GBP/USD fell nearly 1.30% this week, hitting a fresh low of 1.2861 since early November 2020. UK retail sales fell more than expected in March, falling nearly 1.4% month-on-month. British households face rising living costs, the economy is losing steam and consumer confidence is near record lows. Bank of England Governor Bailey said the Bank of England took a strict line between tackling inflation and avoiding recession, a challenge for other major central banks around the world.

The US Commodity Futures Trading Commission CFTC foreign exchange non-commercial position report shows that as of 2022-04-19 in the week (hand) GBP/USD long positions increased by 1297 lots to 36811 lots. Weak growth and a cost-of-living crisis could see the Bank of England raise interest rates less than market expectations, with GBP/USD likely to move further away from the 1.30 mark in the coming months.

Bank of England Governor Bailey: Inflation will rise further due to high energy prices. The strength of inflation this year will depend on energy prices. Distinguishing between the US and European shocks is key. At risk of a second round of inflationary effects. After three rate hikes, we are already on a path to tightening policy. The relationship between inflation and growth must be balanced. The path is "narrowing and narrowing," and policymakers must follow it.

The policy path faces a lot of uncertainty. I believe we can achieve a soft landing. We will only do aggressive QT in stable markets, and if things change, we will stop QT bond sales. We cannot allow central bank balance sheets to keep rising.

Britain's economic growth will slow next year and inflation will be more persistent compared with other major economies, the International Monetary Fund (IMF) forecast on Tuesday. The IMF cut its forecast for UK GDP growth this year to 3.7% from 4.7% in January, while its 2023 growth forecast has almost halved to 1.2% from 2.3%. "Whether the UK will slip into recession remains an open question," said ING economist James Smith, stressing that the savings that many households have built up during the coronavirus pandemic will continue to be a potential driver of growth, "...we think the BoE It is more likely that one or two more interest rates will be added before the pause button is pressed in the summer."

With U.S. inflation now roughly three times the Fed's 2% target, it would be appropriate to move faster, with a 50bps rate hike at the May meeting being an option. On the other hand, the speech of Bank of England Governor Bailey seems to be erratic, showing no hawkish tendency to raise interest rates. To this end, in the overnight foreign exchange market, GBP/USD also fell to around 1.3030 from the previous session's high of around 1.31. At present, the Fed's stance on raising interest rates is becoming more and more hawkish, and the Bank of England is timid. If this situation continues to develop, it will be difficult for the pound to reverse the decline against the dollar.

British military intelligence: Russian Defense Minister Sergei Shoigu said he intended to introduce "new methods of warfare," tacitly acknowledging that Russia's progress in Ukraine did not go as planned. Russia will need time to adapt to new tactics, techniques and procedures, and then implement new tactics to improve combat effectiveness, especially in land-based maneuver warfare. Therefore, in the transition period, Russia is likely to continue to rely on bombing to suppress Ukraine's counterattack. Russian troops will likely continue to be frustrated by their inability to break through Ukraine's defenses quickly.

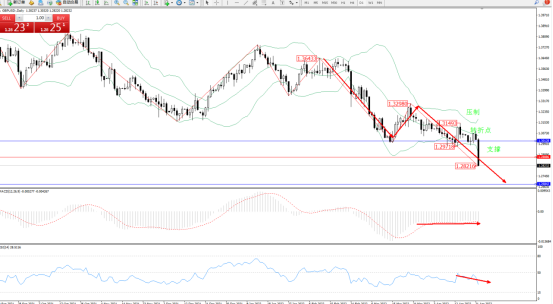

The daily K-line chart of GBP/USD shows:

The bearish sentiment in the market continued. The Bollinger Bands indicator channel continued to fluctuate and fell. After reaching the low level near 1.28216, it continued to decline, and the overall decline of the market showed no signs of ending. , the low support pays attention to the node near 1.26842, pays attention to the turning point near 1.28886, the MACD indicator is in the bearish area to maintain order and translation, and the RSI indicator is in the lower side of the 50 equilibrium line to maintain a volatile downward trend, as shown in the figure:

2022-04-25

2022-04-25

1106

1106

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia