Last night, the situation in Eastern Europe was positive. Russia decided to reduce its military operations in Ukraine to increase the momentum of ceasefire negotiations. The news boosted market optimism. The stock market and a number of currencies made up for the gains, while the prospect of the dollar was suppressed. Gold provided rebound support.

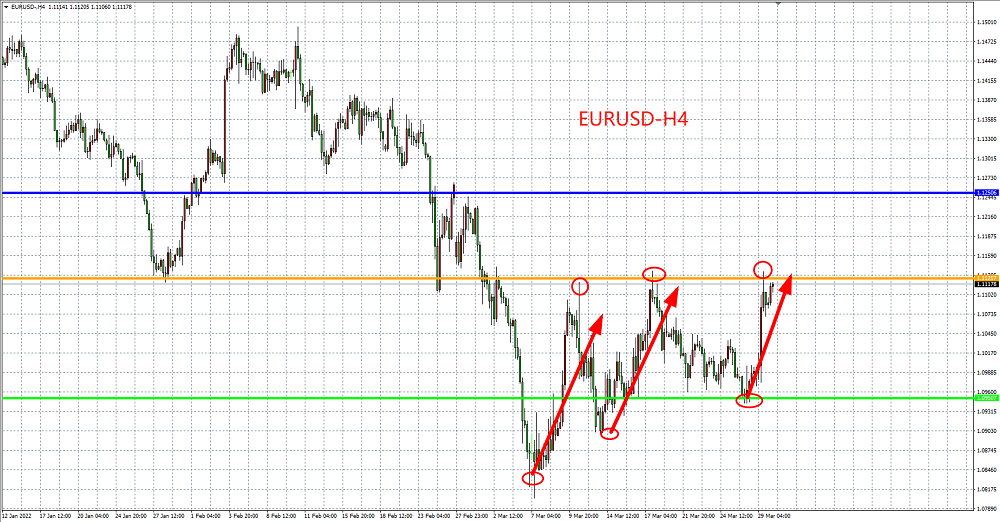

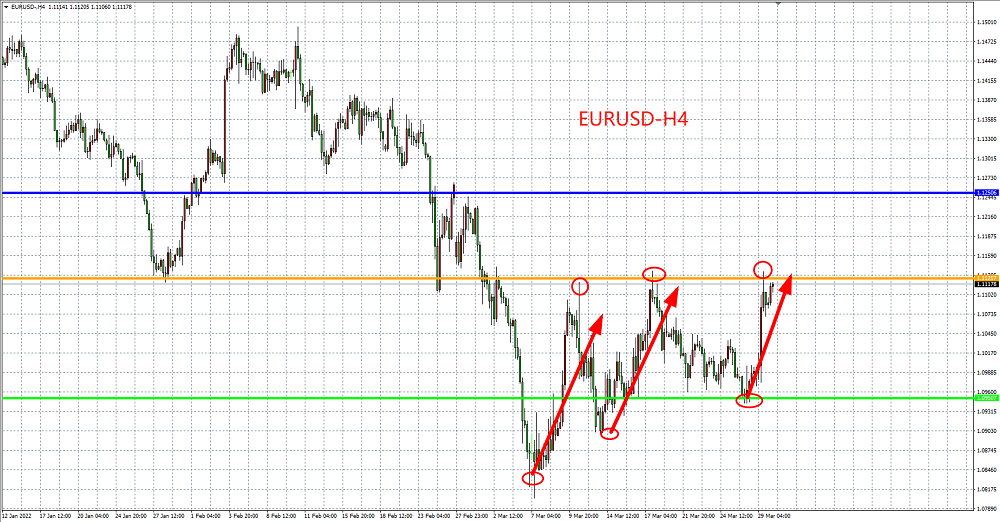

Due to its geographical location and close trade ties with Russia, Europe is the region most affected by the Russian-Ukrainian conflict. Affected by this, the economic growth of the euro zone has been greatly reduced, and the inflation forecast has been significantly revised. With the reduction of geo-risks, the European economy has Both activity and investment sentiment were boosted, and EUR/USD ushered in a retaliatory rebound. From a technical point of view, the exchange rate of Europe and the United States has rebounded rapidly for three consecutive times recently, and each time the callback and rebound position are higher, the bottoming signal is obvious, the current resistance is at 1.1125, and the gain or loss of this level will determine the trend of the next stage. If the top continues to break through, the bulls will see 1.1135-1.1145. On the contrary, if the breakthrough fails to unexpectedly lower, then look at the support near 1.1100-1.0950 below.

Due to the continuous optimistic news from Russia and Ukraine, gold fell by more than 30 US dollars during the session yesterday, and then rebounded after stabilizing at 1895, and has recovered all the losses. The reason for the bottoming out of the gold price is mainly the inversion of the 2/10-year yield curve in the U.S. bond market. Historical data shows that this sign is a signal of economic recession, which further strengthens the market’s belief that the Fed’s interest rate hike will lead to “stagflation”. It is expected that the non-farm payrolls data to be released this week will have a significant impact on the follow-up Fed rate hike process. Tonight's ADP employment data needs to be focused. From a technical point of view, the price of gold will stabilize after testing the support of 1895, and it is expected to start a rebound. It will be viewed with a wide range of fluctuations from 1895 to 1936 in the day, with high altitude and low mainly. If it breaks 1936 effectively, it will rise to 1960.

2022-03-31

2022-03-31

1186

1186

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia