115 area, and if the top breaks through the resistance of the 120-122 area, the market outlook is expected to further challenge the previous high of $130. If WTI crude oil finally falls below $112, you need to be alert to the possibility of oil prices turning into a downward trend, and it may fall back to test $105 or even the low $100 level.

2022-06-08

2022-06-08

1230

1230

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia