Fed officials see low unemployment not enough to lower inflation

2022-09-09

2022-09-09

1360

1360

U.S. Treasury yields soared, in part due to a wave of corporate bond issuance. The two-year Treasury yield rose about 10 basis points to 3.49%, up 0.20% from a year earlier. The yield on the 10-year U.S. Treasury note hovered around 3.32%. The Fed is expected to raise rates by 50 basis points at its policy meeting later this month, followed by 25 basis points in November and December. There are upside risks to the short-term forecast if the consumer price index (CPI) data for August, released on Sept. 13, goes wrong.

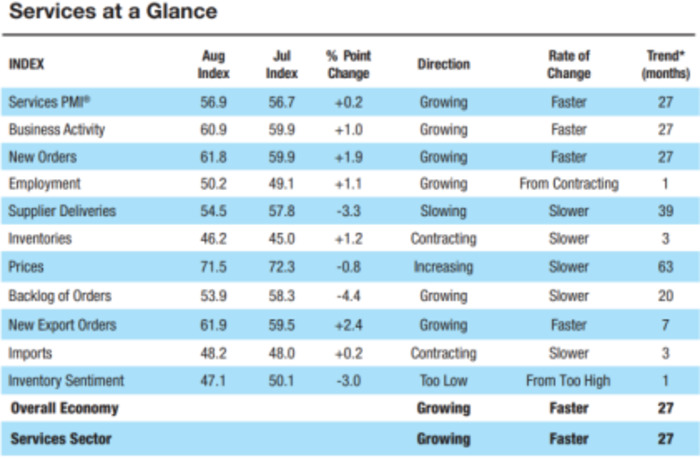

The price payment index, which is widely concerned by the market, has fallen for four consecutive months. That's down 13.1 percentage points from the May peak of 84.6. The overall trend has turned to a downward trend. The lowest value since January 2021. The ISM data also showed indicators of business activity and new orders both rose to their highest levels this year, reflecting a continuing shift in spending habits and steady wage growth. Foreign demand has also strengthened, with export orders rising at the fastest pace in nearly a year.

The fall in output was due to sharp fluctuations in inventories and a trade deficit related to the rigidity of global supply chains. By contrast, job growth remained strong, with the U.S. adding more jobs than expected. Fourteen service industries posted gains in August, led by mining, real estate, leasing, utilities and construction. Agriculture, forestry, fishing and hunting, and arts, recreation and leisure were the only two sectors that contracted.

Analysts at BloombergIntelligence said: “Measures of business activity and new orders both rose to their highest levels this year, reflecting a continuing shift in spending habits and steady wage growth. Foreign demand also strengthened, with exports Orders are growing at the fastest pace in nearly a year."

"The U.S. services sector picked up again in August for a second straight month on the back of strong orders growth and employment, while supply bottlenecks and price pressures eased, strengthening despite the fact that in the first half of the year," analysts at Reuters said. The idea that output is down, but the economy isn't in recession."

"If the U.S. labor market or inflation expectations don't cool significantly, this would justify a modest increase in the Fed's projected unemployment rate," Johns Hopkins economics professor Paul Powell said in a summary of his research presented at the Brookings Institution Economics Conference. Not enough to effectively bring down inflation. To keep inflation in check, unemployment needs to rise and the economy needs to slow sharply.”

Fed officials insist that times are different today. For example, PCE, their preferred measure of inflation, may have peaked at just over 6%. So they still think the Fed can beat inflation without a big rise in unemployment or a recession. But new forecasts from the Fed, due in two weeks, may turn less rosy about the U.S. economic outlook. Analysts expect the Fed's 19 policymakers to see inflation taking longer, harder and unemployment higher than forecast in June, but how high is up for debate.

The August jobs report showed job growth slowed as more workers entered the labor force, with the unemployment rate rising to 3.7%. If the participation rate continues to rise, it could improve the Fed's chances of a "soft landing" for the U.S. economy and reduce the need for more aggressive tightening.

Cleveland Fed President Mester reiterated her view that the central bank needs to raise interest rates above 4% in early 2023 and keep it there for some time to cool inflation at the highest level in nearly 40 years. She doesn't expect the Fed to cut rates next year, noting that policymakers need to keep inflation expectations from spiraling out of control.

The central bank will also reduce its balance sheet by $95 billion a month, a process that should remove easing. Mester reiterated that she would support the sale of mortgage-backed securities at some point to help the Fed's portfolio return to a Treasury-heavy portfolio. She also said she was more concerned with how shrinking the balance sheet would affect liquidity in financial markets than determining how much the process would affect interest rates.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia