Fundamental Analysis:

USD/CHF remains volatile near 0.92155 as Russia extends the Belarus exercise scheduled to end on Sunday, so the focus will be on the upcoming February 24 meeting between US Secretary of State Anthony Blinken and Sergei. Russian Foreign Minister Lavrov meanwhile Investors will be closely watching the developments surrounding the conflict in Ukraine. This will affect risk sentiment and partially boost USD/CHF. USD/CHF attempted to extend Monday's early gain and saw new selling near the 0.9220 area, and now it looks like both. The pair will expand the losses in the coming weeks.

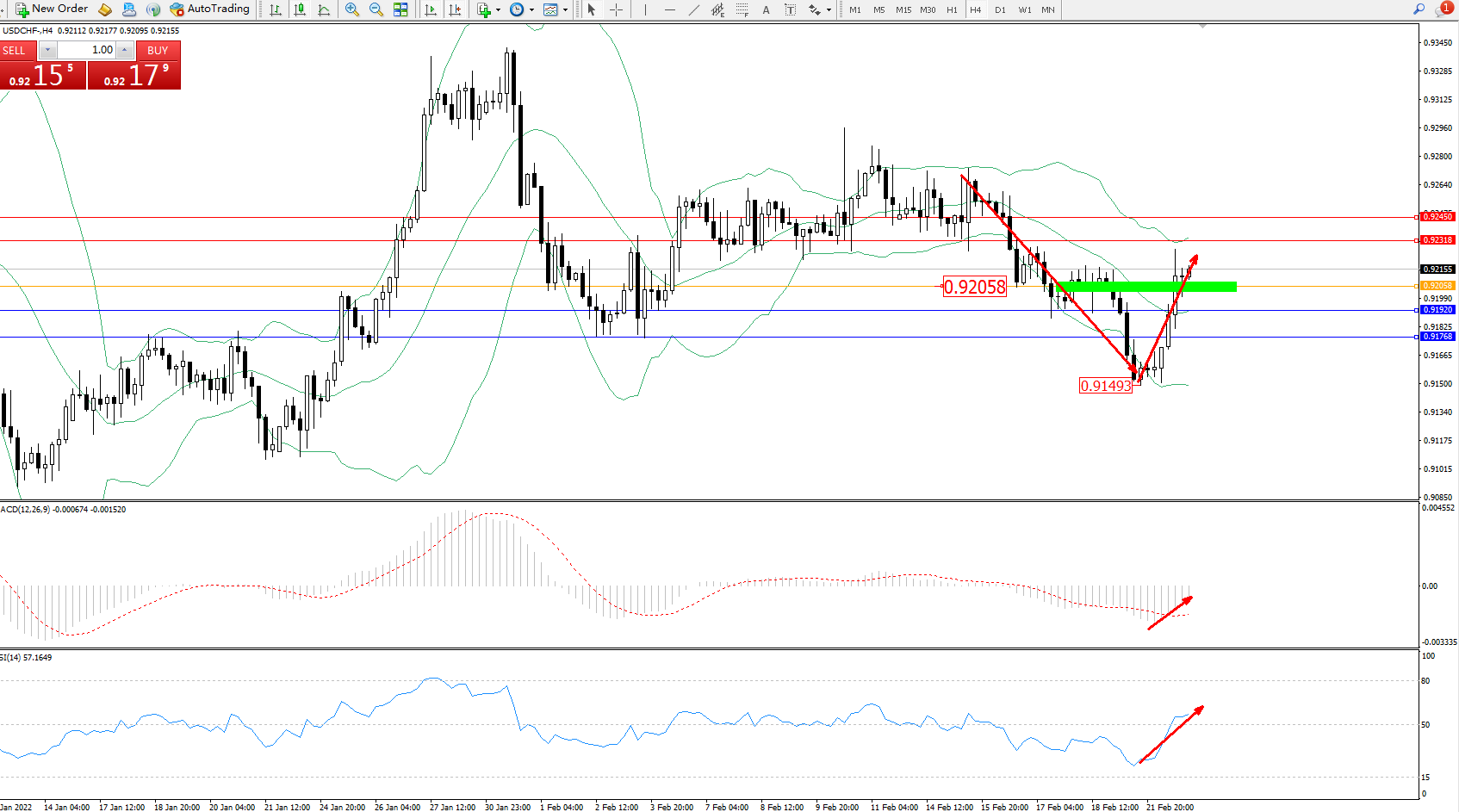

USDCHF USDCHF - 4-hour K-line chart showing:

Technical Opinion: The bearish momentum continues to fluctuate in the middle and lower support of the Bollinger Bands indicator channel, the low level reached 0.91493 and was supported and then sharply rose. Low bullish momentum awaits an opportunity to enter the market after a strong upward move. It is about to touch a node near the upper rail of the Bollinger Bands indicator. The Bollinger Bands indicator moves down and starts moving. The MACD indicator is in a bearish area, volatile at the low level and rising slowly. The RSI indicator is in The bearish area continues to fluctuate and move up to the 50 equilibrium line.

Long and short turning point: 0.92058

Suppression bit: 0.92318, 0.92450

Support level: 0.91920, 0.91768

Trading Strategy: Bullish Above 0.92058 Target 0.92318, 0.92450

Alternative Strategy: Bearish Below 0.92058 Target 0.91920, 0.91768

The above analysis is my personal opinion and is for reference only.

2022-02-23

2022-02-23

969

969

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia