The Fed's tightening is hard to stop, and gold prices face a new round of tests

2023-02-22

2023-02-22

1351

1351

FOMC meeting minutes continue to raise interest rates

The minutes of the Federal Reserve’s January monetary policy meeting released in the early hours of Thursday (February 23) showed that all Fed officials who served as voting committees at the meeting voted for a 25 basis point increase in interest rates; Appropriate, but a few non-voting members want to raise interest rates by 50 basis points to show greater determination to reduce inflation.

The minutes showed signs that inflation was falling, but not enough to offset the need for further rate hikes. With inflation still well above the Fed's 2 percent target, the labor market remains very tight, leading to continued upward pressure on wages and prices.

There is no doubt that with the support of a series of strong economic data such as non-agricultural data, CPI, and PPI in February, the Fed’s statement is regarded by the market as a signal of further tightening. According to CME Group's "Fed Watch" tool, the market generally expects the Fed to raise interest rates by 75 basis points in March, May, and June, and the interest rate will rise to 5.25%-5.50%.

After the data was released, the U.S. dollar index stabilized at 104.0 to 104.59. The three major U.S. stock indexes were mixed. Spot gold fell sharply in the U.S. market, falling by more than $20 at one point. Crude oil was affected by the global economic outlook, rising U.S. dollar, API crude oil inventory Dragged down by a surge of 9.895 million barrels, it fell 3.07% to an intraday low of $73.83, setting a new low in more than two weeks since February 6.

The Fed still needs to focus on the performance of a series of economic data in the future. The main tone of the market may be that the better the US economic data, the more room for the Fed to further tighten. Investors can focus on the US January core PCE price index released on Friday (February 24).

The core PCE is an important reference for the Federal Reserve to measure the outlook for inflation. In December last year, PCE rose 5% from a year earlier, down from 5.5% in November. The market generally expects the PCE to rise by 0.5% month-on-month in January, the largest increase since mid-2022.

Gold Outlook

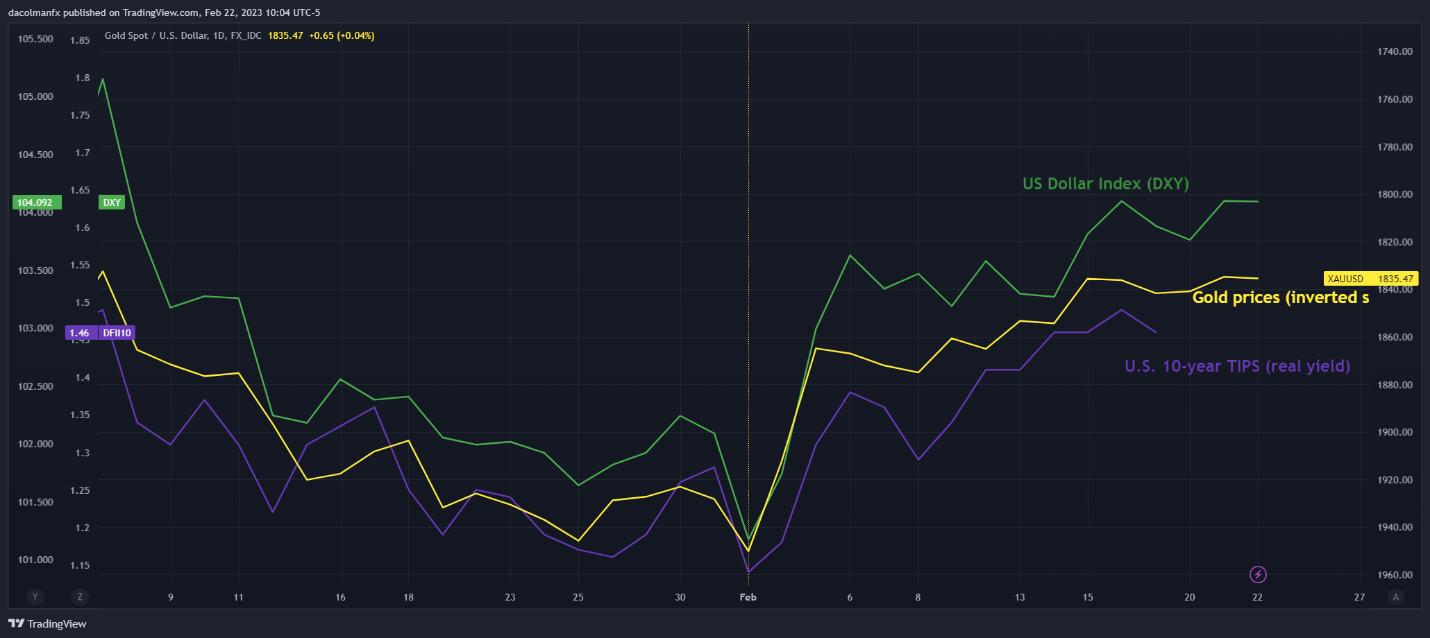

Gold prices fell more than 5% in February, dragged down by a strong rebound in real yields and the dollar. Since the beginning of the year, there has been a strong correlation between these three assets, with gold having a negative correlation with the U.S. dollar and U.S. Treasury yields.

The near-term relationship between currencies and fixed income is unlikely to reverse significantly in the short term, so gold may still be biased to the downside in the short term.

Earlier this year, traders were betting on a rapid decline in U.S. CPI, but inflationary forces have proved stickier than initially expected, thanks in part to a strong labor market. Rising CPI data, combined with the resilience of the economy, increases the risk that the FOMC will raise borrowing costs well above 5.00%, or even resume early rate hikes.

Fed funds futures contracts suggest the Fed's terminal rate could peak at around 5.35% this summer, but rate expectations could move higher if demand-driven price pressures prevent inflation from quickly returning to 2%. This could delay the Fed's dovish turn for the foreseeable future.

An increasingly hawkish monetary policy outlook, coupled with continued higher interest rate expectations, will act as a tailwind for real yields, strengthening the dollar's recovery in financial markets. In this scenario, precious metals and rate-sensitive assets could adopt a defensive stance in the days and weeks ahead. Taken together, the path of least resistance for gold appears to be to the downside.

Technical Analysis

Looking at the four-hour chart, the price of gold maintained a further decline, but compared with the previous decline speed and angle, this week's decline has been significantly reduced, which is the performance of the slowdown of the short-term market. 1820-1846, in this range, the first choice is to sell high and buy low. If it falls below 1820, the short position will accelerate, and look down to 1800-lower; if the market outlook unexpectedly breaks through 1850, the bottom will be formed. 1900 line.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia