Pound, dollar recover on encouraging UK growth data

2023-01-16

2023-01-16

1205

1205

Sterling rose nearly 1.2% against the U.S. dollar, hitting a new high since December 15 to 1.2248, mainly benefiting from the sharp weakening of the U.S. dollar. In addition, encouraging British economic growth data also consolidated the confidence of sterling investors. In the first half of the year, GBP/USD will be stable at the current level. In the second half of the year, as the global monetary policy tightening cycle matures, GBP will experience some moderate strength relative to the generally overvalued USD.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange commercial position report shows that as of 2023-01-10, the (hand) long position of the British pound increased by 3,218 hands to 138,532 hands; the economic data of Germany and the United Kingdom were better than expected, indicating that Both countries may have avoided recession - at least for now - but the news failed to provide a lasting boost to either the euro or the pound.

While markets had already priced in a recession in the UK economy, recent favorable energy price developments have increased the likelihood that the recession will be shallower and shorter than expected. In the Bank of England's latest forecasts, the recession is expected to last until mid-2024. The downbeat assessment leaves more room for surprise growth in the year ahead. The outlook for sterling is now forecast to be more positive later this year, with sterling expected to rise to the 1.3000 level.

According to the British ""Financial Times"", the governments of emerging market countries have raised more than 40 billion US dollars in the international bond market this year. A massive sell-off in fixed-income bonds around the world last year effectively shut out many borrowers in developing countries from bond markets for a long time as central banks raised interest rates sharply to combat runaway inflation. But money has flooded back into bond markets in the new year, amid further signs that inflation may have peaked in the U.S. and the euro zone, with countries including Mexico, Hungary and Turkey launching massive bond sales.

The monthly UK gross domestic product (GDP) report released on Friday showed that the UK economy unexpectedly expanded by 0.1% in November, compared with -0.2% expected and 0.5% previously. Meanwhile, the service sector index for the three months to November was -0.1%, compared to -0.4% expected and -0.1% previously.

Supply disruptions appear to have eased in recent months. There are some (though still preliminary) signs of normalization in consumer demand patterns. We're starting to see a turnaround in labor market indicators.

UK announces more strike action, adding to pressure on health and transport sectors. Meanwhile, lower energy prices pushed the peak BoE rate hike pricing down to 4.41% from recent highs above 4.75%. The above-mentioned factors may also slow the gains of GBP/USD. On the short-term chart, it seems that the exchange rate is well supported around 1.21, but the momentum is weak. The market believes that GBP needs to trade around 1.2210 to develop a stronger sense of short-term direction, although long-term price signals suggest that risks are tilted to the upside.

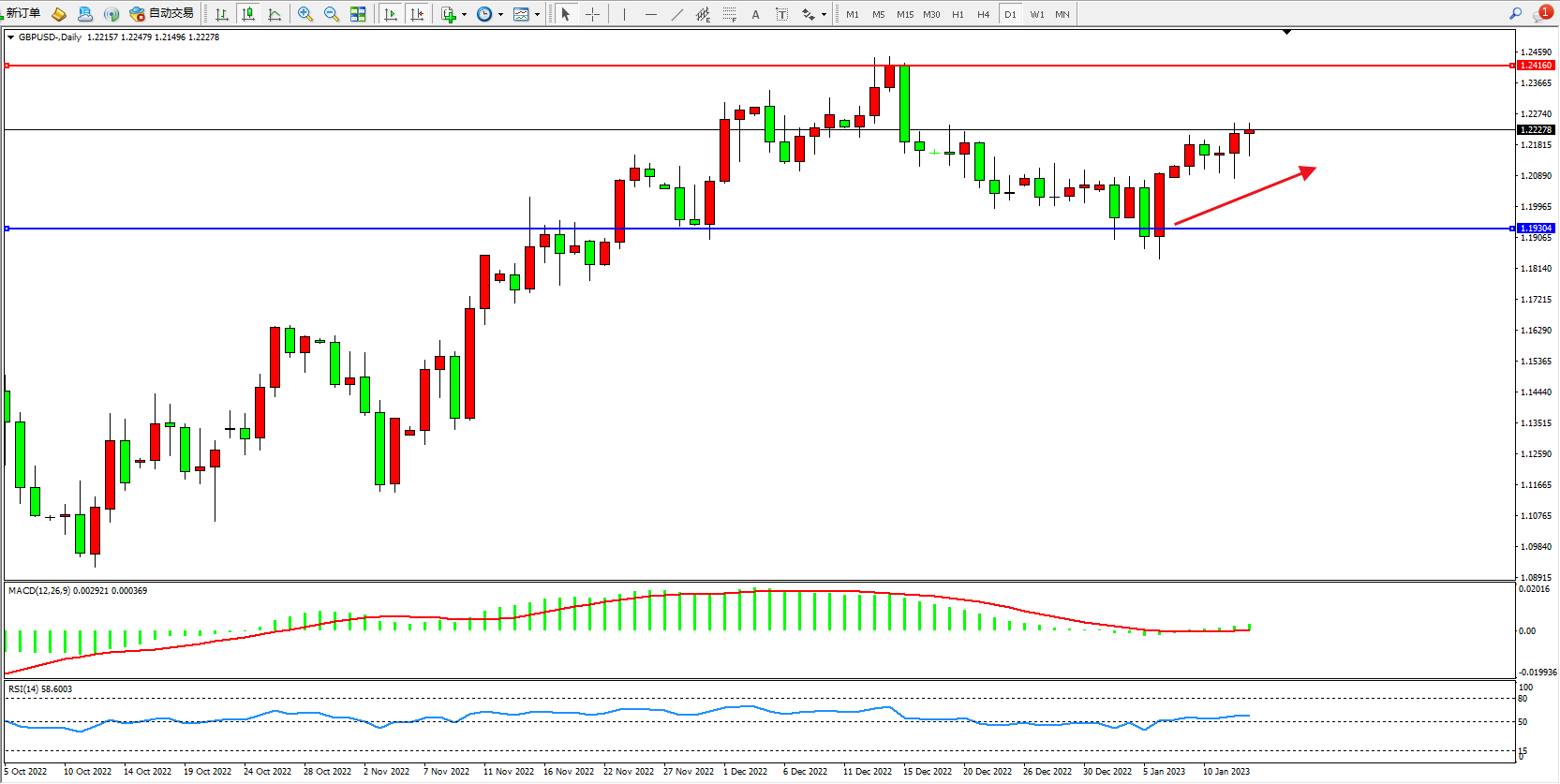

The daily K-line chart of GBP/USD shows:

[Disclaimer] This article only represents the author's own opinion, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained, and does not constitute any investment advice. assumes all risk and responsibility.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia