International crude oil continues to slump, marine oil is 'rebellious'

2022-09-08

2022-09-08

1529

1529

Introduction: Recently, the price of domestic trade marine oil deviates from the "big brother" guidance of crude oil, and the price rises strongly, showing a bit of "rebelliousness".

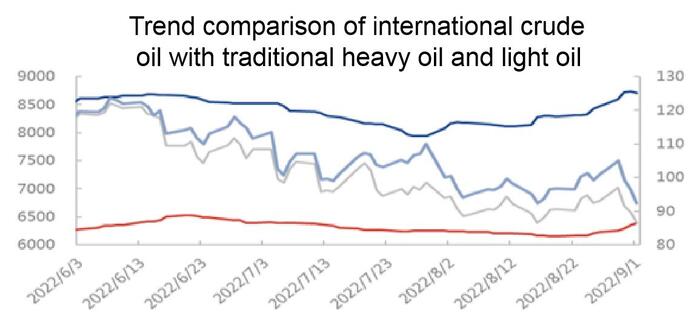

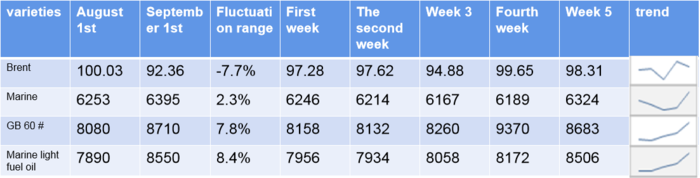

Price comparison between international crude oil and domestic trade marine oil in August 2022: USD/barrel, RMB/ton

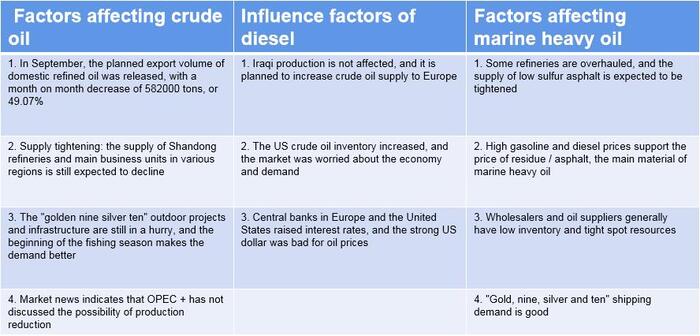

A closer look at the recent price fluctuations and leading factors of marine heavy oil and light oil are as follows:

For light oil:

The correlation between recent trends and crude oil has weakened significantly, and oil prices are mostly affected by various news and policies. Affected by political relations in the first ten days of August, under the background of the market atmosphere, domestic sales units took the initiative to push prices, and diesel prices rose rapidly. Subsequently, the inventory was released, the middlemen made profits, the market buying and selling atmosphere turned weak, and the price of diesel fell slightly. In mid-to-late August, the market was again affected by the decline in export quotas and other news. In terms of superimposed supply, resources continue to tighten. Taking the Shandong market as an example, the operating rate and output of Shandong refineries both declined in August, of which diesel output fell by 6.2% from July, and some refineries still have plans to suspend or reduce production in September; In terms of main business, there is a recent task of ensuring supply, and the amount of diesel released to social units has decreased, which has tightened the overall supply in the market. On the demand side, the traditional diesel consumption peak season of “Golden Nine Silver Ten” is approaching, and diesel demand is improving. At the same time, the middle and lower reaches of the market are increasing. The diesel production and sales rate of Shandong refineries once soared from 38% to 140%. Diesel prices in many places have been raised to the maximum price and sold in limited quantities, and some units have even stopped selling to traders. The imbalance between supply and demand has led to another step in the diesel rally.

For heavy oil:

Driven by the rapid rise in diesel prices, the demand for low-sulfur residual oil/asphalt coking and external production has increased, which has supported prices. At the same time, CNOOC Yingkou Refinery has an overhaul plan, and Luzhou Refinery has a power cut and production shutdown, which jointly stimulates low-sulfur residual oil. / Asphalt material prices rose, CNOOC Binzhou, Cangzhou and Taizhou refinery prices pushed up by 270-400 yuan / ton at the end of the month, an increase of 4.3%-6.5%. The decline in the production of other thin materials and the epidemic have increased the difficulty of arrival, and the prices of shale oil, coal and diesel have pushed up 311-350 yuan / ton or 5.7-7.1% respectively. The mixing cost of marine 180CST rose by 213 yuan/ton or 3.7% to 5937 yuan/ton. At the same time, due to the general low inventory of merchants and reluctance to sell, as of September 2, the price of 180CST warehouses has been pushed up by 100-250 yuan / ton to 6320-6500 yuan / ton. Then, the trend of refined oil and ship fuel under the guidance of far away from crude oil will mainly refer to the following predictable factors:

Short-term oil prices can foresee the main positive and negative factors

Summarize:

In September, the international crude oil market continued to fluctuate widely and weakly. From September to October, the supply and demand pattern of the domestic refined oil and marine oil market is still tight, and the market is still expected. If it is not for the market factors to continue to ferment, the high price of marine diesel and heavy oil may still have an opportunity to break through. The biggest test of international oil prices is still the impact of epidemic fluctuations and policies and news on supply and demand. There is a high probability that international oil prices will continue to slump. After all, the OPEC+ production cut is also a true reflection of the actual market situation.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia