Interest rate hike is expected to restart, gold breaks down, RMB breaks 7

2022-09-16

2022-09-16

1433

1433

Overnight, U.S. economic data bombed in turn, the U.S. index and U.S. bond yields continued to strengthen, gold once plummeted close to $40, crude oil broke down, the three major U.S. stock indexes closed down, and the dollar rose above the 7.0 mark against the yuan. At the current Fed rate meeting on September 22, a 75 basis point interest rate hike is almost a foregone conclusion. If the bet on a 100 basis point rate hike is further strengthened, it will cause further downside for various assets.

U.S. economic data helps Fed hawks

During Thursday's trading session, the US dollar index fluctuated less, and the US retail sales data for September and the number of initial jobless claims for the week ended September 10 were both better than expected. The US dollar index and US bond yields began to rise. The focus is mainly on the Fed's interest rate decision next Thursday (September 22), and the good data will further support the Fed's continued aggressive interest rate hikes.

U.S. retail sales in August, released at 20:30 on Thursday, recorded a 0.3% reading, beating expectations for 0%, showing household consumption spending held up well despite stubbornly high inflation and lower real incomes. Meanwhile, initial jobless claims for the week ended Sept. 10 came in at 213,000, missing expectations for 226,000, with initial jobless claims falling for the fifth straight week to the lowest level in three months, showing Despite the slowdown in economic growth, layoffs are not yet widespread and the labor market remains healthy.

After the above data was released, according to the interest rate watch tool of CME Group, the market completely ruled out the possibility of raising interest rates by 50 basis points in September. 100 basis points.

Market focus on September 22 interest rate decision

The Fed will continue to maintain a hawkish monetary policy stance as U.S. inflation remains high and the economy remains resilient. Wall Street Journal reporter Nick Timiraos, known as the "New Federal Reserve News Agency", wrote a few days ago that U.S. inflation picked up in August, giving the Federal Reserve reason to raise interest rates by at least 75 basis points at next week's meeting, adding to the prospect of sharp interest rate hikes in the coming months. possibility. After the article was published, the possibility that the market expected the Fed to raise interest rates by 100 basis points in September rose from 22% to nearly 50%. In addition, former US Treasury Secretary Summers also believes that the Fed will choose to raise interest rates by 100 basis points in September. At the same time, many analysts believe that the Fed will raise interest rates to 4.25% to 4.5%, while most of the market previously believed that interest rates would be raised to around 4%.

In addition to paying attention to the rate hike rate of the September interest rate decision, the Fed's future interest rate hike path is also worth noting, especially the terminal interest rate level. It is expected that the terminal interest rate level in 2023 will be much higher than the forecast of SEP in June three months ago. U.S. bond yields and the U.S. dollar remain poised for further strength as markets reprice expectations for aggressive rate hikes by the Federal Reserve.

The U.S. dollar index is continuing its upward trend, and the market outlook is expected to refresh a 22-year high again.

Gold breaks new lows, RMB breaks 7

During the U.S. session on Thursday, gold suddenly fell sharply by more than $30, from the level of 1691 to 1660, a new low since the week of April 13, 2020. On Tuesday (September 13), after the US CPI data for August was released, expectations for a more aggressive interest rate hike by the Federal Reserve continued to increase, causing gold to suffer a sustained sell-off.

The performance of the CPI inflation gauge in August reflects a worrying fact: U.S. inflation remains entrenched, and the risks that run deep into the system are real. To keep inflation from spiraling out of control, the Fed may have to raise rates more aggressively.

The Fed's rising interest rate hike expectations led to a frantic sell-off in gold, which eventually fell below the key support of 1680 and hit a new low in more than two years.

This round of gold decline is far from over in terms of time and space.

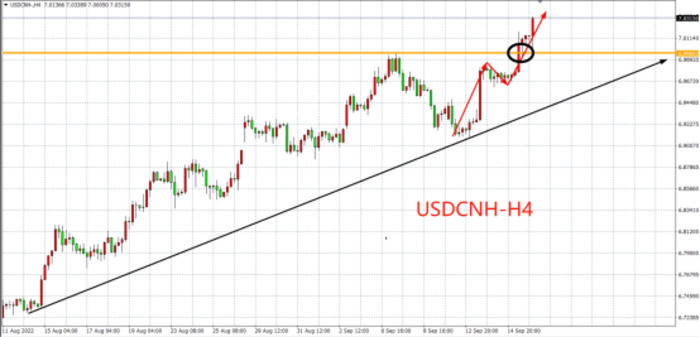

In addition to gold falling below the level, the RMB also suddenly accelerated its decline during the US session yesterday, breaking the 7 mark again after two years. In the early morning of September 16, the central parity rate of the RMB opened at 6.9305, a depreciation of 204 points from the previous day; after the opening of the China Foreign Exchange Trading Center, the onshore RMB also broke through the 7-point mark.

The RMB broke 7 this time, the main driving force still came from the appreciation of the US dollar. As early as the evening of September 13, the United States announced the CPI data for August, which is the most important economic data before the US interest rate meeting on September 21. As a result, the US CPI data was 8.3%, higher than the market forecast of 8.1%, highlighting the long and difficult road to control inflation in the US, and rekindled expectations for a sharp increase in US interest rates. Currently, there is little suspense in raising interest rates by 75 basis points again in September. Affected by the news, the U.S. dollar index rose 1.5%, its biggest one-day gain this year. Subsequently, the market's bets on the Fed raising interest rates intensified, and the renminbi suffered further depreciation pressure.

In response to the pressure of dollar appreciation, the People's Bank of China lowered the foreign currency deposit reserve ratio on September 15. This move will release an estimated $20 billion in liquidity to the market. Although the absolute amount is not large, it still signals the central bank to stabilize the exchange rate.

USD/CNY has risen above the previous high of 6.9960, with the next resistance at the mid-2020 high near 7.19

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia