Sunak becomes UK's new prime minister

2022-10-25

2022-10-25

1114

1114

British Prime Minister Election Schedule

①14:00, October 24 (Beijing time, 21:00, October 24): Deadline for members to submit nominations

②18:00 on October 24 (1:00 on October 25, Beijing time): Members vote for the first time

③October 24th 21:00 (October 25th 4:00 Beijing time) - the second vote of members

④11:00 on October 28 (18:00 on October 28, Beijing time) - voting ends

⑤October 31st - UK Budget

At 9:00 pm on October 24th, Beijing time, former British Chancellor of the Exchequer Rishi Sunak has successfully won the position of leader of the British ruling Conservative Party, and he will succeed Truss as the new British Prime Minister.

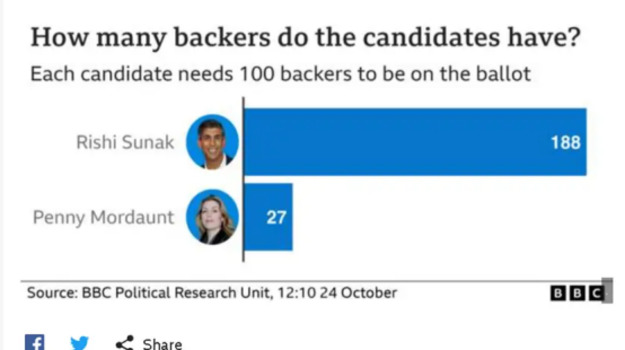

Judging from the BBC's report, Sunak "won" very easily, because former British Prime Minister Boris Johnson announced in the early morning of the 24th Beijing time that he would not run for the Conservative Party leadership election, but instead After switching to support Sunak, Sunak has already won enough votes in the Conservative Party.

The chairman of the "1922 Committee", Graham Brady, announced that Sunak has received enough votes to become the next leader of the British Conservative Party. :30) in a speech to lawmakers, British government bonds maintained their gains, with the 10-year bond yield falling 24 basis points to 3.82%. GBP/USD fluctuated within a short-term range against the U.S. dollar, now at 1.13.

Josh Mahoney, senior market analyst at IG Group in London: The news of Sunak becoming the new prime minister has created additional uncertainty for the market today, and it will basically be Sunak and Chancellor of the Exchequer Hunt leading the UK through this crisis .

The reaction in the UK government bond market has undoubtedly been positive, with the fall in yields raising hopes that we will see borrowing costs continue to fall after a tumultuous Trus tenure. Nonetheless, the pound is under pressure as pro-growth policies become a thing of the past and given warning signs from sharply lower PMI data this morning.

Many hope that the Bank of England's tightening and government policies will bring down inflation quickly without doing too much damage to the economy. However, traders remain concerned that these policies will be more damaging to the economy than expected, and that high inflation will keep the Bank of England rates high for longer.

With Rishi Sunak being appointed as Britain's third prime minister in three months, the question now is whether today's events will mark the start of the pound higher as confidence is restored in the government's fiscal plans. Regardless of how Sunak's term as prime minister unfolds, Britain's economy could face tougher times as it grapples with a worsening recession and even the prospect of a general election - upheaval that could further disrupt markets. Having said that, the flip side that is often overlooked in favor of GBP is that a slowdown in Fed (tightening) policy could help boost GBP as much, if not more, than UK fiscal policy.

Former Prime Minister Truss spokesman: I can confirm that the handover of the new prime minister will not take place on Monday. The chief of defense staff agreed with the Russian defense minister that open lines of communication are important to reduce the chance of miscalculation. The chief of defense staff spoke to Russia's foreign minister, denying allegations of plans to escalate the conflict in Ukraine. It will be up to the new British Prime Minister Sunak to decide whether to announce the mid-term fiscal plan on October 31. There was no confirmation on whether the transfer of power to the prime minister would take place on Tuesday. The handover time for Truss and Sunak will be determined later on Monday.

Ramsden, deputy governor of the Bank of England, said that now has entered a new era of unprecedented shocks. Investment firms have built resilience against a 200 basis point rise in yields. I think we've signaled quite a bit of quantitative tightening to the market. Quantitative tightening will have a tightening effect on profits. There was no discussion with the Treasury about changing the way the Bank of England's bond portfolio is compensated. New British Prime Minister Sunak: I am humbled and honoured to be elected leader. There is no doubt that we face profound economic challenges. Stability and solidarity are needed.

The market expects the pound to remain under pressure and fall to 1.09 by the end of the year, and it will take time for investor confidence in British bonds and sterling to recover. And now the political turmoil in the UK is making it increasingly difficult for investors to regain confidence. In addition, the key events that will determine the trend of the pound in the future may be the announcement of the fiscal plan and the rate hike of the Bank of England. However, it was reported earlier that the announcement of the medium-term fiscal plan was postponed again, and the deputy governor of the Bank of England also expressed that he did not confirm the central bank. Whether a substantial rate hike is needed.

与此原文有关的更多信息要查看其他翻译信息,您必须输入相应原文

发送反馈

侧边栏

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia