Gold's fundamental environment deteriorates, and a long-term decline is formed

2022-09-26

2022-09-26

1288

1288

After the Federal Reserve announced a 75 basis point interest rate hike, many central banks in Europe, Asia and Africa followed its pace and raised interest rates sharply. The world set off a frenzy of interest rate hikes. Gold fundamentals deteriorated again, and a long-term bearish pattern has been formed.

The fundamental environment is deteriorating

Last week, the Fed announced a rate hike of 75 basis points in its interest rate resolution, marking the fifth rate hike this year and the third consecutive increase of 75 basis points. Although the rate hike this time is in line with mainstream expectations, and there is no unexpected direct increase of 100 basis points, the dot plot has significantly improved the forecast of the terminal interest rate - raising the median interest rate expectation at the end of 2022 to 4.4%, and the expected value at the end of next year. increased to 4.6%.

Under the expectation of strong interest rate hikes, the market is betting that the Fed will continue to raise interest rates by 75 basis points in November. According to the latest data from the CME Fed Watch Tool, there is a 70% chance that the next meeting will continue to raise interest rates by 75 basis points. Under the expectation of continuing violent interest rate hikes, the dollar's rally continues to rise, and the strength of the pricing currency constitutes a direct negative factor for the price of gold.

The Fed's September rate decision was more hawkish than the market expected. Ahead of the meeting, interest rate markets expected the federal funds rate to peak at 4.5% in 2023 and close to 4% by the end of the year. But a summary of economic forecasts for September showed that some Fed policymakers were leaning toward a peak near 5% for key interest rates.

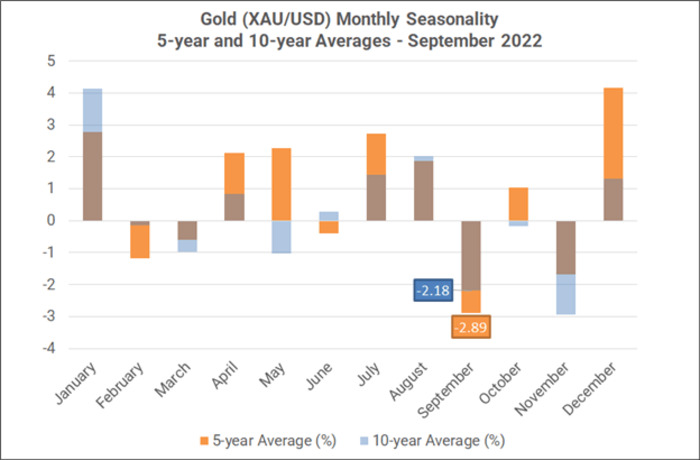

After the Fed's decision, U.S. Treasury yields rose further, which is the fundamental reason for the decline in gold prices in the past few months. Clearly, the fundamental environment for gold has become tougher, further reinforcing an already weak technical backdrop, while seasonal trends also suggest gold tends to underperform in September.

From a seasonal perspective, September was a less-than-friendly month for gold. Taking the past 5 years of data as a statistic, September was the worst month of the year for gold, with an average decline of -2.89%, and in the past 10 years, it was the second worst month of the year. , the average decline was -2.18%.

Let's look at another major factor that determines the price of gold - the real interest rate. The current real interest rate, measured by the yield on inflation-protected bonds, has also accelerated across the board. The yield on the U.S. 10-year inflation-protected bond was last at 1.29%, the highest level since 2010. The era of negative real interest rates is over, greatly diminishing the allure of non-interest bearing gold.

At present, whether it is the U.S. dollar or the real interest rate, the changes in the bearish gold price trend are very obvious, and under the superposition of the two major bears, the gold price trend is difficult to avoid risks and enter a longer period of decline.

Outlook

The weekly chart of gold shows that the price of gold confirmed last week that it broke the medium and long-term support of the 1680 line, which has now been turned into resistance. Effectively falling below 1680 means that the top of the big cycle has been formed, the broad downside space has been opened, and the next downside target is to look at the 1600 mark. If the market rebounds and corrects, continue to pay attention to the resistance near 1680, as long as the price is not recovered, the bearish outlook will remain

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia