OPEC agrees to cut output, U.S. undermined

2022-10-10

2022-10-10

1403

1403

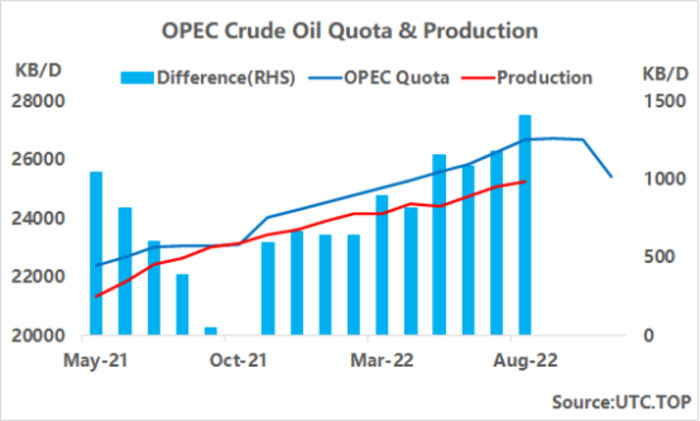

OPEC and a coalition including Russia announced at a joint ministerial meeting in Vienna that they would cut crude output by 2 million bpd from August 2022 levels, effective from November. The OPEC+ decision will have the most negative impact on low- and middle-income countries. Biden directed the energy secretary to explore other responsible actions to increase domestic production. Biden called on U.S. energy companies to lower retail gasoline prices.

Energy positions: Speculators' net long positions in Brent and WTI crude oil increased by 53,179 contracts to 373,467 contracts, the most recent 11-week high. Among them, the speculative net long position of WTI crude oil futures increased by 18,814 lots to 174,564 lots. The net long position on NYMEX natural gas fell to 42,866 contracts, the lowest level in more than two years.

Speculators' net-long bets on the dollar fell to their lowest since mid-March in the latest week, according to calculations and data released by the U.S. Commodity Futures Trading Commission (CFTC). The net long dollar position fell to $9.44 billion in the week ended Oct. 4 from $10.43 billion the week before. Speculative net long positions in gasoline futures rose by 8,224 contracts to 52,035 contracts in the week to Oct. 4, Intercontinental Exchange (ICE) data showed. The speculative net long position in Brent crude futures rose by 27,459 contracts to 185,332 contracts.

In fact, the only countries that have the ability to adjust crude oil production in the short term are: Saudi Arabia, the United Arab Emirates, Kuwait, Iraq, and Iran. Therefore, the decision of OPEC+ to make a deep production cut at this time is a political decision in a larger sense. The purpose is to maintain the alliance's international political status and internal unity as much as possible, and avoid greater internal differences and disorderly market share competition in the alliance when oil prices are under pressure.

免費開通賬戶> > 入金最高送 $88

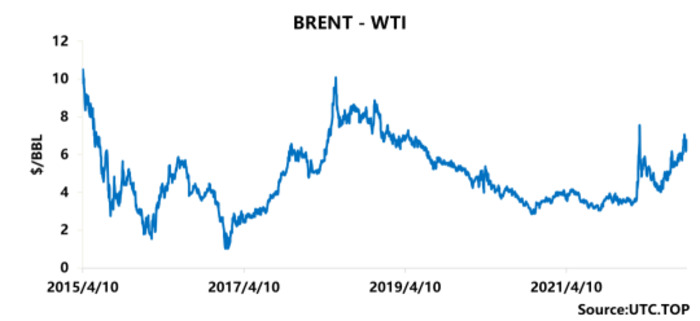

Earnings expectations for U.S. refiners will suffer a direct hit, with RBOB-WTI and HO-WTI cracking basis, U.S. Gulf product tanker freight prices, and will be sold off by funds in the short term, as U.S. Gulf refineries are under the refined product ban. The processing capacity plan of the factory will inevitably be reduced, and the amount of crude oil available for export in the United States will face a surge in the short term, and the price of WTI will be hit, and then more countries will flock to the United States to buy crude oil priced at WTI As a result, the Brent-WTI spread will narrow.

免費開通賬戶> > 入金最高送 $88

An informal meeting of EU leaders was held in Prague, the Czech capital, on the 7th. Leaders at the meeting held consultations on energy issues, but did not reach any concrete results. European Commission President von der Leyen said at a joint press conference after the meeting that in response to the current rising natural gas and electricity prices, the European Commission will come up with detailed proposals in the next few weeks, including negotiating reasonable prices with suppliers. scope, limit natural gas market prices and their impact on electricity prices, etc.

免費開通賬戶> > 入金最高送 $88

Due to the different energy demand, dependence on suppliers and energy structure of EU member states, different adjustment capabilities, and related decisions must first be based on their own interests, there are always difficulties that cannot be bridged in the introduction of the overall energy policy within the EU. disagreement. The bloc has been unable to make a breakthrough on issues such as a cap on natural gas prices for weeks, even as EU member states have agreed to joint measures in response to severe energy supply tensions.

US crude oil daily K-line chart:

The bullish momentum at low levels continued to fluctuate and continued to rise. Short-term bullish sentiment began to pour in, and the bullish sentiment in the market began to heat up. The top suppression focused on the vicinity of 99.983, the low-level support focused on the vicinity of 85.323, the MACD indicator was hovering above the 0 axis, and the RSI indicator was on the 50 equilibrium line. The side continues to oscillate upward, as shown in the figure:

免費開通賬戶> > 入金最高送 $88

[Disclaimer] This article only represents the author's own point of view and does not constitute any investment advice. Please read this for reference only and assume all risks and responsibilities.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia