Gold price trend adds variables PCE+ meeting minutes hit

2023-02-21

2023-02-21

1292

1292

Gold prices have fallen for three consecutive weeks after Fed officials sparked concerns about further interest rate hikes. Looking ahead to this week, the Fed meeting minutes and the US PCE are expected to spark debate over the pace of interest rate hikes. If the dollar strengthens further It will be negative for gold again.

Fed rate hike expectations push gold down

The overall macroeconomic environment supports the Federal Reserve's hawkish resolve to fight inflation. The U.S. January PPI data and initial jobless claims data released on Thursday both performed well, seemingly in response to the non-farm payrolls and CPI inflation data that have recently caused the market to panic about interest rate hikes. It is worth noting that PPI data is an index to measure ex-factory prices and is also leading data, so it has certain forward-looking significance. The monthly rate of PPI in January was 0.7%, far exceeding market expectations of 0.4%, and the previously revised -0.2%. It also means higher ex-factory prices are likely to be passed on to end consumers, clouding the outlook for still high and sticky inflation.

Amid a buoyant U.S. job market, the Fed's number one problem remains its elusive inflation woes. Compared with the market's worries about economic recession and hard landing, the Fed seems not to be kidnapped by the market's expectations at all, and is likely to implement its inherent procedures step by step in order to maintain its credibility, that is, to take hawkish measures to increase financing costs to reduce overheating economic activities .

On Friday (February 17), Barkin, chairman of the Richmond Fed, released a "dove" signal. He said that more interest rate hikes are needed to control inflation, and last supported 25 basis points; She said that inflation in the United States is still too high, and the Fed needs to continue raising interest rates until it sees significant progress in combating high inflation, and the interest rate has not yet reached a restrictive level. Currently, the Fed swap market is fully pricing in 25 basis point hikes in March and May.

In general, Fed officials support one-step interest rate hikes. Although the possibility of raising interest rates by 50 basis points is almost very small, the market's shattered expectations for the Fed's imminent rate cuts have been the main reason for the decline in gold prices in the past.

Gold price loses risk aversion support logic

There is no doubt that gold soared last year on the back of geopolitical risks detonated by the Russia-Ukraine war, which attracted a surprising amount of buying support. Recently, the gold market is betting on rumors of a more intense battle between Russia and Ukraine in March. The bulls seem to be counting on the continued discussion of the recession fears caused by the inversion of the U.S. bond yield curve and the possibility of war escalation, so as to seek a meeting Profit from long gold at low prices.

Recession-induced flight to safe haven is more likely to flow to cash dollars. Given that Fed officials estimate peak interest rates at 5.1%, even with a sharp 75 basis point cut, interest rates are above 4.0%, so the dollar is more attractive than non-yielding gold. And when market participants suddenly find themselves headed toward a low point in the economic cycle, they may be looking to liquidate their positions for cash and use them as bullets for bargain-hunting assets in search of better returns when the economic cycle picks up. Second, high gold prices will weaken the attractiveness of the risk-reward ratio. Third, the expectation of the Russia-Ukraine war has been digested by the market for a year, unless the war further expands to other countries, triggering greater panic in the market.

This week's outlook

In the new week, investors will focus on U.S. economic data, especially the January PCE price data released on Friday, the U.S. February Markit manufacturing/service industry PMI preliminary value released on Tuesday, and Thursday's April Quarterly GDP revisions. The market is currently at a turning point in anticipation of whether the U.S. economy will be in recession. If the data continues to be strong, it will further enhance the panic that the Fed will continue to raise interest rates or even increase the intensity of interest rate hikes. The Eurozone will focus on January CPI and Germany's fourth-quarter GDP data. Currently, the market generally believes that Europe has temporarily escaped the economic recession, while the European Central Bank's willingness to raise interest rates is still strong.

On the first anniversary of the Russia-Uzbekistan conflict, the rivalry between Europe and Russia will also usher in a new flashpoint. The meeting of energy ministers of EU countries will start on Tuesday. The G7 announced a new round of large-scale sanctions against Russia. At this sensitive moment, US President Biden will also visit Poland, which will continue to stir up the situation.

The overall strength of the U.S. economic data last week exceeded expectations, confirming that the U.S. economy is still strong. FOMC members Bullard and Mester even hinted that they are inclined to raise interest rates by 50 basis points, and the dollar rebounded sharply. Economists from several Wall Street investment banks including Goldman Sachs, Bank of America and Citigroup have raised their forecasts for the Fed's peak interest rate to 5.25%-5.50%.

However, markets have repositioned ahead of the U.S. long weekend and await clues on the Fed's response to still-elevated inflation. FOMC meeting minutes and more speeches from Fed officials will reveal more clues that could hint at the Fed's future actions, which may become a potential catalyst for further dollar strength.

Gold has fallen by about 7% in the past few weeks under the joint pressure of fiery non-agricultural data, stubborn CPI data, strong retail sales and PPI data. At present, gold seems to be stabilizing around 1820-1830. If the price of gold in the afternoon falls below $1,820, the selling force will intensify again, and $1,780-1,800 will be the next major support.

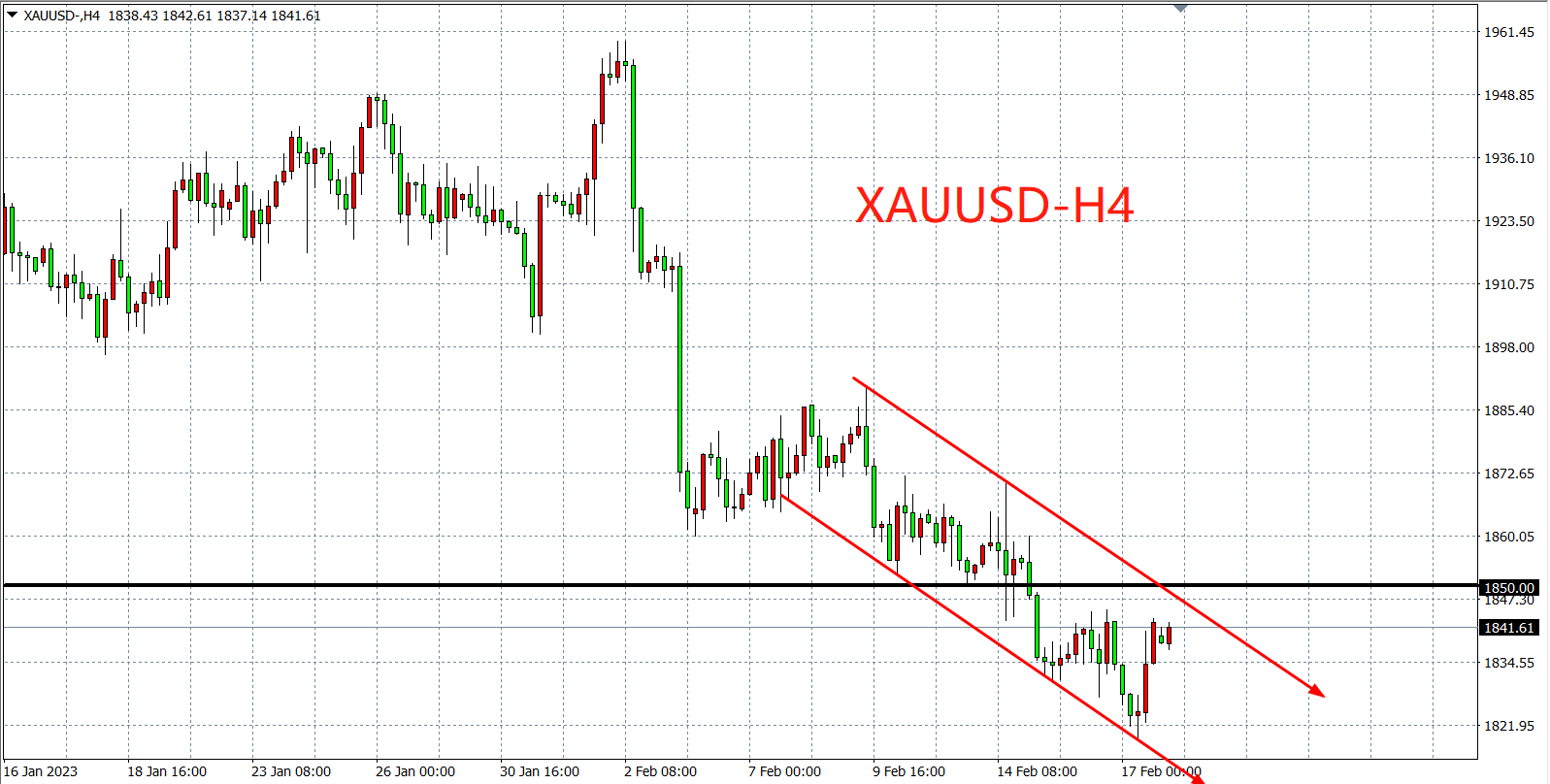

Technical Analysis

From a technical point of view, the price of gold still maintains a bearish trend, but rebounded quickly after hitting a low of 1820, forming a "V-shaped" structure at present, and the resistance level still focuses on the 1850 line, which breaks through the short-term bottom and establishes the upper target Look at 1880-1900, if you keep running below 1850, the short position will continue, and continue to look at 1820-1800 below

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia