Gold prices fell for a fifth straight session, the longest losing streak since November last year, as gold's appeal waned amid a stronger dollar and more U.S. interest rate hikes; major catalysts weighing on gold and silver markets The factor is a rebound in the U.S. dollar, gold and the U.S. dollar are competing safe-haven assets, and rising U.S. interest rates suggest a stronger U.S. dollar, which will add further downside to gold.

Speculators' net long positions in COMEX gold fell by 6,561 contracts to 46,236 contracts in the week to August 16, according to data from the U.S. Commodity Futures Trading Commission (CFTC). Net long dollar positions rose to $13.37 billion from $12.97 billion the prior week, the first increase in four weeks. Gold ETFs data on August 19 showed that as of August 19, the world's largest gold ETF-SPDR Gold Trust held 989.01 tons of gold, an increase of 3.18 tons from the previous trading day.

The minutes of the Fed's July FOMC meeting showed that the committee still sees inflation as a major risk to the economy. "Participants observed that inflation remains unacceptably high, well above the committee's long-term 2 percent target," the minutes said. "Participants also noted that high living costs are a particularly heavy burden on low- and middle-income households. Participants agreed that there has been little evidence so far that inflationary pressures are waning."

The market evaluates the minutes of the Fed's July meeting and believes that the duration of high inflation may far exceed expectations, and the Fed may continue to aggressively raise interest rates at the September meeting, thereby putting pressure on gold prices. The Federal Reserve's remarks that interest rates are likely to remain elevated for an extended period of time could have a negative impact on the gold market. Previously, due to the bright U.S. non-farm payrolls data in July, the CPI and PPI improved slightly, which made the market optimistic for a time, and began to expect the Fed to slow down the pace of interest rate hikes, and even expected that the tightening policy would be reversed.

U.S. stocks are likely to remain stagnant after Wednesday's rout, CNBC's Jim Cramer said, urging investors to trim some of their positions. He believes there are three reasons: the market is overbought, the Fed has not finished raising interest rates, and there is too much bubble in the market. He is not optimistic about the U.S. stock market outlook, and U.S. stock investors may turn to safe-haven assets such as gold.

The National Association of Home Builders/Wells Fargo Housing Market Index fell into negative territory in August, marking the eighth straight month of declines in builder confidence. "The Fed's tightening monetary policy and rising construction costs have contributed to the housing recession," NAHB chief economist Robert Dietz said in a news release. The New York Fed's Empire State Manufacturing Survey fell 42 points in August, which matched new orders. related to a sharp drop in shipments.

So far, gold still faces further downside risks due to significant dollar demand. The dollar continued to build on a recovery rally driven by risk-averse market conditions amid heightened recession fears.

The sell-off in global bond markets continues as central banks are likely to stick to a tightening path in the face of raging inflation. The resulting surge in U.S. bond yields also bodes well for the U.S. dollar, while weighing on non-yielding gold. The recent rally in the dollar was sparked by hawkish comments from the Federal Reserve as they continued to support restrictive monetary policy until they were confident that inflation had fallen.

St. Louis Fed President Bullard, one of the Fed's most hawkish policymakers, said on Thursday (August 18) that he is inclined to support a third straight 75 basis point rate hike in September. He added: "We should raise rates quickly to put significant downward pressure on inflation as soon as possible. I really don't understand why the process of raising rates should be delayed until next year."

Strategists at TD Securities believe that next week's annual meeting of global central banks in Jackson Hole could dent demand for gold, as Fed Chairman Jerome Powell is likely to dampen expectations for a rate cut. "Jackson Hole could provide a platform for the Fed to fend off market rate-cut bets, which should dampen investment interest in gold."

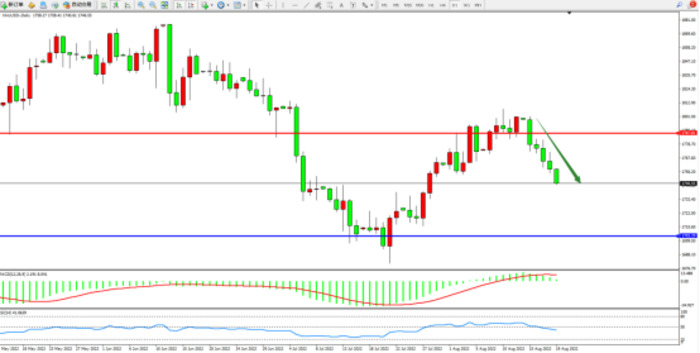

The gold daily K-line chart shows:

The bearish sentiment in the market is shrouded. The low-level bulls continue to oscillate upwards and then start to reverse and move downwards. The short-term bearish momentum continues to move downwards. The top suppresses and focuses on the vicinity of 1787, and the low-level support focuses on the vicinity of 1703. The MACD indicator is weak on the upper side of the 0 axis. Move, the RSI indicator is in a weak order below the 50 equilibrium line; as shown in the figure:

[Disclaimer] This article only represents the author's own point of view and does not constitute any investment advice. Please read it for reference only, and bear all risks and responsibilities.

2022-08-22

2022-08-22

1398

1398

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia