Interpretation of key elements of the international oil market

2022-10-03

2022-10-03

1484

1484

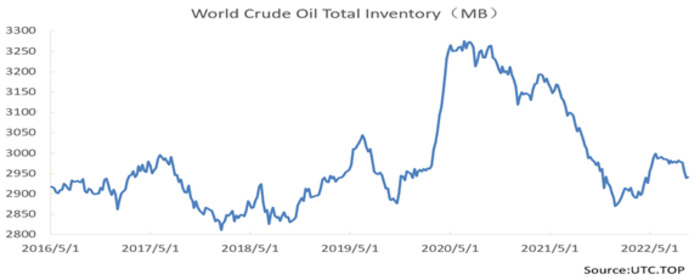

With the continuous release of SPR in the United States and the weakening of global demand due to the strong dollar, international oil prices fell from highs and fell back to the level before the Russian-Ukrainian conflict. However, the total data of global crude oil inventories continued to decline, which supported oil prices.

Figure 1: Global Crude Oil Inventory Curve

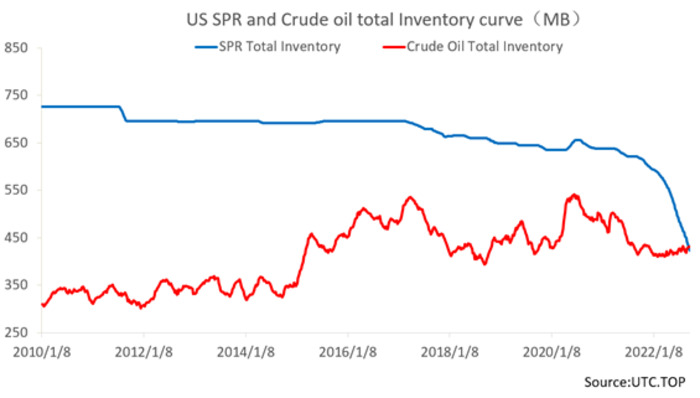

The U.S. has been rapidly drawing down its oil reserves so far this year. The Department of Energy said on the 19th that it has released about 155 million barrels of crude oil since President Biden authorized the release of as much as 180 million barrels of crude oil on March 31. This means that slightly less than 900,000 barrels of crude oil are released per day, which is close to 1% of global oil demand.

The U.S. Strategic Petroleum Reserve fell by nearly 7 million barrels last week, leaving about 427 million barrels remaining, the lowest level since 1984. For the first time since 1983, the U.S. Strategic Petroleum Reserve is below commercial reserves.

Investors should pay close attention to whether the U.S. SPR inventory continues to be released significantly in the market outlook, which is related to the national security issue of the United States.

Figure 2: U.S. SPR Inventory Curve Overlaid with U.S. Commercial Crude Oil Inventory Curve

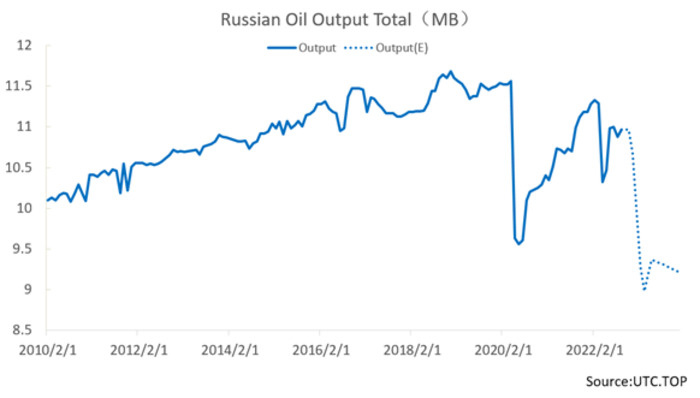

In April, the IEA predicted that Russia’s crude oil production would decrease by 3 million barrels per day due to economic sanctions in half a year. The latest IEA report shows that as of August, Russia’s oil exports were only 400,000 to 450,000 barrels per day lower than pre-war levels. Russia's actual crude oil production level is currently 9.77 million bpd, 1.2 million bpd below the quota.

Figure 3: Russian Crude Oil Production Curve

The key problem in the market now is that, under the background of the strong dollar suppressing demand, seasonal factors suppressing demand, China's epidemic prevention and control suppressing demand, and the United States releasing SPR to increase supply, global crude oil inventories have not increased significantly. The European energy crisis broke out again in the fourth quarter, or China's demand suddenly jumped, where will the supply of the market shortage come from?

Therefore, the next key fundamental factors facing the global crude oil market are:

01

Real data on Russian crude oil production. After the North Stream pipeline was bombed, the game between the West and Russia took another step forward, and the market began to expect a significant drop in Russian production.

02

The return of Chinese demand. According to market rumors today, the fifth batch of refined oil export quotas of 13.25 million tons was issued. According to current market data, if this amount is to be fulfilled, China's crude oil processing capacity must be increased by at least 1 million barrels per day.

03

Will OPEC+ continue to increase production? Sources said that OPEC+ began discussing production cuts at its October 5 meeting.

04

Whether the US SPR continues to be released. The U.S. Department of Energy said the U.S. will also sell 10 million barrels of SPR in November, extending the plan to release the largest SPR in U.S. history until the end of October.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia