Market sentiment swings, pound and dollar are strong but still worrying

2022-11-14

2022-11-14

1289

1289

[Opening the sale of some British government bonds in the central bank's portfolio]

The Bank of England announced that from November 29, it will open the sale of some of the British government bonds in the central bank's investment portfolio to interested buyers. These government bonds are traditional long-term British government bonds and index-linked government bonds purchased between September 28 and October 14, with a total purchase of 19.3 billion pounds (about 22 billion U.S. dollars), of which long-term government bonds are 12.1 billion pounds and the remaining 7.2 billion. GBP is an index-linked government bond.

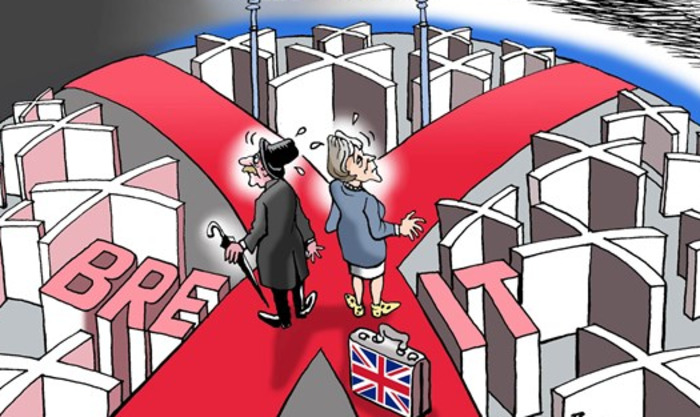

[The market doubts that the British government has borrowed heavily]

Britain's Chancellor of the Exchequer David Cowarten announced the most aggressive tax cuts in the UK in half a century. Although the plan is under the banner of supporting economic growth, the outside world does not buy it. Analysts questioned that the plan relies on a large amount of government borrowing and lacks consideration in fiscal prudence, and accused the plan of not taking into account the negative impact of the current high inflation in the UK .

[The disappearance of fears of a British recession puts pressure on the pound]

Under the weight of high inflation and high interest rates, the British economy is struggling through the "cold" of recession. This "chill" has been reflected in many areas: in addition to the fact that national output in the UK is below the level before the outbreak, the British housing market has cooled for many years; the living standard of the British people has fallen as wages have not kept pace with the rise in prices; although the British The government has set price limits, but the average Briton's energy bill is double what it was a year ago, and the government is even "drilling" for the possibility of a week-long blackout this winter.

[The Bank of England keeps raising interest rates]

In the current wave of interest rate hikes in Europe and the United States, the Bank of England took the lead in raising interest rates as early as the end of last year, but the rate of interest rate hikes lags behind the Federal Reserve and the European Central Bank. At present, the Federal Reserve has aggressively raised interest rates several times, and the European Central Bank has also chosen to raise interest rates by 75 basis points in one go. In this context, the Bank of England also raised interest rates by 75 basis points in November, indicating its determination to fight inflation, thus setting its largest interest rate hike in 33 years. So far, UK interest rates have soared to 3% from close to zero at the end of last year.

[The Bank of England admits it was a mistake to implement QE during the epidemic]

The chief economist of the Bank of England admitted that it was a mistake to implement QE during the epidemic, and the printing of money caused British inflation to soar. Bank of England chief economist Huw Pill testified before the House of Lords Economic Affairs Committee on Tuesday that the current high inflation in the UK is mainly caused by soaring gas prices in Europe. But it also admitted that the 450 billion pounds of quantitative easing policy by the Bank of England during the epidemic was also an important factor in fueling inflation.

[The recent trend of the pound needs to be cautious]

The recent sterling movement needs to be cautious. Lower UK sovereign credit risk, fading Brexit concerns and easing UK financial conditions are likely to keep sterling volatility lower in the near term. However, the latest developments do not mean that the pound is out of the woods. In fact, we think the aggressive fiscal austerity measures to be announced by Chancellor of the Exchequer Hunt next week will make the already weak UK economic outlook even worse. In the near term, however, the prospect of a sharp economic downturn could mean the Bank of England will disappoint market rate hike expectations that are still relatively hawkish.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia