Oil prices fall below 90 mark as risk sentiment plummets

2022-10-12

2022-10-12

1315

1315

The Bank of England said that bond purchases to save the market were a temporary move. The market believed that the rescue efforts were insufficient, causing the pound to plunge more than 200 points, and risk sentiment plummeted. At the same time, the IMF once again lowered its global economic growth forecast for next year, and the economic recession has clouded the outlook for crude oil demand; When the heavy inflation data of the US CPI was released, the crude oil market was still mainly affected by the sluggish demand, and the US crude oil fell below the $90 mark.

Bank of England messes up

On Tuesday, the Bank of England stepped up its intervention again, announcing to expand the scope of bond purchase operations to include index-linked government bonds. But the UK pension fund believes that this is not enough, and the Bank of England should also extend the bond purchase period or introduce more policies to stabilize the bond market. Then Bank of England Governor Bailey extinguished expectations for an extension of the bailout, saying the bond-buying bailout was a temporary move and funds had only three days. This remark turned the pound against the dollar from a daily high dive of more than 200 points, and the risk sentiment fell sharply. The dollar index turned up and returned to 113.

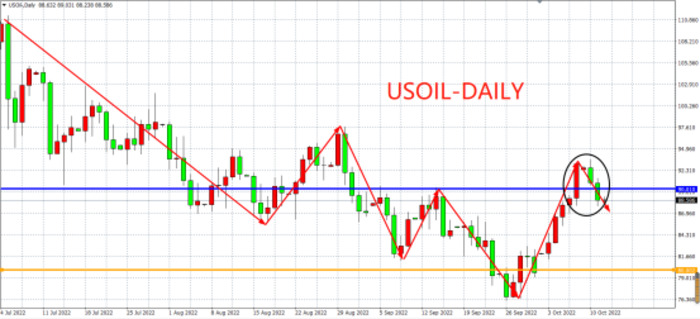

U.S. crude oil remained weak after being blocked from a high at the beginning of the week. On Tuesday (October 11), it fell 2.44% to below $88, falling below the psychological barrier of $90. After briefly digesting the 2 million barrels per day (bpd) production cut announced by OPEC+, the crude oil market was repressed by a strong dollar and the main line of demand destruction.

There is no doubt that inflation is the main reason for the market to be firmly bullish on the dollar. The market is now focusing on the US September Producer Price Index (PPI) released on Wednesday (October 12) and the US September 2019 released on Thursday (October 13). Monthly Consumer Price Index (CPI) for more evidence of a pullback in inflation.

It is foreseeable that the escalation of the Russian-Ukrainian conflict and the inflation under the European energy crisis may be supported by more factors. If the economic data shows that the Fed has not made any progress in reducing inflation, further tightening policy to reduce inflation will still be the main focus of the Fed. Task. Federal Reserve Mester said on Tuesday (October 11) that the biggest policy risk is that the Fed does not raise interest rates enough.

In fact, the strength of the dollar is also due to the fact that funds seek safety in a time of declining liquidity, and the bond market crisis in the United Kingdom has strengthened this attribute of the dollar. Bank of England Governor Andrew Bailey reiterated in his speech in the early hours of Wednesday (October 12) to strengthen the Bank of England's plan to end temporary bond purchases in an earlier announcement. Bailey said the intervention was temporary and would not be extended, and its message to financial markets, related funds and all companies was that there were only three days to prepare for the worst.

免費開通賬戶> > 入金最高送 $88

IMF cuts global growth forecast for next year

On the other hand, the International Monetary Fund (IMF) released the latest "World Economic Outlook Report" on Tuesday (October 11). The IMF maintained its forecast for global economic growth of 3.2% in 2022, but lowered its forecast for 2023 growth by another 0.2 percentage points to 2.7%, and predicted that there is a 25% chance that the global economic growth rate will fall below 2% next year.

IMF chief economist Gourinchas said the U.S. unemployment rate is expected to rise by 2 percent in 2023 and 2024, adding that 5.5 percent would be a "pretty good number" in exchange for a return to inflation. 2% target level. And it expects central banks’ efforts to fight inflation to continue through 2024.

In addition, the report pointed out that the downside risks to the economic outlook are "unusually large" and that monetary policy may be miscalculated and not in line with the correct stance to reduce inflation. Policy paths among the world's largest economies are likely to continue to diverge, leading to further gains in the dollar. However, the IMF still expects oil prices to rise 41.4% in 2022, averaging $98.2 a barrel, before falling to $76.3 a barrel in 2025.

Oil prices ignore the escalation of the situation in Russia and Ukraine, and the market outlook focuses on CPI

Escalating tensions between Ukraine and Russia did not appear to be helping crude prices either. According to Bloomberg, Russia's latest missile attack on Kyiv was "the most violent since the invasion began days ago." It comes after Russian President Vladimir Putin accused Ukraine of blowing up a key bridge between Crimea and Russia over the weekend.

The terrorism danger level in the vicinity of the Crimea Bridge has been raised to a "yellow" (altitude) level until October 23. Putin signs presidential decree extending food counter-sanctions until end of 2023.

Ukrainian President Volodymyr Zelensky said the G7 group must respond to Russia's bombing of energy infrastructure and impose strict price caps on Russia's oil and gas exports. Zelensky ruled out talks with Putin, saying it could be with another Russian leader or in a "different format".

While waiting for the U.S. CPI report on Thursday, geopolitics is still an uncertain factor affecting oil prices, but the long-term fierce battle between Russia and Ukraine has been digested in advance by the market, and the marginal effect is gradually decreasing. The overall CPI is expected to increase by 8.1% year-on-year in September, higher than the previous value of 8.3%, and the core CPI is expected to rise to 6.5% from the previous value of 6.3%. A rise in the latter is the last thing the Fed wants to see. An unexpected uptick in data could easily exacerbate volatility in financial markets, further depressing crude prices.

Outlook

免費開通賬戶> > 入金最高送 $88

Looking ahead, if U.S. oil counterattacks again and stabilizes above the $90 mark, the market outlook is still expected to rebound to challenge the $94.-97-100 mark; if it remains below the $90 mark, oil prices will continue to decline as The main, short-term look at the bottom 86-84 US dollars, the mid-term decline does not rule out falling back to test the 80-dollar mark support.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia