Morgan Stanley: U.S. stocks will keep falling, but a bear market rally is coming

Against the backdrop of persistently high inflation and aggressive interest rate hikes by the Federal Reserve, most analysts expect U.S. stocks to fall further. Morgan Stanley's long-term bearish chief equity strategist Michael Wilson pointed out in a recent report that "pricing is still wrong", when the stock risk premium (ERP) rose to 3.4% and the price-earnings ratio fell to 14-15 times, The bear market in US stocks will end; although US stocks have adapted to higher interest rates, the ERP has not yet reached the expected target of 3.4%. The current ERP is 3.0%, and the market has underestimated the risk of future returns. The question is, will the stock market accept a possible impending profit cut, or will companies be required to formally lower their guidance? Given the prevailing bearish sentiment and extreme oversold conditions at the moment, we could see it play out either way.

Goldman Sachs downgrades short-term outlook for global equities to neutral

Goldman Sachs downgraded global equities to neutral in three months, as it expects risk assets to remain in a "wide flat" range in the near term until economic growth and inflation improve. Goldman still has an overweight rating on stocks in the 12-month period; underweight ratings on credit and sovereign bonds in the three-month and 12-month periods.

U.S. retail sales in April beat expectations

The monthly rate of U.S. retail sales in April was actually 0.90%, compared with the expected 0.8%, and the previous value was 0.5%; the annual rate of U.S. retail sales in April was actually 8.19%, compared with the previous value of 6.9%. The monthly rate of core retail sales in the United States in April was actually 0.60%, expected 0.3%, and the previous value was 1.1%. US retail sales in April recorded a monthly rate of 0.9%, the highest since January this year.

Rising tensions between EU and Russia support oil prices

The U.S. Energy Information Administration (EIA) said on Monday that the largest U.S. producer of shale oil, the Permian Basin in Texas and New Mexico, will increase oil production by 88,000 barrels per day in June, It reached a record 5.219 million barrels per day. "Rising geopolitical tensions" between the European Union and Russia will further support oil prices as Sweden and Finland seek to join NATO, "which could lead to Russian retaliation and further cuts in gas supplies."

Russia's oil output rose slightly in first half of May

According to a report by the Russian media TASS on May 16, from May 1 to 15, the average daily output of Russian oil and gas condensate was 1.398 million tons, an increase of 1.7% compared with the same period in April. Since the spring of 2021, Russian oil production has maintained a steady growth trend. However, after the Russian-Ukrainian conflict broke out this year, Russia was sanctioned by the United States and Western countries, including a ban on investment in Russian crude oil exploration, production and processing.

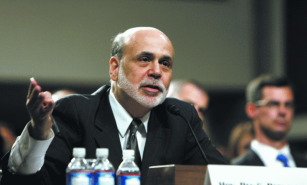

Powell and Biden both criticized

Former Fed Chairman Bernanke said in an interview on Monday (May 16): "The Fed believes that supply chain bottlenecks may resolve themselves over time by mid-2021. In other words, the supply shock is temporary. Yes, inflation will ease on its own, and the Fed doesn’t need to respond to the early stages of inflation, but it turns out to be wrong.” After the passage of the Biden administration-backed “rescue package,” the unemployment rate lingered at mid-year Near 6%, the Fed missed the best time to start raising rates given that the labor force "still has a lot of slack."

Euro hits double whammy as dollar rises in Russia-Ukraine conflict, falls for sixth straight week

The euro fell for the sixth week in a row, weighed down by concerns over the Russian-Ukrainian conflict hampering the economy and a rise in the dollar, although the European Central Bank is widely expected to start raising interest rates in July, but it is expected to raise rates at a slower pace than the Federal Reserve. Goldman Sachs, a well-known investment bank, believes that if the downward trajectory of the euro against the dollar continues, it may lead to an increase in the overall inflation rate in Europe by as much as 0.5 percentage points per year in the next two years. That would increase pressure on the European Central Bank to raise rates more quickly. Once the European Central Bank takes action in raising interest rates, it may ease the recent downward trend of the euro.

2022-05-18

2022-05-18

928

928

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia