FOMC resolution + OPEC meeting strikes, the oil market is about to explode

2023-02-01

2023-02-01

1227

1227

IMF raises global economic growth forecast

On Tuesday (January 31), the International Monetary Fund (IMF) predicted in the latest ""World Economic Outlook Report"" that economic growth is more resilient than before, and a global recession may be avoided. Among them, consumer dynamism and the reopening of the Chinese economy are reasons for a more optimistic outlook.

The IMF raised its forecast for global GDP growth in 2023 to 2.9% from 2.7% estimated in October last year; lowered its forecast for global GDP growth in 2024 to 3.1% from 3.2% estimated in October last year; The economic growth forecast was revised up to 5.2% from 4.4%.

In addition, the IMF expects that due to reasons such as falling commodity prices, the global inflation rate in 2023 and 2024 will drop from 8.8% in 2022 to 6.6% and 4.3%, respectively.

There is no doubt that the global economy in 2023 will still be affected by central banks raising interest rates to deal with inflation, the war between Russia and Ukraine, and the progress of China's economic recovery, but the IMF believes that since October last year, the adverse risks have eased .

However, the IMF warned that the global economy still faces considerable risks, including (China's health problems may hinder recovery, Russia's war in Ukraine may escalate, and tightening global financing costs may also exacerbate the debt crisis, etc.). It is worth noting that the IMF emphasized that the fight against inflation is not over, and urged central banks to resist the temptation to turn.

The downward trend of WTI crude oil since June 2022 is closely related to the global economic outlook. The Fed began to shrink its balance sheet, causing the market to fall into a ""dollar shortage"" at an accelerated pace, while the central banks of various countries followed the Fed to raise interest rates, which impacted the global economic outlook. WTI crude oil fell 43% at this stage.

Although this situation has substantially improved with OPEC+ production cuts at the end of last year, the Fed's tightening pace slowed down, and the release of the epidemic in China. But on the whole, the uncertainty of the inflation outlook still limits the pace of oil price upside, and oil prices are likely to be in the bottom construction stage.

The Fed's interest rate decision is coming

According to the latest CME ""Fed Watch"", the probability of the Fed raising interest rates by 25 basis points to the range of 4.50%-4.75% is 99.1%. As high as 5%, and at the end of the year to reduce the interest rate to 4.6%.

In fact, wage growth is slowing as recent U.S. economic data released showed the employment cost index. At the same time, housing inflation is expected to fall in the middle of the year due to the hysteresis effect, and commodity inflation prices will slow down due to the recovery of the supply chain. The overall inflation will show a clear downward trend. That means the case for betting the Fed will cut interest rates before the end of the year is getting stronger.

In addition, the US Conference Board consumer confidence index for January released on Tuesday (January 31) fell to 107.1, expected to be 109, and the previous value was 108.3. U.S. consumer confidence fell unexpectedly this month, reflecting less optimistic expectations for the economy and job market. The market speculates that the Fed is more concerned with economic growth than controlling inflation.

The U.S. dollar has fallen from 114.0 since the end of September last year, mainly due to financial stability and inflation. As the market expects inflation to decline and the MOVE index has fallen from last year's high, it is expected that the Federal Reserve's interest rate decision will be announced on Thursday (February 2) Will be biased towards the ""hawks"".

Will may re-emphasize his determination to control inflation and ""remind"" the market of the ""stubbornness"" of inflation. Since oil prices are denominated in US dollars, it may be difficult for oil prices to break through in a trend at this stage. Investors who are bullish on oil prices should remain patient.

In addition, the OPEC+ meeting will be ushered in within a few days. According to a Reuters survey, OPEC's oil production in January fell by 50,000 barrels per day from December to 28.87 million barrels per day, and the country with the largest decline in production was Iraq.

OPEC's move to cut production by 2 million barrels per day last year means that it is in an ""observation period"". In view of the fact that the author believes that OPEC+ member countries' production cuts of more than 3 million barrels per day may have a real impact on oil prices, therefore This time, OPEC+ is likely to adopt a conservative attitude and maintain the same production scale.

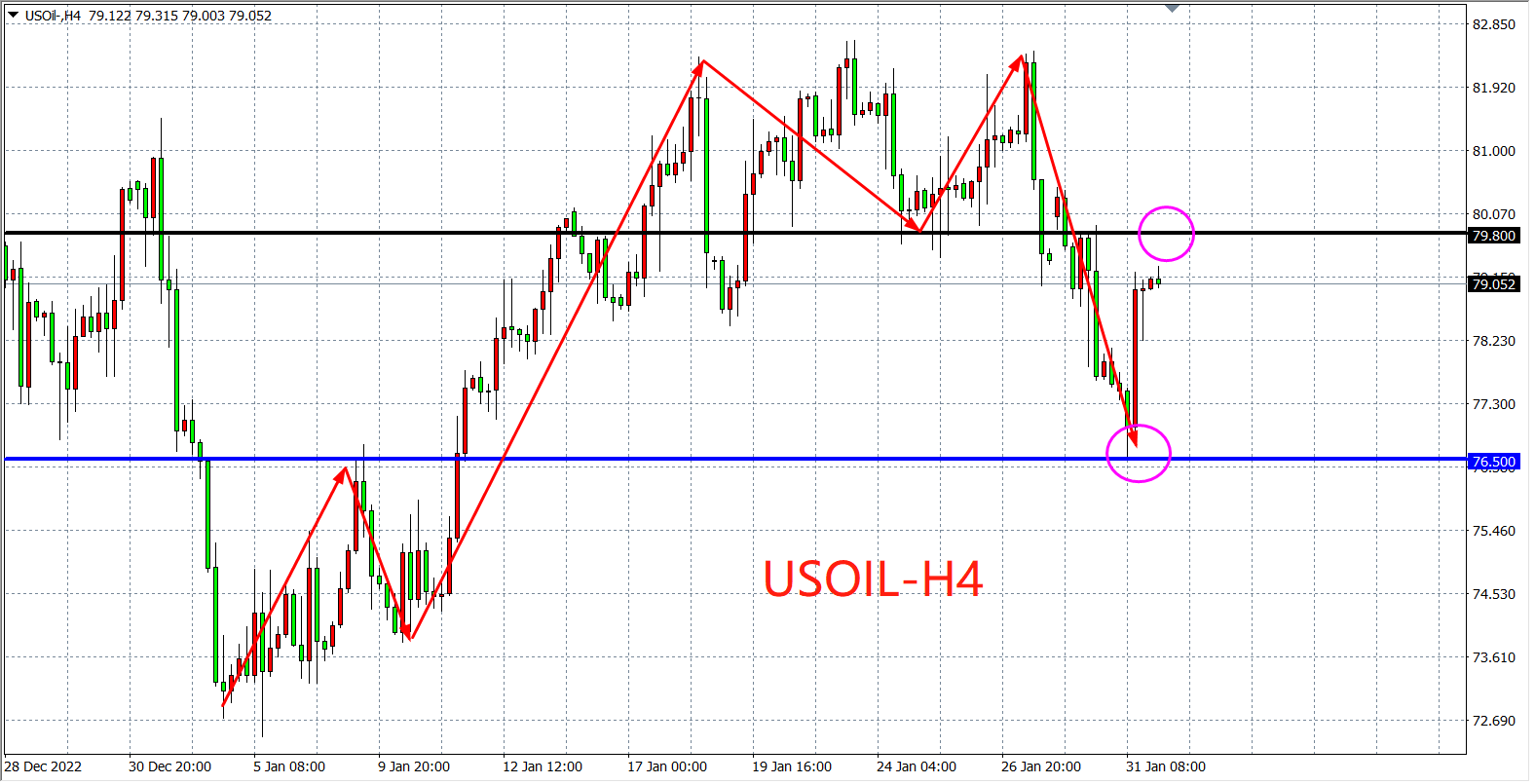

Technical trend analysis:

From a technical point of view, WTI crude oil is suppressed by the top form above, while the line below 77 is supported again. The short-term long-short competition is more obvious. The top is mainly focused on the short-term resistance of 79.80. Below this level, further corrections are still not ruled out 78-76 US dollars, if this position breaks up, it is expected to return to 82 US dollars

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia