GBP/USD closed slightly higher in shock this week. Expectations of a substantial interest rate hike by the Bank of England increased, but a stronger dollar limited the pound's gains. British inflation reached its highest level in 30 years, and expectations for a substantial interest rate hike by the Bank of England increased. The Bank of England may announce in May that it will raise interest rates from 0.75% to 1%, and then raise interest rates to 2%-2.25% by the end of this year. But academics expect the Bank of England to be less aggressive.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange non-commercial position report shows that as of the week of 2022-04-12 (hand) GBP/USD long positions decreased by 359 lots to 35,514 hand-held positions. The pound has basically not changed much recently. The daily line is still in a downward trend. The price has been hovering and fluctuating around 1.300. There is neither a strong break below nor a reversal structure formed here, so it is still necessary to wait for a trend. change.

With inflation hitting a 30-year high, the Bank of England is under pressure to tighten policy further. Britain has raised interest rates three times since December. Markets are all but certain that the central bank will raise its benchmark rate by 25 basis points to 1% on May 5 and then to 2%-2.25% by the end of 2022. However, the Bank of England has softened its rhetoric on the need for further tightening as soaring energy prices threaten economic growth.

The Fed raised interest rates by 25 basis points to 0.25%-0.5% in March, and signaled that it would raise interest rates by 50 basis points on May 4. At the same time, there is still discussion on the reduction of the table. U.S. inflation, at 8.5%, a 40-year high, may be starting to peak, but is expected to remain above the Fed’s 2% target through at least the end of 2023.

Ambrose Crofton, a strategist at JPMorgan Asset Management, believes the BoE will try to strike a balance, setting policy on a more neutral stance while keeping a close eye on consumer conditions. However, some analysts pointed out that when inflation is caused by external factors, such as the squeeze on energy prices caused by the international situation, then raising interest rates by the domestic central bank may not be the answer to the problem.

In addition, given the uncertainties facing the current global economic situation, tightening monetary policy may hinder the prospects for economic recovery. In fact, at a time when global supply chains are tightening and commodity prices are soaring, most advanced economies are facing a similar situation to the UK, namely how to strike a balance between containing inflation and avoiding a recession.

Financial markets expect the Bank of England to almost certainly raise interest rates from 0.75% to 1% after its next meeting, and then to 2%-2.25% by the end of 2022. But economists expressed a different view, arguing that the Bank of England would not take such aggressive action. Among them, G7 economists at AXA Investment Management said that despite today's strong labor data, the Bank of England is still likely to pause interest rate hikes in the second half of 2022.

While the UK labour market remained tight in March, indicators showed that was starting to ease as employment and job vacancies growth slowed. The agency expects the Bank of England's Monetary Policy Committee to raise interest rates by 25 basis points to 1% in May, after which it is likely to raise interest rates once in June to 1.25%. But policymakers will pause rate hikes in the second half of 2022 as economic demand weakens and job growth begins to slow.

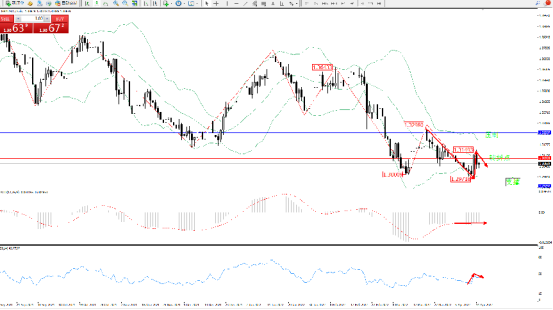

The daily K-line chart of GBP/USD shows:

The short-term bearish momentum continues to oscillate downward in the middle and lower rails of the Bollinger Bands indicator channel. The low-level long-term momentum is waiting for an opportunity to enter the market in the short term, maintaining a wide range of shock and translation within the Bollinger Bands indicator channel. The short-term short-term bearish momentum continues to decline. In the downward movement, the top suppression is concerned about 1.32507, the low support is about 1.29292, and the turning point near 1.30958 is concerned. The MACD indicator is in the bearish area to maintain order and move, and the RSI indicator is in the bearish area to maintain shock and move up to the lower side of the 50 equilibrium line. picture:

[Disclaimer] This article only represents the author's own views, and remains neutral with respect to the statements and opinions in the article, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained therein, and does not constitute any investment advice. Please read For informational purposes only, and at your own risk and responsibility.

2022-04-18

2022-04-18

1237

1237

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia