Expectations of interest rate hikes by major central banks are gradually heating up

2022-10-19

2022-10-19

1327

1327

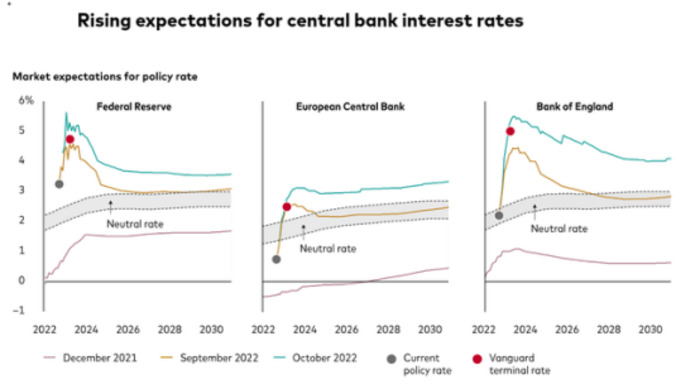

Market expectations for rate hikes by the Federal Reserve, the European Central Bank and the Bank of England have increased. According to the one-month forward swap rate, the Fed's policy rate could breach 5% in 2023 from its current target range of 3%-3.25%. The Fed's policy rate next year is expected to exceed 5%, but the Bank of England's rate is likely to be higher.

The Bank of England's policy rate is expected to hit nearly 6% in 2023, while the European Central Bank's rate is expected to remain below 4%. These rates would be well above the existing policy rate and the "neutral rate" of around 2%. Neutral rates are expected to neither stimulate nor constrain major economies.

While the direction of interest rates ultimately depends on "future events and data," markets expect central banks to stick with their plans to raise rates to fight inflation unless "surprises", or markets threaten to erupt, beyond the slowdown they are trying to control.

The U.K. government will be under pressure to legislate for an inevitable, unmanageable election, and as the economy heads toward one of the worst recessions in decades, it was predicted even before the recent bond market turmoil. The cumulative 3-day jump in UK interest rates on a combination of doubts about fiscal sustainability and inflation risk has been staggering - 30-year Treasury yields soared 121 basis points, more than double the 50 basis points, which in itself is an extreme event. "

The Bank of England has bought almost £20bn of government bonds since September 28. On Saturday, BoE Governor Bailey described the event as a "liquidity event", which led to the Bank of England's intervention on Wednesday, following the fiscal event on Friday, September 23. Sterling appears to have benefited from the intervention, so it could be vulnerable to any new or further liquidity pressures, although UK inflation data for September and the greenback are also important on Wednesday.

The new British Chancellor of the Exchequer Jeremy Hunt issued a statement saying that "almost all" tax cuts in the large-scale tax reduction plan announced by the government in September this year will be cancelled to ensure the stability of the British economy and enhance the outside world's confidence in the government's fiscal policy .

Adam Button, chief currency analyst at ForexLive, said: “The pound has been the driver of the FX market so far this month, with the big reversal announced by the UK government restoring confidence in the pound and taking away dollar buying.”

UK Prime Minister's Spokesperson: The finance minister told the cabinet that it would work with various departments to make difficult decisions on spending and taxation. The cabinet agreed that the government needs to improve efficiency further. The prime minister remains committed to increasing defense spending to 3% by 2030. How to get to 3% will be decided by the Ministry of Defence and the Treasury, the Prime Minister and the Chancellor of the Exchequer currently have no commitments in individual policy areas, we will protect the most vulnerable, overall government spending will increase, we are not in another crunch at the moment period.

After the news, the price of British government bonds rebounded sharply. Hunter replaced Quatten, whose unfunded tax cut proposal on Sept. 23 sparked a rout in bond markets. Chris Beauchamp, chief market analyst at IG, said: "For now, the market seems happy to give the new chancellor time and space to sort out the mess in government."

The FT has learned that senior BoE officials came to this view, backed by its Financial Policy Committee, after judging the gilt market in recent weeks as "very bad". By contrast, other central banks have begun the process of shrinking their balance sheets to reduce their balance sheets and increase their room to act in any future currency or financial crisis. BoE officials insisted that inflation control could be implemented by changing interest rates, rather than so-called quantitative tightening. At the rate set by the Bank of England, it will take a decade or more to complete the QT.

与此原文有关的更多信息要查看其他翻译信息,您必须输入相应原文

发送反馈

侧边栏

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia