Investment strategy in the era of high inflation

2022-10-17

2022-10-17

1159

1159

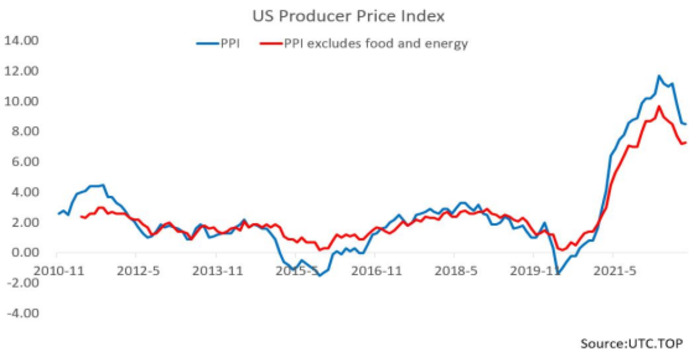

On October 12, 2022, the U.S. Department of Labor’s Bureau of Labor Statistics released a report that despite the Federal Reserve Board’s efforts to control inflation, the U.S. final demand producer price index (PPI) rose 0.4% in September compared with the previous month, and the market expected an increase of 0.2%. %, a month-on-month decrease of 0.1% in August; an increase of 8.5% compared with the same period last year, and the market expects an increase of 8.4%, excluding the final demand PPI of food and energy, still increased by 0.3% compared with the previous month, in line with expectations. It increased by 0.4% month-on-month, compared with the same period of last year, increased by 7.2%, and the market expected an increase of 7.3%. The final demand PPI, excluding food, energy and trade, rose 0.4% from the previous month and 5.6% from a year earlier.

Today, the U.S. CPI data for September will be announced, which attracts the market's attention. Currently, the market expects the latest CPI to be 8.1, the previous value was 8.3, the core CPI is expected to be 6.5, the previous value is 6.3, and the market is worried that the Fed will continue to actively raise interest rates , in order to seek to further suppress inflation, and today will also announce the number of initial jobless claims last week, the number of jobs also need to focus on.

Today we will focus on inflation, divided into the following questions:

- What are the causes of inflation in the current environment?

The reason that economists and netizens often mention when talking about inflation is the flood of market liquidity caused by the implementation of monetary and fiscal stimulus policies by central banks and governments, but in UTC's view, this is not the most fundamental reason. We should pay attention to the Fed's view. If these monetary liquidity are really used to invest in the production and operation of goods or services to increase supply, will it still cause inflation? The real problem in the world now is that in the past two years or so, due to the COVID-19 pandemic, governments around the world have used helicopter money to directly subsidize people's lives in order to protect people's lives and restrict people's production activities. People's consumption demand, but people stay at home instead of working but only consume, doesn't this mean that the supply is reduced? The United States alone has sown $4.5 trillion for this, and the Fed insists that the main reason for inflation now is that the money put in is not used to increase the supply of goods and services, but is used by people to increase consumption, or even be used. Come to hype assets such as cryptocurrencies (the global cryptocurrency asset scale is 2 trillion US dollars).

- What's wrong with the stock market due to inflation?

After inflation is high, people's income growth rate is not as fast as inflation, then there will be consumption restraint, so the Fed must firmly raise interest rates sharply to curb inflation, but the side effect of this is that sharp interest rate hikes will cause the discount of stocks Rates soar, which will lead to a decline in stock return expectations. After all, stock valuations are carried out through the discount rate. When the discount rate rises, the stock will be sold, causing further price declines.

- How does inflation affect stock investment returns?

Due to inflation, the cost changes of different listed companies will be significantly different. Some companies will not increase their costs significantly in an environment of high inflation, so their revenue expectations will be stronger. For example, PepsiCo, some companies will Labor costs have risen sharply and faced high costs, staff turnover, and production declines, so it's expected to weaken.

- Investment strategies in the age of inflation

By examining past CPI indices for countries, we can find that the biggest sources of inflation are energy and food, followed by housing, rent, travel and leisure, and healthcare. So, the food and beverage industry, they're going to be the beneficiaries because the biggest part of their cost is relying on robotic automation, not a lot of labor, so we saw PepsiCo's stock jump yesterday after the company posted a good In the third quarter, the company posted revenue of $21.97B and core EPS of $1.97, up from expected third-quarter earnings and raising its full-year guidance. Analysts had expected $1.85 and $20.82B, respectively, with a 20% increase in revenue from North America, and rapid growth in Latin America, which are key drivers of PepsiCo's strong third quarter performance, which is a belt of rising inflation. benefits to come.

Pepsi Day K Line

By the same token, in addition to the highly automated food and beverage industry, smart investors will scrutinize the following companies with low-cost assets:

- Enterprises with a large number of advanced intellectual property rights

- Commodity enterprises with a large number of low-cost mineral mining rights

- Businesses with large amounts of low-cost undeveloped land

We can foresee that after high inflation, high prices of goods and services will stimulate these enterprises to immediately increase production and supply, and they can quickly expand their income scale with lower costs to achieve better operating profits.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia