Deterministic trading opportunities amid uncertainty

2022-10-17

2022-10-17

1380

1380

The world is focusing on Russia and Ukraine are focusing on the crude oil market, however, for crude oil trading, the key risk factors that have occurred recently are:

- OPEC's deep production quota reduction, the US political circles began to make a stronger statement and response to Saudi Arabia.

- The Crimea Bridge was bombed, Russia retaliated against Ukraine, the number of epidemic cases in China increased, US stocks began to enter the third quarter earnings season, and economic recession worries continued to ferment.

- The U.S. hurricane season has gradually passed, and the northern hemisphere will usher in the winter heating challenge. These risk factors have brought more uncertainty to the crude oil market, disrupting the pricing balance that has been achieved in the market over the past few months, resulting in the near future. Crude oil has re-emerged with large fluctuations. We believe that these risk factors can be divided into three categories: macroeconomic risks, geopolitical risks, and natural weather; in terms of macroeconomic risks, crude oil demand is increasingly being driven by recession worries Dominant influence; In terms of geopolitical risks, crude oil supply risks mainly focus on the struggle between the Biden administration and OPEC, and whether the tension between Russia and Ukraine will further expand and escalate. The recent trend of oil prices shows that market investors are oscillating between macroeconomic and geopolitical risks. As the traditional hurricane season is coming to an end, it is unknown whether the winter will be cold or not. The next trend of crude oil prices will start to incorporate weather factors. Therefore, we say that the uncertainties in the crude oil market have increased, and the crude oil market will begin to enter a faster volatility rhythm to achieve a new round of pricing balance.

Let's analyze these factors in detail:

- OPEC's production cut quota has become a historical decision. What the market needs to pay attention to next is how the United States will face it?

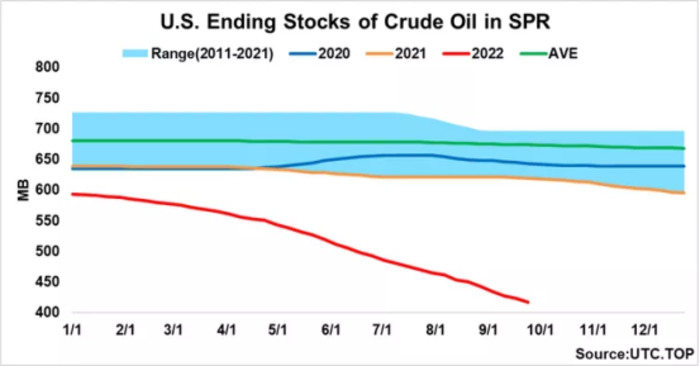

For the President of the United States, the most realistic and feasible option tool is still to release the strategic reserve inventory. Since President Biden announced the goal of releasing 180 million barrels of war reserves in March this year, the sales volume that can be counted has reached 165 million. Barrels, according to the relevant bills of the US Congress in 2015 and 2018, the US government still needs to sell at least 26 million barrels of strategically prepared crude oil in fiscal year 2023. The number of crude oil storage chips is 1.8-1.65+0.26=0.41 billion barrels. It is worth pointing out that the US fiscal year 2023 starts from October 1, 2022, that is to say, in addition to those that have not yet been released this year, Biden also Additional releases of 26 million barrels can be added at any time under the established authorization of Congress.

- The expansion and escalation of the Russian-Ukrainian war will theoretically lead to a more tense expectation of a shortage of crude oil supply in winter

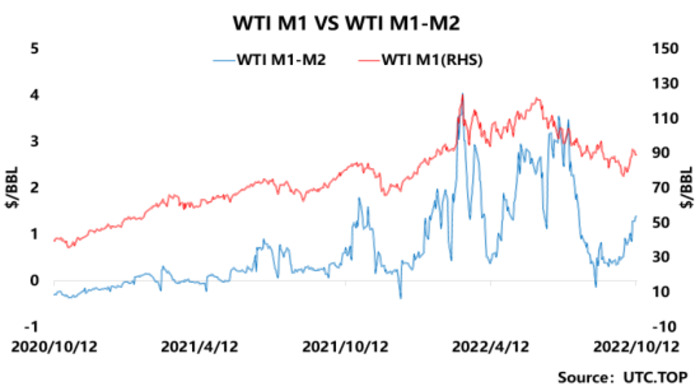

So we saw a lot of buying after WTI fell below 80, but it is worth pointing out that even with the deep OPEC production cuts and the recent re-emergence of large-scale conflict between Russia and Ukraine, which has caused nervousness in the physical market, oil futures definitely The first month-to-month difference between oil prices and crude oil futures has not yet risen to the high point during the previous period of the fierce conflict between Russia and Ukraine, which fully shows that the current oil price is mainly worried about the risks on the demand side, rather than the tight supply side.

- The current driving force affecting the demand side of oil prices mainly comes from macroeconomic risks and weather factors

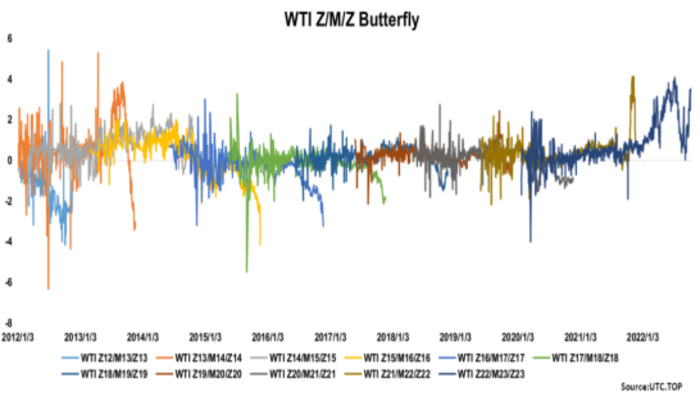

The expectation of economic recession brought about by the Fed’s continued interest rate hikes and withdrawals is a topic that the market is actively discussing. Macroeconomic risks are fully factored into market prices every day. We will not analyze them here. Point out some key issues. From the current seasonal butterfly spread combination, WTI's 2212-2306-2312 butterfly spread combination has significantly increased to the highest level in recent years compared with previous years, which shows that the market is fearing winter weather. factors, worrying about the increase in crude oil demand caused by the shortage of refined oil products caused by the severe cold in winter.

Through the above analysis, the UTC capital team believes that in the context of the rising capital cost of crude oil buyers brought about by the Fed's interest rate hike, it is unpredictable whether the global crude oil buyer group is willing to stock up for the winter. , after all, the capital cost, cash flow, sales ability, currency exchange rate and other factors of crude oil buyers all over the world are different. Therefore, this winter, it is very dangerous to simply buy or sell crude oil futures to bet on the absolute value.

Based on the above analysis, we believe that there are only two remaining speculative trading strategies with relatively high feasibility in the crude oil market, namely:

- Conservative hedging strategy

Buy the CSO Call Option (Calendar Spread Options) on the WTI DEC 22 VS JUN 23 spread and sell the WTI 2212-2306-2312 Butterfly Futures Spread.

- Aggressive speculative strategies

Buy a CSO put option on the WTI DEC 22 VS JUN 23 spread. The key logic of these two trading strategies is: when this winter is not as cold as expected, WTI's 2212VS2306 CFDs will encounter the risk of disk liquidity and may be sold to collapse instantly by a large number of selling.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia