British Prime Minister's New Year's speech, pound and US outlook weak

2022-12-31

2022-12-31

1267

1267

GBP/USD remained largely volatile this week, rising 0.09% to $1.2063 at the end of the day, representing an annual decline of 10.8%. A weaker dollar and the Bank of England's hawkish policy supported the pound, but a weaker outlook for the UK economy limited gains for the pound. The Bank of England will continue to raise interest rates next year, which will curb domestic investment in the UK while raising mortgage rates and curbing residents' propensity to consume.

Sterling net short positions fell by 10,887 contracts in the week ending December 27, 2022. By the end of the first quarter of 2023, the pound will fall to the 1.14 level against the dollar from the current level of around 1.21. Markets are particularly negative on the growth prospects of the UK economy. will fall into a year-long recession in 2023. In 2023, UK GDP will shrink by 0.4%.

Britain's problems will not "disappear" in 2023 after a "difficult" 12 months, Prime Minister Sunak said in his New Year's address. Sunak said in his speech that the coming year will be very difficult. The new crown epidemic and the situation in Russia and Ukraine have had an impact on economies around the world, and the United Kingdom has also been affected. Many Brits are facing unprecedented electricity price increases. Sunak said that he "will not pretend that all problems will disappear in the new year", but in 2023 Britain will have the opportunity to "show its best side on the world stage".

A number of research institutions predict that the British economy is expected to shrink further by the end of this year and in 2023. UK GDP will shrink by 0.3% in the fourth quarter of 2022, and by 0.3% in the first and second quarters of 2023. The Bank of England previously predicted that the British economy may fall into a technical recession starting in the fourth quarter, and the recession may extend into next year.

Inflation will remain a conundrum for the UK economy in 2023. Most market participants said that UK inflation may slow down next year, but it will continue to run at a high level. Against the background of high inflation and a tight labor market, the Bank of England will raise interest rates from the current 3% to around 4.5% early next year; even in the face of a recession, the Bank of England will not consider cutting interest rates until 2024, and curbing inflation still remains will be its primary goal in 2023.

UK Prime Minister Rishi Sunak is preparing to halve financial support for companies' energy bills amid concerns over costs, The Times reported. The report did not cite sources. Former Prime Minister Truss announced a six-month plan in September to subsidize wholesale energy prices for businesses. Chancellor of the Exchequer Hunt "is set to announce a 12-month extension to the scheme, but the level of the subsidy will be halved, amid concerns that taxpayers will be exposed to volatile energy prices. ”

Sterling has rebounded from a sharp sell-off sparked by former Prime Minister Truss' unfunded tax cut proposal in September 2022. It is expected that GBP/USD will fluctuate in the range of 1.23-1.28 in 2023. For the pound to continue to appreciate, the UK needs to come up with a sustainable long-term growth strategy. The outlook for the UK in 2023 is bleak, with a possible recession, the largest foreign trade deficit among developed countries, and trade with the EU hampered by Brexit.

The Bank of England also faces a daunting task of reducing high inflation without deepening the UK recession and falling house prices. Against this backdrop, the market believes that GBP/USD could weaken further. Expect GBP/USD to average between 1.23-1.28 until long-term conditions improve.

The British Ministry of Health and Social Security stated on December 30 that starting from January 5, Chinese passengers need to show a negative nucleic acid certificate within 48 hours before they can board the plane. This is the first time that Prime Minister Sunak has decided to reinstate travel restrictions for the new crown since the UK lifted all new crown restrictions in February this year. In addition, the United Kingdom has also decided to test nearly one-fifth of the passengers from China in the United Kingdom for genetic sequencing analysis and tracking of the virus strain. However, scientific advisers such as the UK's vaccine director also said that the UK's border testing is meaningless because it cannot stop the spread of the virus, and there is currently no evidence that a new variant of the new crown has emerged in China.

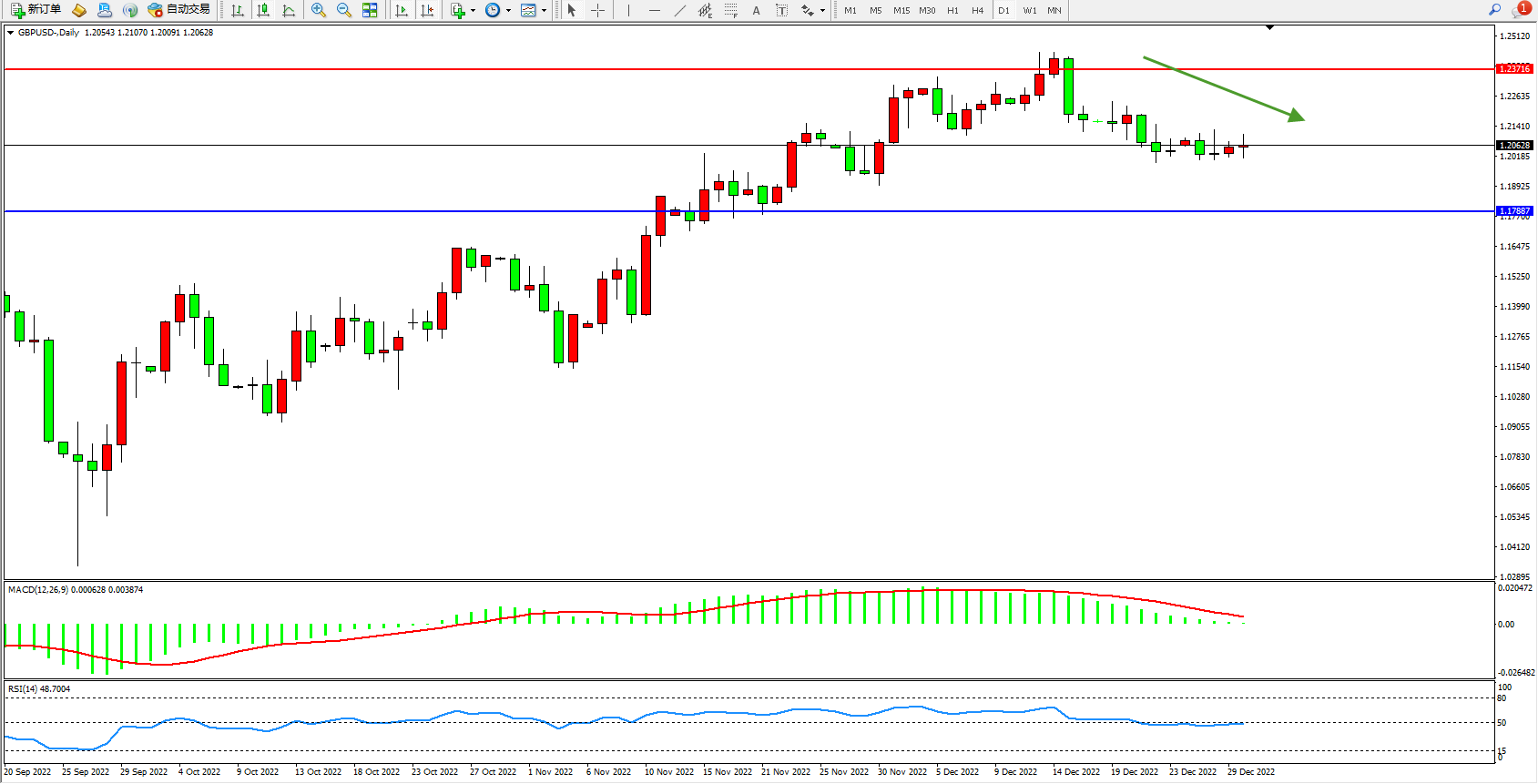

The daily K-line chart of GBP/USD shows:

The high-level short-term dynamics maintain a weak position and slowly move down, and the market's short-term sentiment begins to emerge downward. The upper side suppresses and focuses on around 1.23716, and the low-level support focuses on around 1.17887. , as shown in the figure:

[Disclaimer] This article only represents the author's own opinion, and is neutral to the statements and opinion judgments in the article. It does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained, and does not constitute any investment advice. , readers are only for reference, and all risks and responsibilities are assumed by themselves.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia