Oil prices fluctuated strongly, and the moving average gradually strengthened

2023-03-08

2023-03-08

1102

1102

Price performance: On Friday (March 3), international oil prices fell and then rose, as renewed optimism about a recovery in Chinese demand overshadowed rising U.S. crude inventories and tightening in Europe Oil prices closed up for the week due to fears of economic recession brought about by monetary policy.

Crude oil prices are volatile:

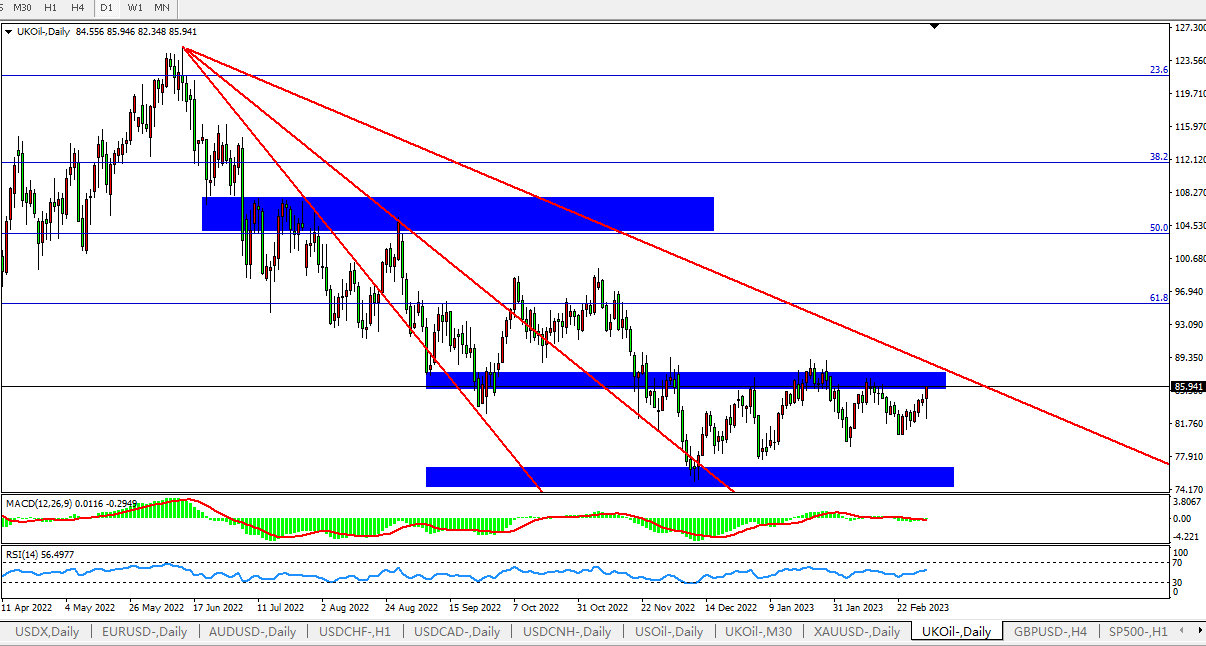

In the first week of March, oil prices entered the fifth band since the beginning of the year, and continued to fluctuate around $85. The amplitude continued to narrow, and the moving average gradually flattened. Since the beginning of the year, the price of Brent crude oil has experienced four rounds of shocks in the range of 80-90 US dollars per barrel. In early January, China's demand expectations and financial sentiment improved, supporting a sharp increase in oil prices. In the second half of January, the oil products in the United States and Europe continued to accumulate realities, putting pressure on oil prices to rise and then fall. In early February, the European Union imposed sanctions on Russian refined oil products, and Russia announced to cut production in March, pushing up oil prices again in the short term. In late February, Biden announced that he would sell reserves in March in response to Russia's production cuts. The higher-than-expected U.S. inflation data raised expectations of the Fed's interest rate hike, causing oil prices to fall back to the lower edge of the range.

Oil price long-short logic analysis:

Multiple influencing factors of crude oil prices still maintain the balance between long and short, and the lack of absolute dominant factors keeps the price volatile. The positive comes from the supply-side support brought about by OPEC and Russia's production cuts, and the negative comes from the pressure on the demand side from the slowdown of overseas economies. For the time being, we are in the transitional period from the improvement of pessimistic expectations in the early stage to the realization of actual reality. Follow-up attention will be paid to the expected fulfillment of demand.

①Geographic perspective: The support mainly comes from OPEC's annual production cuts, Russia's initiative to cut production, and other short-term supply disruptions. The pressure mainly comes from Biden's still strong willingness to suppress oil prices.

②From the perspective of financial attributes: the recovery of China's economy is positive for financial sentiment, and the slowdown of overseas economies puts pressure on financial sentiment.

③From the perspective of supply and demand attributes: the supply side provides upward momentum for oil prices, and the demand side is the main downward pressure on oil prices.

Oil price outlook----strong shocks

①In the short term: Saudi Arabia and Russia cut production, providing support for oil prices from the supply side. However, due to the status quo of inventory accumulation, the upper space is temporarily limited. The short-term focus on high inflation makes the Fed may change the pace of interest rate hikes, which has an impact on financial sentiment.

②In the medium term: In the first half of the year, the fundamental drivers are weak at first and then strong. If demand expectations are fulfilled and oil products are shifted from storage accumulation to destocking, the center of crude oil prices is expected to rise.

③ In the long run, the forecast for a wide range of fluctuations at US$70-100/barrel will be temporarily maintained throughout the year. The US$70 is supported by the repurchase price range of the US strategic inventory, and the US$100 is supported by the important integer mark under the general trend of economic growth slowing down.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia