The tension between Russia and Ukraine continued to rise over the weekend, the border between Russia and Ukraine went into flames, the United States and a number of NATO countries issued warnings of sanctions against Russia, and Russia extended military exercises. The squeezed risk aversion was released on Monday, and both gold and crude oil were released. go higher.

But then there was the smallest news that Biden and Putin accepted the French proposal for a meeting, and the situation in Russia and Ukraine was expected to cool down. U.S. stocks rebounded quickly, while the U.S. index, gold, and crude oil fell.

The Russia-Ukraine situation and the competition between Russia and the United States are still the main theme of the market. Although the situation seems to be showing signs of easing, considering the complexity of the situation, it is still a long way from a smooth transition. On the contrary, any potential red flag can easily be amplified by the market, making it difficult for the situation to de-escalate from extreme tension.

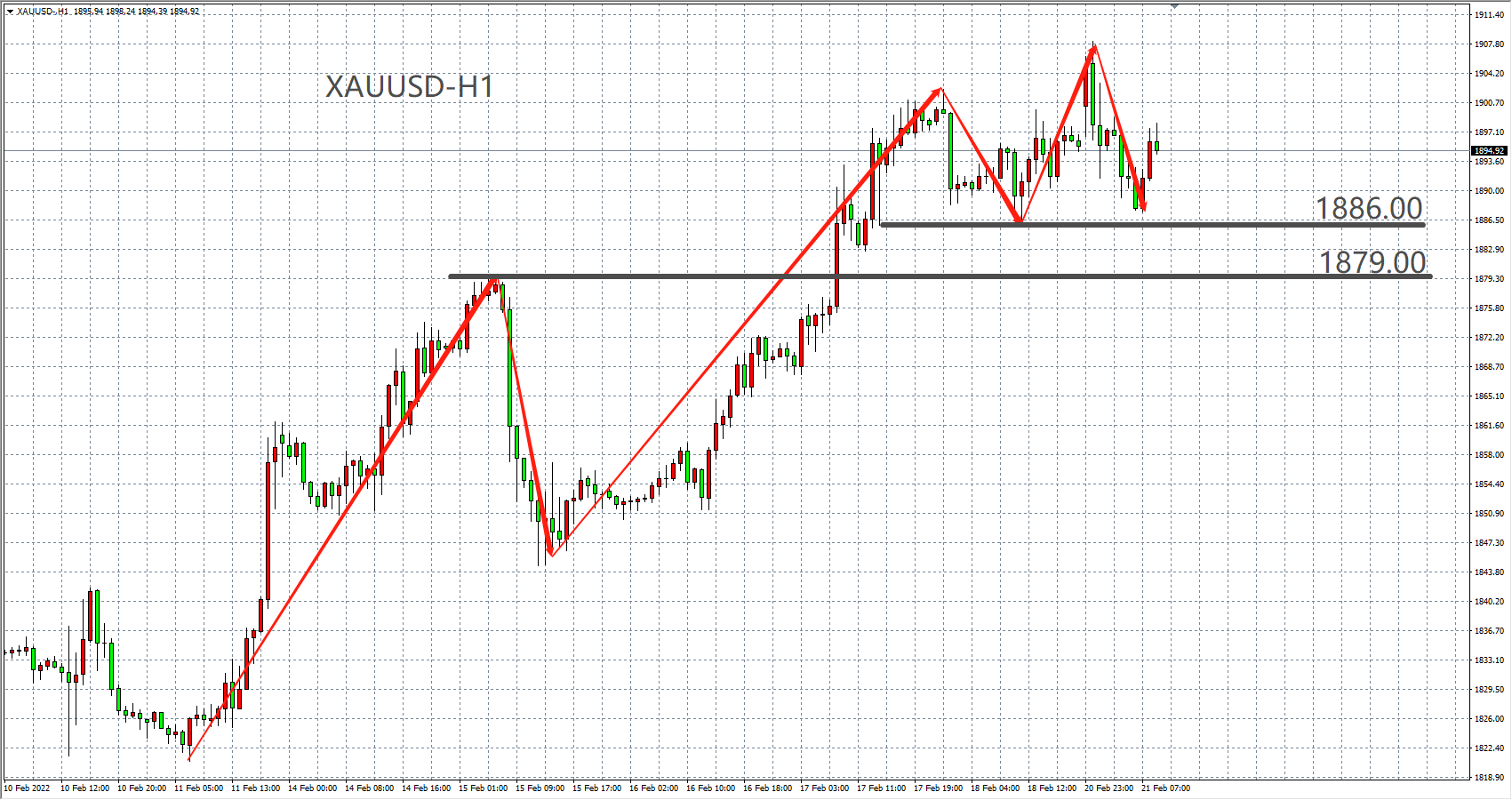

In terms of gold, driven by the repeated turmoil in Russia and Ukraine, the speculative atmosphere is still strong, and risk aversion dominates the main buying power. We maintain the bullish $1910 unchanged, and the next stage of the rally can be established after a breakthrough.

Today’s opening is the highest After hitting $1,908, it fell back quickly, and the resistance at this level was confirmed. For intraday operations, it is recommended to take the line of 1886 US dollars as the dividing point. The current short-term topping pattern appears, and if it breaks below 1886, it will be established in the short term, and the latter trend may start to pull back. Look below at 1879-1868-1860; if it maintains operation above this level during the day , continue to be bullish, target 1910 to higher.

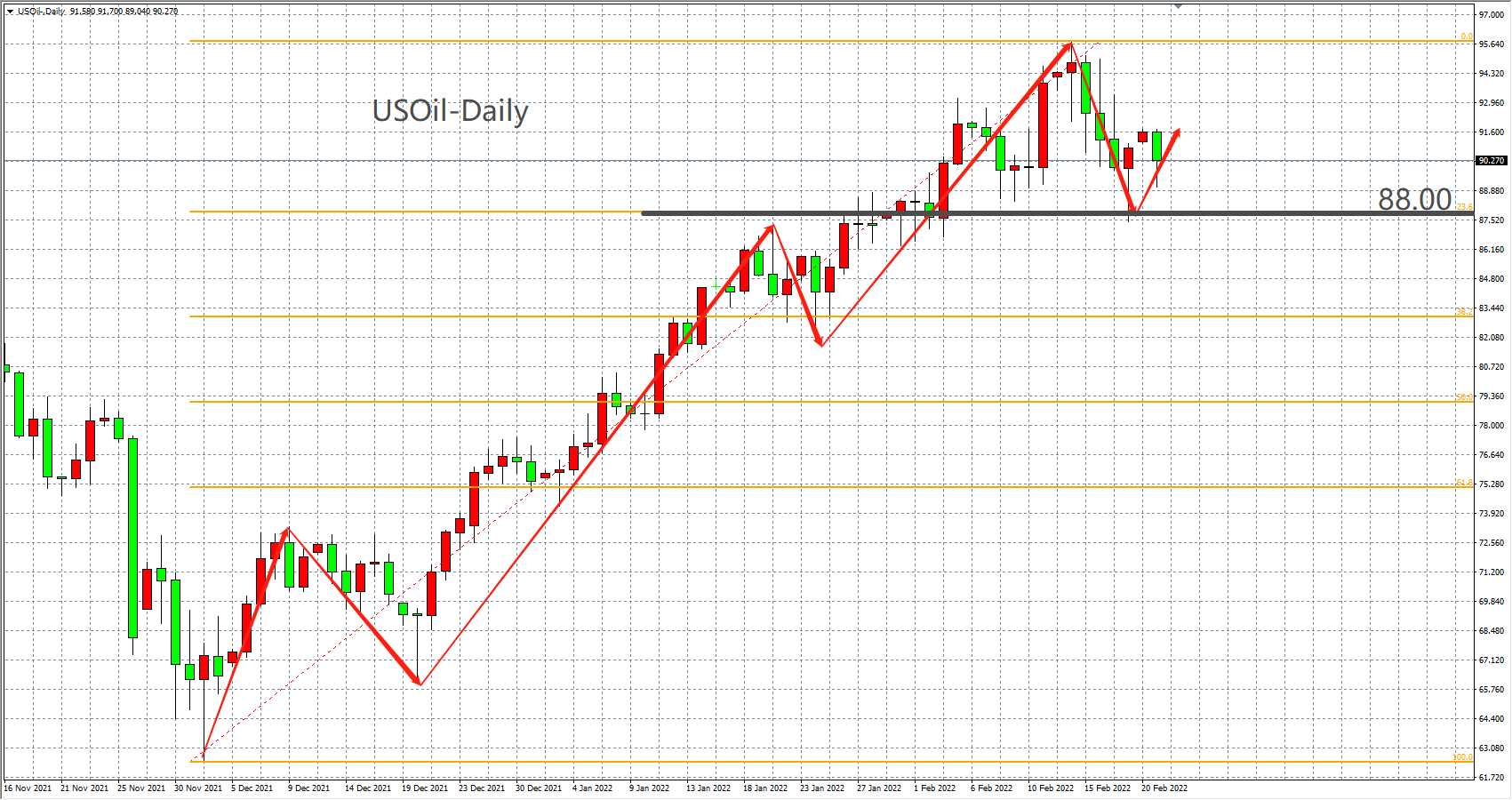

In terms of crude oil, the recent surge in gold has not been able to effectively follow. The main reason is that the current oil price is not only affected by the situation in Russia and Ukraine, but also the important factor of the Iran nuclear agreement. These two factors are competing with each other, and the ups and downs are mixed. As the Iran nuclear deal has entered the final stage, the expectation of Iran's return has increased significantly.

Once the situation in Russia and Ukraine fails to ferment further, it is expected that the Iran nuclear deal will become a factor that dominates oil prices in stages. Therefore, it is even more necessary to be wary of the possibility of oil prices rising and falling in the near future. . From a technical point of view, U.S. oil is currently supported by the $88 line.

A wave of retracement on Friday finally gained support and rebounded sharply at this level. The support has been verified again. It can remain bullish above this level within days, and it will be strong. The resistance is at $91.60-93, if it falls below $88, look at $86-84 below.

The above content is for reference only and does not constitute the basis for order construction. Investment is risky, and transactions should be cautious.

2022-02-23

2022-02-23

1290

1290

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia