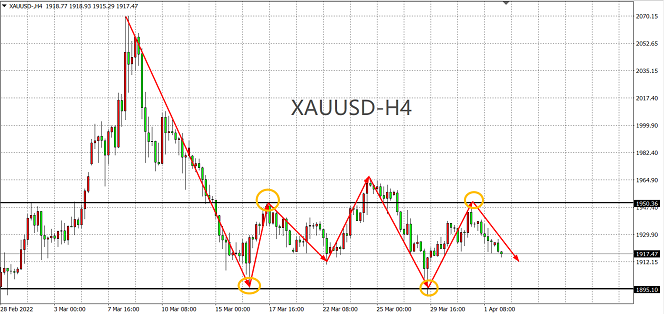

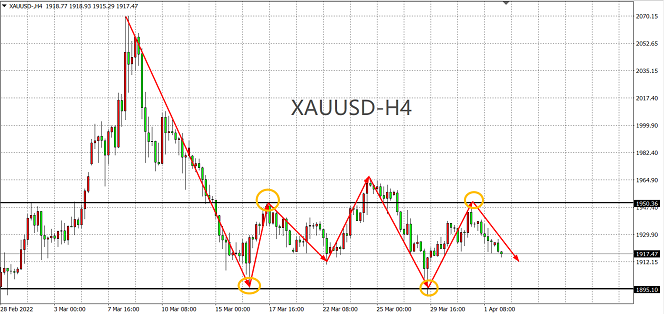

On Friday (April 1), the non-farm payrolls data increased by 431,000, slightly lower than market expectations. Affected by this, the US dollar index bottomed and rebounded. At the same time, the 2-year and 10-year US bond yield curves inverted again. It shows that although the data has not changed the Fed's expectation of raising interest rates by 50 basis points in May, it has increased the market's expectation of a future economic recession and provided some support for gold. On the other hand, under the expectations of the Fed's hawks and the rumors that an agreement is about to be reached in the Russia-Ukraine negotiations, the tightening of liquidity and the easing of the geopolitical situation have created downside risks for gold, and the price of gold will face a choice of direction this week. From a technical point of view, the current range of the box is narrowed to 1895-1950 US dollars. It is difficult to have a clear direction before this range is broken. The operation is mainly based on high selling and low buying in the box. After breaking the position, adjust the direction according to the trend.

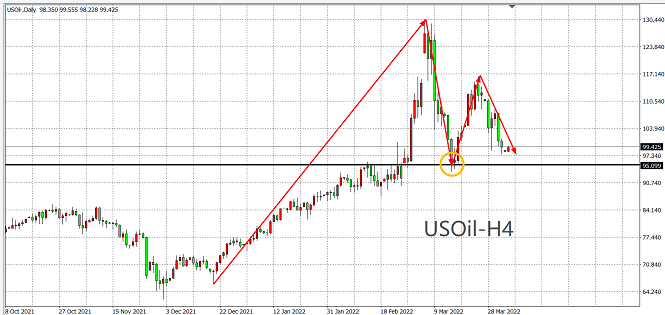

In terms of crude oil, last week, under the double blow of the easing of the situation in Russia and Ukraine and the release of 180 million barrels of oil reserves in the United States, it fell by nearly 12%, and the pessimism in the oil market permeated. From the perspective of supply, the effect of the 1 million barrels per day released by the United States may be "insignificant" and cannot fully fill the gap in Russia's oil supply. Whether the plan can produce lasting effects remains to be assessed, and the supply and demand pattern of the oil market remains tight. From a technical point of view, the oil price rebounded again and was blocked to form a double-top prototype. The bottom line of 95 US dollars is the watershed position. Above this level, the oil price still has rebound momentum. Gains and losses at this point.

2022-04-04

2022-04-04

1304

1304

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia