Long-term energy investment opportunities from a macro perspective

2023-02-06

2023-02-06

1181

1181

Chinatown holidays and Chinese New Year are gradually coming to an end, and major economies have officially entered 2023, so whether the global macro themes in 2022 will still be influential in 2023, this article lets us explore how they continue to continue .

The hottest macro themes in the world in 2022: Inflation and monetary policy, energy prices, and China's epidemic eradication policy.

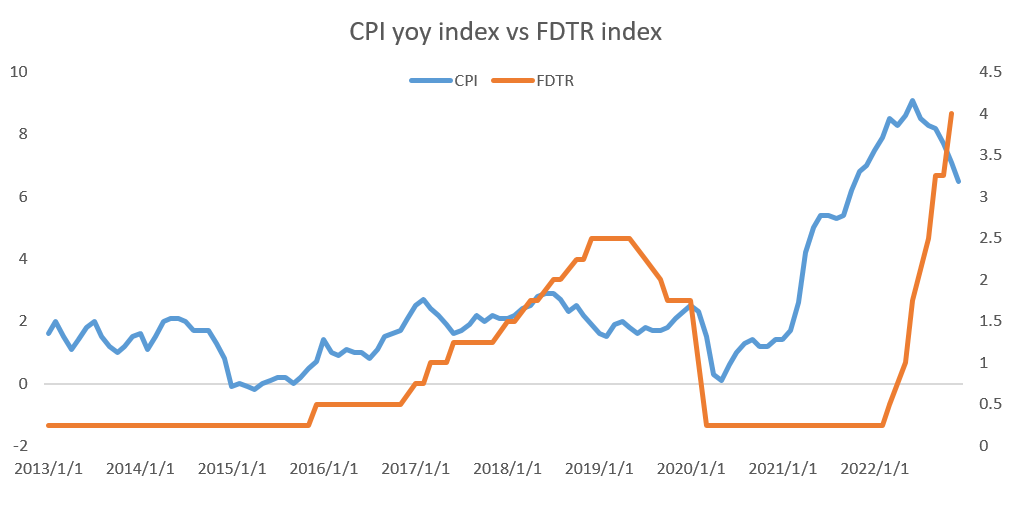

Inflation and monetary policy. From the chart below, the negative correlation between the two is obvious. The CPI and the Fed’s rate hike are indeed effective. If the CPI continues to decline, then the Fed’s rate hike should be slowing down. Judging from the latest forecast of the International Monetary Fund, although the forecast for this year is lower than the average before 2019, it is still better than last year. As concerns about global economic recession and inflation have begun to fade, investors are also reducing their expectations for the pace and scale of interest rate hikes by the Federal Reserve and central banks.

It took China only three months to return to the familiar movie-watching frenzy during the Spring Festival three years ago. It can be seen that the impact of China's economy on the world has completely changed from epidemic prevention and control to the recovery of Chinese demand.

So for energy prices, that is, the analysis and judgment of the expected slowdown of interest rate hikes in various countries superimposed on the demand expectations brought about by China's reopening.

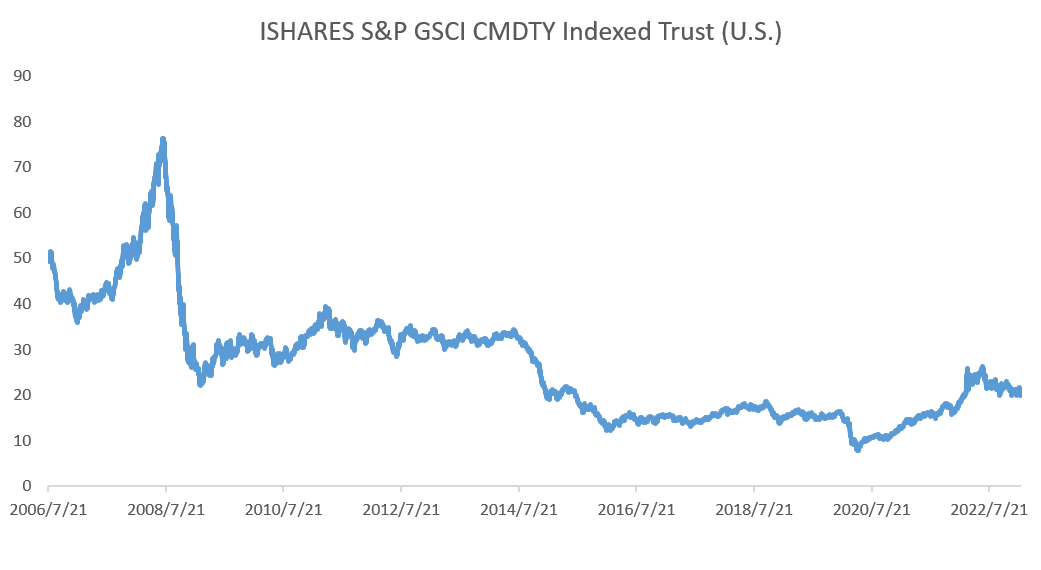

For large fund managers, the macro environment in 2023 is better than that in 2022. Many of the obstacles in 2022 will no longer exist this year. Commodities will definitely be the focus of major asset allocation this year. Among them, the GSCI Goldman Sachs Commodity Index is a good observation window. Although crude oil futures plummeted on Friday, the index collapsed in the morning session of the US market and then flattened throughout the day, which is quite different from the trend of crude oil.

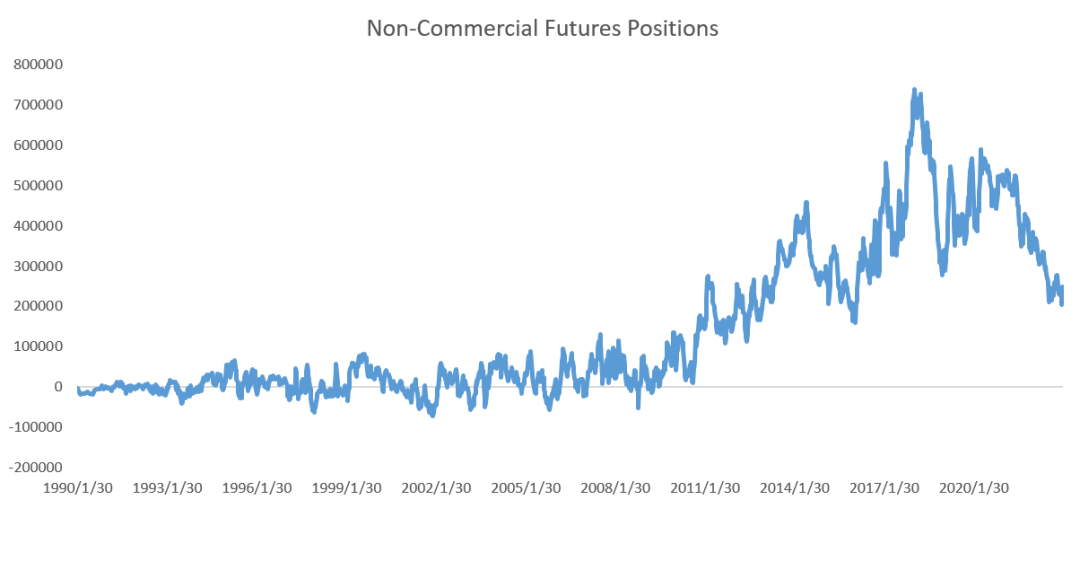

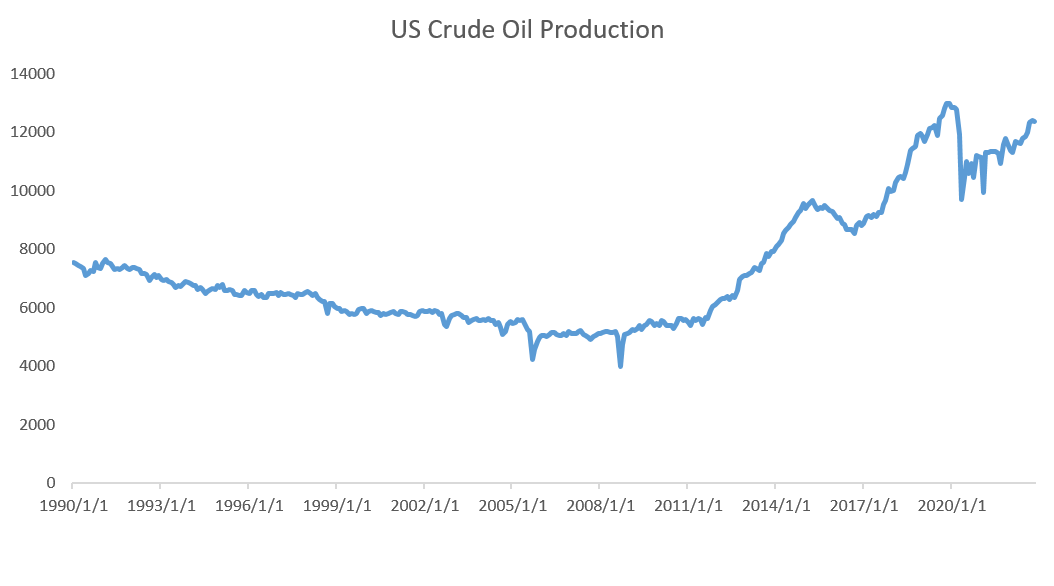

For large fund managers, the S&P index, U.S. bonds, and commodities are the three major categories, and the return on investment is more attractive. In the S&P index and the 10-year period, it is obvious that the return rate of the S&P index is not as attractive as that of U.S. bonds. After U.S. bonds become the preferred choice of fund managers, commodities always have to be selected. The three charts show that the number of speculator positions in U.S. crude oil futures has fallen, U.S. crude oil production has risen, and U.S. energy stock fund ETF prices have risen.

The logic here is: Crude oil production gap ---> energy stocks are expected to rise ---> producers are willing to produce more crude oil if their share prices are good ---> short-term oil consumption demand cannot keep up --- >Slight surplus of crude oil brings oil price correction--->Demand returns completely--->Producers hold up prices--->Oil prices rise. However, due to the continuous decline in the position data of U.S. crude oil futures this year, large fund managers are long crude oil, and many of them are limited due to liquidity. Therefore, the GSGI index on Friday went flat after the opening fell. It can be seen that large funds have quietly started to buy In, there is support.

We're going to try to find out if the main energy bulls are creeping in. So as to analyze the next step of crude oil capital risk. The political side defines the trend, the capital side starts the trend, the macro side sets off the trend, the technical side boosts the trend, the fundamental side confirms the trend, and the news side ends the trend. In the previous meeting, we have analyzed the U.S. Department of Energy’s statement on the repurchase war reserve, which is tantamount to conveying to the market that a bull market will start at an appropriate price, but before the bull market starts, it is worth exploring where smart big funds are ambush in advance.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia