The Fed's hawks raised interest rates, and the market staged a "night terror"

2022-09-22

2022-09-22

1464

1464

On Wednesday, September 21, Eastern Time, the Federal Reserve Monetary Policy Committee announced after the FOMC meeting that it would raise the benchmark interest rate by another 75 basis points, raising the target range of the federal funds rate from 2.25% to 2.50% to 3.00% to 3.25%. The highest level since early 2008.

So far this year, the Federal Reserve has raised interest rates five times in a row, and has raised interest rates by 75 basis points in the last three consecutive times, maintaining the strongest single rate hike since November 1994.

The Fed reiterated that it is appropriate to expect continued rate hikes and reiterated that the Committee is highly concerned about inflation risks, with the Russia-Ukraine conflict creating additional upward pressure on inflation. Fed officials expect monetary policy to take a harder line.

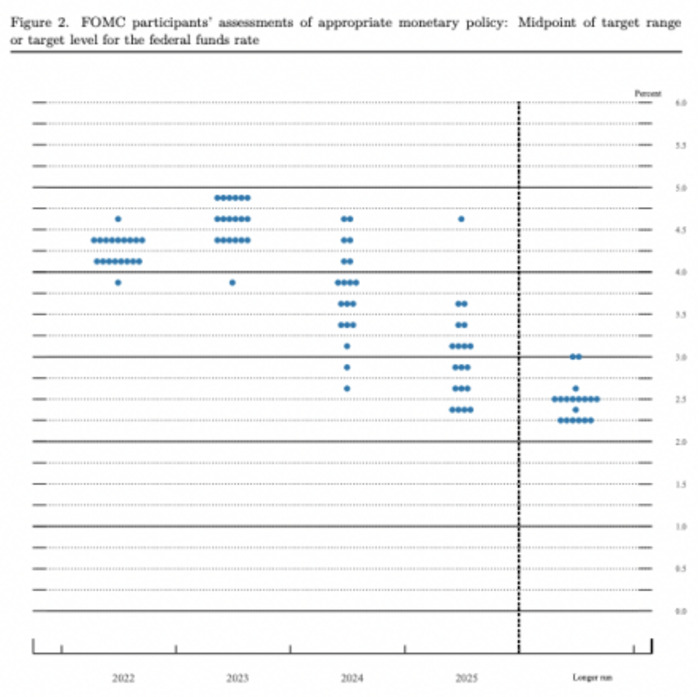

Hawkish dot plot sparks panic

The Fed's quarterly forecasts show a steeper rate path than officials set in June, raising rates by at least 1.25 percentage points at the remaining two meetings of the year. This underscores the Fed's determination to reduce inflation.

Officials forecast interest rates to hit 4.4 percent by the end of the year and 4.6 percent by 2023, a shift in what they called the dot plot more hawkish than expected. That means a fourth straight 75 basis point rate hike is likely at the next meeting in November, about a week before the US midterm elections.

免費開通賬戶> > 入金最高送 $88

Specifically, all but one of the other 18 Fed officials expect the policy rate, the federal funds rate, to rise above 4.0% this year, and nine of them expect it to be in the 4.25% to 4.5% range.

In addition, 19 officials all expected the policy rate to exceed 4.25% next year, and 12 of them expected it to exceed 4.5%, which means that the interest rate will be raised by 25 basis points next year, but the interest rate will not be cut.

The dot plot shows no rate cut until 2024. Powell and his colleagues have emphasized in recent weeks that a rate cut next year is unlikely because the market has been pricing in.

The chart shows as many as three cuts in 2024 and four in 2025 to reduce the long-term funds rate to a median outlook of 2.9%.

In terms of economic forecasts, the FOMC expects GDP growth to slow to 0.2% in 2022, before edging up to a long-term growth rate of just 1.8% in subsequent years. The revised forecast was down sharply from June's 1.7% forecast and came after two consecutive quarters of negative growth, the generally accepted definition of a recession.

Powell insists on putting "Eagle"

Fed Chairman Powell continued to be tough at the press conference after the meeting. He said that he would be resolutely committed to reducing inflation and that he was adjusting policy to a level sufficient to limit economic growth. Powell also insisted that the U.S. economy is strong and does not expect to consider it in the short term. Sale of residential mortgage-backed securities (MBS).

"My main message hasn't changed since Jackson Hole," Powell said at a news conference after the meeting.

Powell said his main message was that he and his colleagues were determined to reduce inflation to the Fed's 2 percent target, and they "will stick to it until the job is done." That quote quoted former Fed Chairman Paul Waugh The title of Erke's memoir "Hold On".

"We've written down what we think is a reasonable path for the federal funds rate. The path we actually execute is enough -- it's enough to restore price stability," he said. That's a strong signal that officials won't hesitate to raise rates by more than they currently expect, if that's what is needed to cool inflation.

"We have to get out of inflation. I want a painless way to do that. No," Powell said after officials raised their target for the benchmark federal funds rate to a range of 3% to 3.25%.

FOMC Statement Summary

In its September rate decision statement, the FOMC said recent indicators point to modest increases in spending and production. Employment growth has been strong in recent months and the unemployment rate has remained low. Inflation remains high, reflecting supply and demand imbalances related to the pandemic, rising food and energy prices and broader price pressures.

Russia's war against Ukraine is causing enormous human and economic hardship. The war and related events are putting additional upward pressure on inflation and weighing on global economic activity. The Committee is highly concerned about inflation risks.

The committee seeks to maximize employment and inflation at a rate of 2% over the long term. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3% to 3-1/4%, and expects that continued increases in the target range will be appropriate.

In addition, the committee will continue to reduce its holdings of U.S. Treasury and agency debt and agency mortgage-backed securities, as outlined in the Fed's plan to reduce the size of its balance sheet released in May. The Committee is firmly committed to returning inflation to its 2% target.

market performance

The three major U.S. stock indexes fell quickly after the Fed's announcement of the rate decision, with the Dow Jones Industrial Average down 522 points, or 1.70%, despite rising more than 300 points earlier in the day. The S&P 500 fell 1.71% and the Nasdaq Composite fell 1.79%.

The dollar rose strongly, hitting a new 20-year high for the first time since 2002, standing above 111 for the first time since 2002.

After the Fed raised interest rates by another 0.75 percentage points, the yield on two-year U.S. Treasuries exceeded 4.1%, reaching 4.138%, the highest since October 2007. Meanwhile, the benchmark 10-year Treasury yield rose to a high of 3.64%, its highest level since February 2011.

Spot gold staged a roller coaster market, first falling below the $1,660 mark, and then pumping back about $34, reaching as high as $1,687.98, and finally closed up 0.56%.

In terms of crude oil, the two crude oils rose first and then fell. WTI crude oil fell sharply after rising to a high of US$86.64/barrel in European trading, and finally closed down 1.47% at US$83.02/barrel; Brent crude oil fell below the US$90 mark, and finally It closed down 0.94% at $89.98 a barrel.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia