Positive news came out from Russia and Ukraine again. Russia stated that the first phase of the military operation had been completed. Biden reiterated that the United States did not need to directly intervene. Ukraine also offered an olive branch and expressed its willingness to remain neutral and consider compromises on major issues. As a result, the risk aversion in the market dissipated again, and the Fed's more aggressive interest rate hike expectations have heated up. Gold and crude oil fell after the opening bell today.

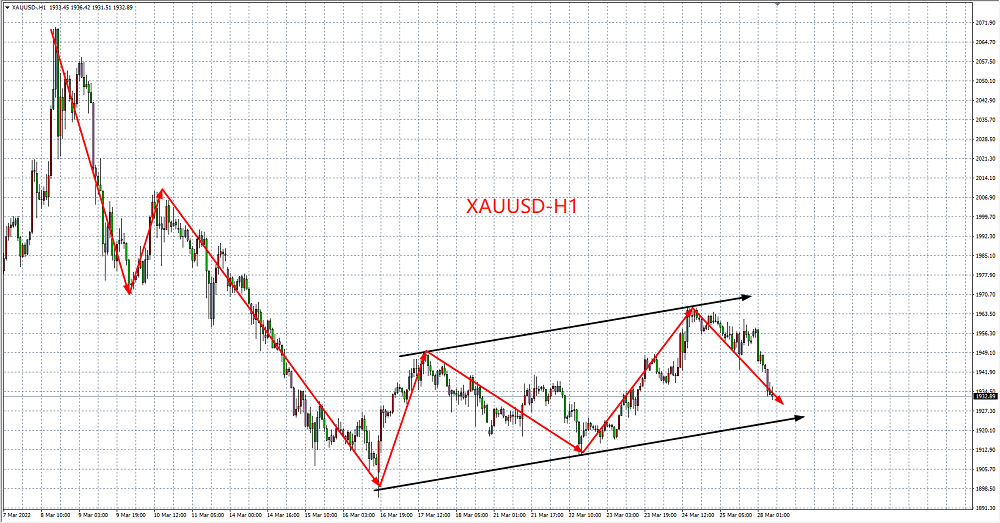

The bullish support of the situation in Russia and Ukraine began to weaken, and the bearishness of the Fed’s monetary policy outlook has re-emerged. After Powell and a group of senior Fed officials issued intensive hawkish remarks, the market began to increase bets on an imminent interest rate hike by 50 basis points. Bond yields hit a new high in nearly three years, and gold prices were under obvious pressure. From a technical point of view, after the gold price rebounded, it was blocked and fell back, falling below the support continuously, but the short-term upward trend has not been completely destroyed, so I will not be too bearish for the time being, and focus on the support near $1927. If this position falls, the bears are expected to increase. Decline, look at the bottom 1910-1900 US dollars, if it stops above this level, you can see a rebound of 1950-1960 US dollars.

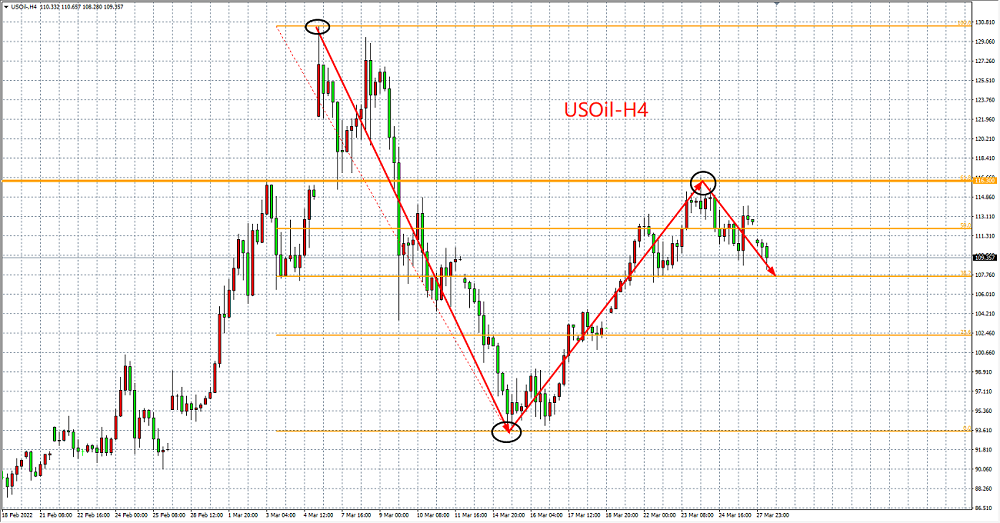

In terms of crude oil, currently affected by a series of factors, the price has seen repeated tug-of-war. The positive factor is that the European Union proposes to ban Russian oil imports, Saudi Arabia's oil facilities are armed and sabotaged, and the worries about the energy supply chain have not yet subsided; Reserves sell off; there is also an X factor - the OPEC+ meeting on Thursday (March 31), if the meeting mentions the issue of raising the production baseline in May, it is expected to put new pressure on oil prices. From a technical point of view, U.S. oil rebounded to the 61.8% golden ratio ($116.30) of the previous wave of decline, and then fell back after being blocked, which is a signal for the continuation of the bears. The main, the bottom support 107-102-94 US dollars.

2022-03-28

2022-03-28

956

956

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia