The GBP/USD fluctuated and rebounded this week, mainly benefiting from the weakening of the U.S. dollar, but this week, the market's expectation of cautious interest rate hikes by the Bank of England limited the pound's rise. Manufacturing and services data released by the UK underperformed. The UK economy will fall into negative growth in the second quarter. Inflation is likely to worsen as supply chains, labor shortages and other factors affect. The British economy is in a stagflation crisis, which also puts the Bank of England in a dilemma.

The US Commodity Futures Trading Commission CFTC foreign exchange non-commercial position report shows that as of 2022-05-24 the week (hand) GBP/USD long positions decreased by 677 lots to 25,936 lots. At present, the entire rhythm of GBP/USD seems to be dominated by bulls. The price has been pulled up all the way, coupled with the continuous testing of the high point, the pound still has further upward momentum, but at the same time the price has come to the conversion pressure of the previous downward trend, which means that it is now the selection stage of long and short.

Huw Pill, chief economist of the Bank of England and a member of the Monetary Policy Committee, said the bank needs to further tighten monetary policy to deal with rising inflation, but is also worried that too fast action will bring recession risks to the British economy. Expect further BoE action in the direction we forecast in the coming months. Under the influence of Brexit and the epidemic, more needs to be done for monetary policy to transition from supporting economic development to a state that may return to a financial crisis. Not necessarily an extremely tight stance, but a stance that forgoes some easing and is more reflective of the fact that inflation is higher and the labor market is tightening.

The package of fiscal stimulus announced by the UK on Thursday had a limited boost to the pound and may only be able to stabilize the pound at its current level; market concerns about the UK's fiscal deficit and the UK government's windfall tax on energy companies have created headwinds for investment. Sterling's gains are likely to be capped; in addition, UK fiscal stimulus may ease market concerns about the Bank of England raising rates too aggressively.

With the UK government announcing that it will impose a windfall profits tax on oil and gas companies, BP said it would reconsider its plans in the UK. BP has previously said it plans to invest £18bn in the UK by 2030 and that the plan is not dependent on the government raising taxes.

British Chancellor of the Exchequer Sunak announced in the House of Commons on Thursday that a 25% tax on energy profits would be imposed on oil and gas companies. Soaring oil and gas prices weigh on British households at a time when inflation remains stubbornly high, and the Jensen government has finally agreed to a tax hike under pressure from multiple parties. However, Sunak also said that the tax increase is only temporary and will be phased out when oil and gas return to more normal levels.

The Jensen government is also helpless in imposing windfall profits tax on energy companies. Oil and gas prices rose further after the Russian-Ukrainian conflict broke out, and energy companies reaped huge profits. That sparked a backlash at home in the UK, with critics arguing that it was unreasonable for fossil fuel companies to make record profits at a time when many consumers were struggling to cope with soaring energy prices.

Domestic opposition MPs and environmentalists have repeatedly called on Prime Minister Jensen to impose a windfall profits tax on oil and gas giants to help struggling British families. Jensen at one point rejected a windfall tax, saying it would depress important investment and keep oil prices high for a long time.

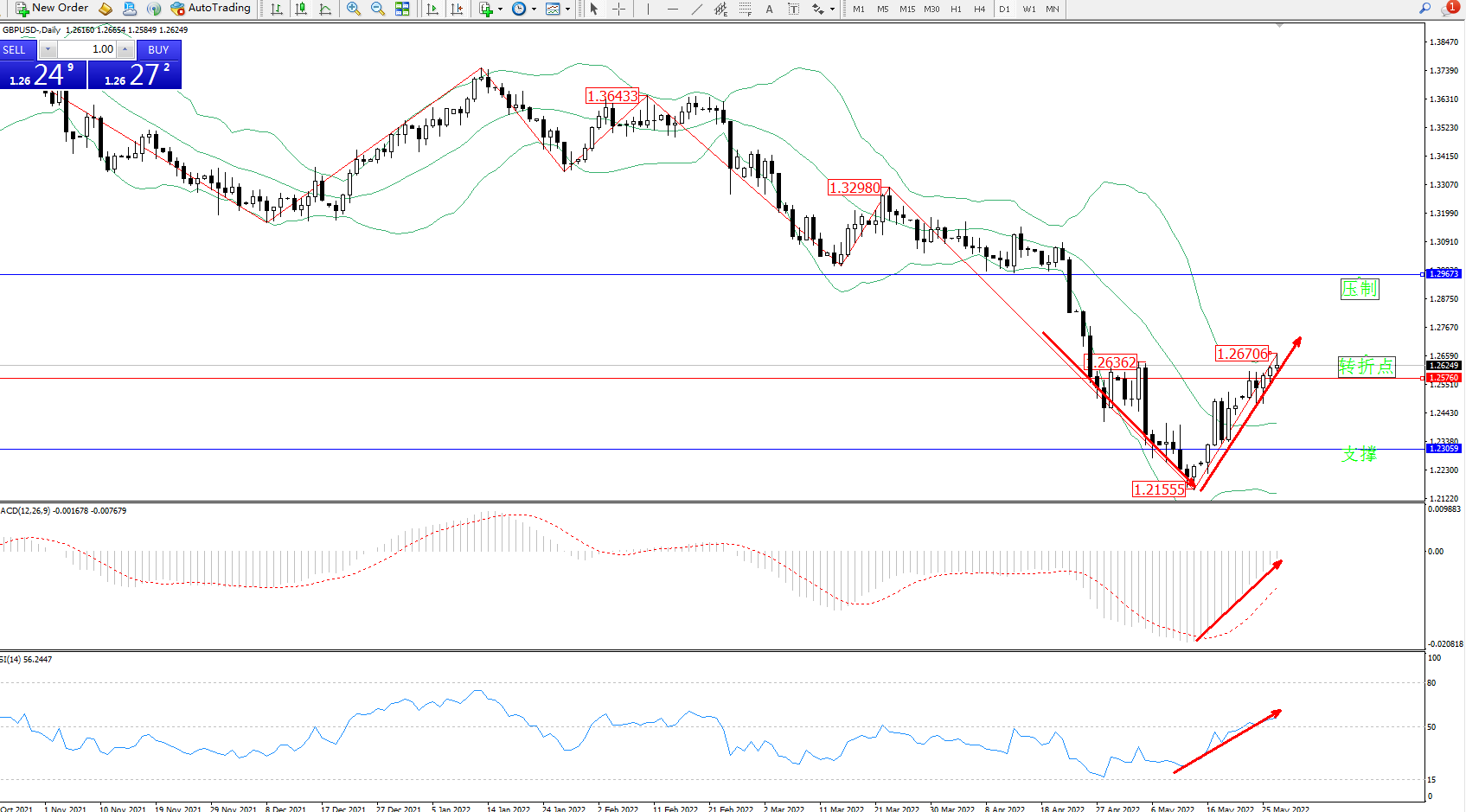

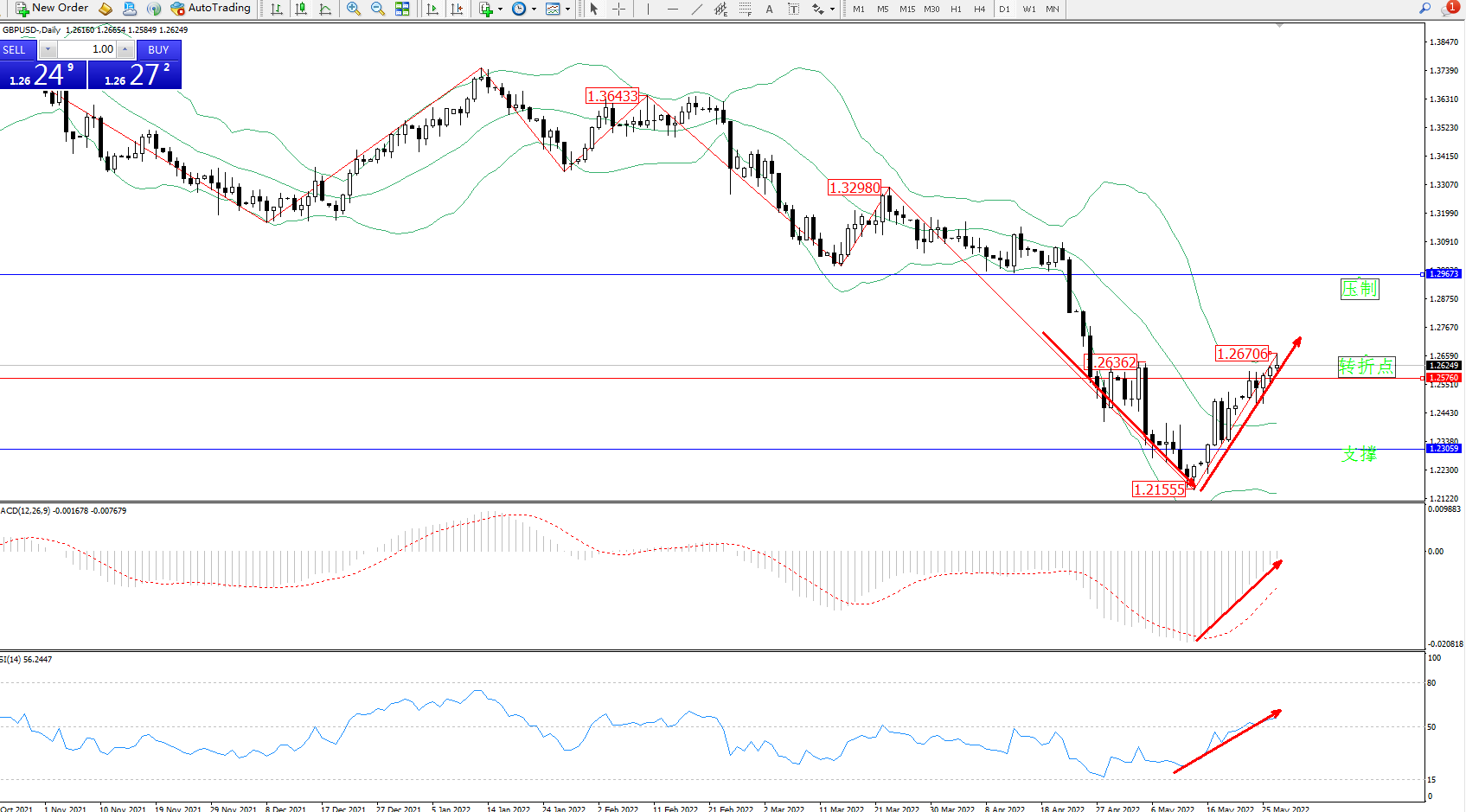

The daily K-line chart of GBP/USD shows:

The strength of the bears continued to oscillate downward in the middle and lower rails of the Bollinger Bands indicator channel. After reaching the node near 1.21555, the low began to reverse and move up in a V-shaped trend. It touched the upper rail of the Bollinger Bands indicator and settled at the node near 1.26706. The short-term bullish momentum continued to rise. Pulling up the trend, the Bollinger Bands indicator shows a closing trend and then begins to move. The upper suppression focuses on the node near 1.29673, the low support focuses on the vicinity of 1.23059, and the turning point near 1.25760. The MACD indicator remains in the bearish area and moves upwards to hover around the 0 axis. The RSI indicator is long. The power lift moves up to the 50 balance line and hovers on the side, as shown in the figure:

[Disclaimer] This article only represents the author's own views, and remains neutral with respect to the statements and opinions in the article, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained therein, and does not constitute any investment advice. Please read For informational purposes only, and at your own risk and responsibility.

2022-05-30

2022-05-30

870

870

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia