The overall outlook for the UK economy remains rather bleak

2023-02-25

2023-02-25

1094

1094

GBP/USD retreated from gains and is now down about 0.20%. The overall outlook for the UK economy remains rather bleak. The Brexit dilemma looms as the Eurosceptic Conservative Party challenges the PM's talks with the EU over the Northern Ireland border , Europe's recovery lagged that of the US, and the UK lagged behind the euro zone.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange commercial position report shows that as of 2023-01-31, the (lot) long position in the pound increased by 3,163 lots to 130,370 lots. Any gains in sterling will be short-lived. GBP/USD still has a lot of room to fall after falling below 1.20.

British consumer confidence rose sharply in February, boosting the outlook for the UK economy and the pound rose accordingly. The GfK consumer confidence index rose 7 points to -38 in February, the highest level since April 2022. In part, the data suggested life would be tougher for the BoE as it tries to cool aggregate demand to curb inflation. Markets are now pricing in a BoE rate of 4.50% by the end of the year, with 25 basis points of rate hikes expected in March and May.

Markets doubt that the Bank of England will raise interest rates, peaking at around 4.5%, before cutting them at the end of the year, mainly to stimulate an economy that is widely expected to slip into recession. Earlier this month, the Bank of England announced its interest rate decision at its meeting, and the language in the statement softened compared with recent months, raising expectations that the bank may make a decision at its next meeting on March 23. The final rate hike of 25 basis points at the meeting marks the end of the current rate hike cycle.

BoE Monetary Policy Committee (MPC) member Catherine Mann has warned that UK interest rates will have to keep rising to prevent inflation from sticking around for too long. She told an event hosted by the Resolution Foundation that she did not think the current level of interest rates was "in a restrictive stance".

Deutsche Bank stated that based on the assumption that there is a standard linear lag period of 18-24 months in the transmission of monetary policy to the real economy, we have calculated that only 30% of the interest rate hike effect of the Bank of England may be transmitted to the economy. rose to 75%. Assuming no interest rate cut next year, the effect of raising interest rates will not be 100% apparent until the fourth quarter of 2024. The Bank of England is likely to raise interest rates one last time in March as monetary policy further weighs on the economy.

The British Purchasing Managers Index released by S & P showed that in January, the services PMI soared 4.6 to 53.3, pushing the composite PMI from 48.5 to 53.0. However, manufacturing indicators are still below the dry-boom line. The sub-indices showed that a measure of supplier deliveries recorded the highest level since 2019, while manufacturing output rose for the first time since June.

Signs of peaking inflation, improving supply chains and easing recession risks lifted broader business sentiment, said Chris Williamson, an economist who compiled the report. A rise in inflation measures in the survey added to pressure on the Bank of England to tighten policy further, and possibly more aggressively. While data showed that the chances of a near-term recession have fallen sharply, rising inflationary pressures clearly remain a concern. ”

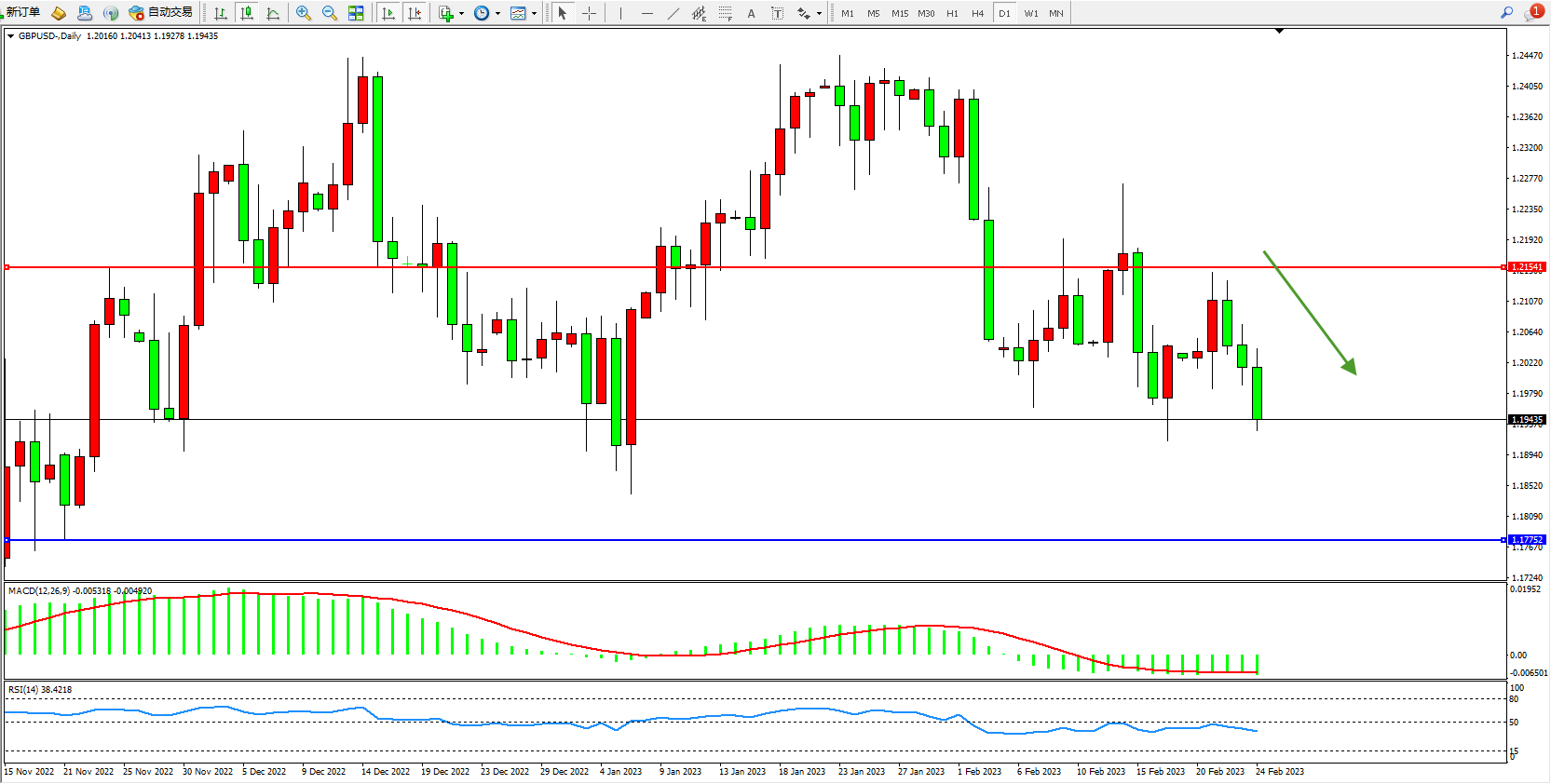

Daily K-line chart of GBP/USD

The short-term momentum maintains the ladder shock and moves down, and the short-term decline has not stopped. The market is shrouded in bearish sentiment, and there is a trend of continuing to move downward. For upper suppression, focus on around 1.21541, and on low support, focus on around 1.17752. The RSI index is hovering below the 50 balance line;

[Disclaimer] This article only represents the author's own opinion, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained, and does not constitute any investment advice. assumes all risk and responsibility.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia