The GBP/USD fluctuated and climbed this week, benefiting from a weaker U.S. dollar. Meanwhile, expectations of a rate hike by the Bank of England also supported the GBP. The Bank of England announced on June 16 that it would raise its benchmark interest rate from 1% to 1.25%, the fifth time the Bank of England raised interest rates since December last year. In the minutes of the meeting released on the same day, the Bank of England predicted that the UK's gross domestic product (GDP) in the second quarter would fall by 0.3. The UK economy may fall into recession with a sharp rate hike.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange business position report shows that as of the week (hands) of 2022-06-21, the long positions of GBP/USD decreased by 6841 lots to 177170 lots. GBP/USD rebounded greatly, and the market's expectations for a substantial interest rate hike by the Bank of England increased.

Sterling will weaken as markets may be forced to scale back expectations for a rate hike by the Bank of England. The UK forward rate curve appears to be "too aggressive" pricing in rate hikes given evidence that the UK economy is deteriorating. Only one 25bps rate hike is expected in August, with rates peaking at 1.50%, while the UK forward curve still reflects a peak of more than 3%. GBP/USD will fall to 1.15 by the fourth quarter of next year.

According to data from the Office for National Statistics on June 22, the UK consumer price index (CPI) rose to 9.1% in May from 9% in the previous month, the highest since March 1982. In addition, the UK CPI rose 0.7% month-on-month in May, slightly higher than the previous expectation of 0.6%. The inflation data was in line with economists and analysts' expectations. Foreign media reported that the May data rose further, indicating that the current British inflation situation is grim, and the future inflation outlook may further deteriorate. Inflation levels in the UK have been rising recently as soaring food and energy prices continue to push up the cost of living. The Bank of England had expected the UK CPI to exceed 11% in October.

Britain's strong labour market, fiscal stimulus recently announced by Chancellor Rishi Sunak and excess savings accumulated during the pandemic are all seen as cushioning the economy. At the same time, price pressures do not appear to have intensified and may have peaked, which could point to the benefits of the MPC starting the rate hike cycle earlier than other developed-world central banks, he said. As such, they remain in the institutional camp, arguing that a recession will be avoided, even though the economy is slowing.

"While output is holding up fairly well for now, as businesses try to address staffing shortages and employment continues to grow, the outlook is changing," Berenberg economist Salomon Fiedler said in a note published after the PMI data. “The survey pointed to a sharp drop in new orders indicators and business expectations to their lowest level since May 2020,” he added.

The UK economy appears to be heading into recession, with worsening supply shocks, soaring inflation and tighter monetary policy overpowering most of the sound fundamentals. The UK recession is forecast to last for four quarters, from the second quarter of 2022 to the first quarter of 2023, and Berenberg expects peak-to-trough real GDP of around 2.2%.

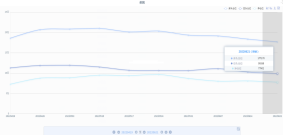

The daily K-line chart of GBP/USD shows:

The bearish power is oscillating downward in a step-like manner. The low level falls below the node near the lower rail of the Bollinger Bands indicator and then reverses and moves up. It is about to touch the node near the middle rail of the Bollinger Bands indicator and begins to organize. The top suppresses and focuses on the vicinity of 1.25841, and the low support focuses on the node near 1.20037. , the Bollinger Bands indicator is closing, the MACD indicator is in the short area to maintain order and translation, and the RSI indicator is in a weak position below the 50 equilibrium line, as shown in the figure:

[Disclaimer] This article only represents the author's own views, and remains neutral with respect to the statements and opinions in the article, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained therein, and does not constitute any investment advice. Please read For informational purposes only, and at your own risk and responsibility.

2022-06-27

2022-06-27

1381

1381

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia