GBP/USD closed this week at a node near 1.31053, and remains at a low level in the short term. The Bank of England raised interest rates moderately by 25 basis points in March, which may set a bearish tone for GBP in the coming weeks. With rising energy prices and other inflationary factors, the UK CPI is expected to be close to 8% this year. Risks for the pound in the future are skewed to the downside. Furthermore, the UK's fiscal support for households is unlikely to change the Bank of England's stance, providing only limited support for the pound.

The US Commodity Futures Trading Commission CFTC foreign exchange non-commercial position report shows that as of 2022-03-29 in the week (hand) GBP/USD long positions decreased by 2129 lots to 30624 lots. Sterling was down 0.25% at $1.3109. Sterling traded in a narrow range against the dollar in the absence of major economic or policy news. In the context of continued high inflation, the Bank of England is likely to maintain tightening policy, which paved the way for the future upward movement of the pound.

According to news from CCTV Finance on March 31, due to climatic constraints, many farms in the UK will use greenhouses to grow crops and use natural gas to heat the greenhouses. Since the beginning of this year, natural gas prices have continued to rise, and some farmers have had to suspend greenhouse cultivation, which has led to shortages of common agricultural products such as cucumbers, eggplants, and tomatoes in supermarkets. According to the British Plantation Association, the cost of growing a cucumber in the UK last year was about 0.25 pounds (about 2.1 yuan), and now it has doubled. As energy prices continue to rise, the cost of a cucumber Costs will likely rise to £0.70.

In order to ease the price pressures faced by British people and businesses, the British government's spring budget announced on the 23rd includes a series of response measures. Industry insiders pointed out that the British government's support measures were insufficient due to the rapid rise in prices of energy and food. Against the background of the Russia-Ukraine conflict, inflation in the UK may rise further and economic growth may slow, which will make the Bank of England more cautious in raising interest rates to curb inflation.

The UK Health Security Agency recently issued a report saying that it is not uncommon for the emergence of recombinant strains of the new coronavirus, and there is currently insufficient evidence to draw conclusions about the growth advantages or other characteristics of the recombinant strain XE, and the agency will continue to monitor the situation. The data shows that there have now been 637 cases of XE in the UK (i.e. the recombination of Omicron BA.1 and BA.2).

According to reports, when an individual is infected with two or more new coronavirus variants at the same time, a recombinant variant will be produced. And this is not uncommon, with several cases of recombination of Covid-19 variants being discovered during the Covid-19 pandemic. The UK Health Security Agency (UKHSA) analyzed 3 scenarios, namely XE, the reorganization of Omicron BA.1 and BA.2, and XD and XF for the reorganization of Delta and Omicron BA.1 . The data show that a total of 38 cases of XF and 637 cases of XE have been identified in the UK; no cases of XD have been identified, but 49 cases have been reported in global databases, most of them in France.

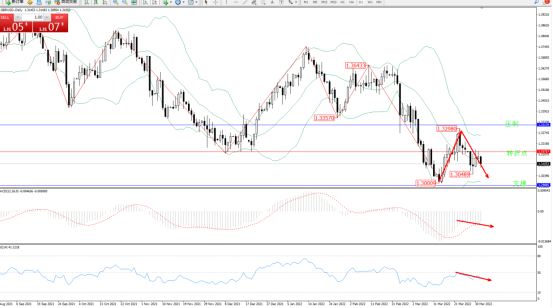

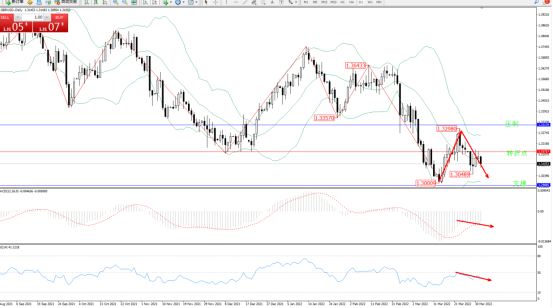

GBP/USD daily candlestick chart shows:

The bearish momentum maintained a low level after a short-term shock and moved up, and fell again, entangled in the weak shock of the lower side of the middle rail of the Bollinger Bands indicator channel, and continued to decline in the short term. The Bollinger Bands indicator showed a closing trend, breathing and panning. , the top suppression concerns around 1..33176, the low support around 1.29885, the turning point around 1.31717, the MACD indicator is in the bearish area below the 0 axis to maintain order and translation, and the RSI indicator is hovering weakly below the 50 equilibrium line, as shown in the figure:

[Note] This article only represents the author's own views, and remains neutral with respect to the statements and opinions in the article, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content, and does not constitute any investment advice. Please read For informational purposes only, and at your own risk and responsibility.

2022-04-04

2022-04-04

1130

1130

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia