A short-term bottom is formed, can gold prices turn around?

2022-09-30

2022-09-30

1176

1176

Under the "technical recession", Fed officials remained firm and hawkish. The Bank of England's bailout continued to bring about a rebound in market risk appetite. Opportunities for a rebound in gold prices, spot gold first fell and then rose. The US market once rose to a high of $1,664.78, and finally closed up 0.04%. Looking ahead, the prospect of interest rates and risk aversion are expected to continue to support the US index higher. If the US dollar continues to strengthen, then the rebound in gold prices may not be sustainable.

The driving factors of this round of gold rebound

The price of gold continued the gains of the previous day, fell back to around $1640 and then continued to rise. After refreshing the new low of 1615 since April 2020, it suddenly soared, reaching a maximum of $1663 per ounce and closing at around 1660 .

The reason why the price of gold can rebound in the short term is due to the combined effect of the high and sharp drop in the US dollar and the sharp drop in real yields, and the occurrence of these two major changes points to the same event - the Bank of England's rescue of the market. On Wednesday afternoon, the Bank of England announced the temporary purchase of long-term government bonds from September 28 to October 14 to prevent the further spread of the financial crisis. The scale of each operation does not exceed 5 billion pounds, and the total size does not exceed 65 billion pounds.

The Bank of England's bailout has two major impacts: On the one hand, the bailout has brought some comfort to the recent global turmoil in financial markets, as investors seem to believe that the Bank of England's case of buying and buying to stop the market from falling will be followed. The recovery in risk appetite in the market has weakened the demand for the US dollar, causing the US dollar index to continue to fall sharply on Thursday, which is one of the key factors driving the rebound in gold prices.

On the other hand, the Bank of England's bond purchases directly lowered the yields of British government bonds, but the spillover effect caused the yields of government bonds in other countries to fall sharply. The yield on the 10-year U.S. Treasury bond fell by 21 percentage points on Wednesday. basis point. The sharp drop in nominal yields has a direct impact on real interest rates. Real yields, measured by the yield on 10-year inflation-protected bonds, tumbled by 25 basis points on Wednesday, another key to boosting the price of gold.

Market Outlook

The U.S. dollar has retreated from a strong rally for two consecutive days, and the time has not yet come to a turning point. Although the resistance from rival currencies (GBP, EUR) is increasing, the interest rate outlook and risk aversion will continue Support for the US dollar index. If the dollar continues to strengthen, then the rebound in gold prices may only be short-lived.

In terms of real interest rates, the Bank of England's temporary bond purchases are unlikely to be widely followed, especially since the Fed is unlikely to resume bond purchases to support the U.S. bond market shortly after the start of the balance sheet reduction, so the fall in U.S. nominal yields may It is also temporary, and with inflation peaking, real interest rates may rise faster than nominal interest rates in the future, which will be unfavorable for gold prices.

Technical Analysis

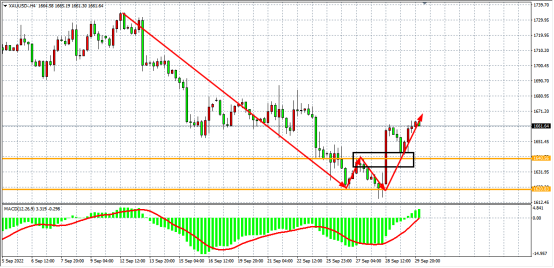

4 hour chart Look, the price of gold formed a shock range of 1620-1640 on September 29. With the short-term double bottom pattern after 1640 was broken, it fell back to 1640 yesterday and continued to rise again, confirming the support of this level again, and the market outlook is at this level. If it runs above, continue to see a rebound of 1680-1700, if it falls below 1640, it will fall back weak, and look at 1620-1600 below.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia