Bank of England and the market game to maintain inflation target of 2%

2022-09-29

2022-09-29

1269

1269

The yield on the 30-year British government bond fell the most on record after the Bank of England announced its bond purchase plan. British government bonds continued to soar. The yield on the 10-year government bond fell 42 basis points to 4.08%. Sterling failed to hold gains after long-dated Treasuries, showing the challenges the central bank is facing now.

The Bank of England is currently playing games with the market and has not reached a stable equilibrium. That means they may need to do more, which could include emergency rate hikes. Talk of the pound falling to parity has been heating up since last Friday, but that could be just the beginning. Under the conditional reflex, it fell to 1.0620 once, triggering intraday stop loss.

The new Truss government has unveiled the most aggressive tax cuts since 1972 - through a series of tax cuts totalling £45bn between 2026 and 2027. In addition, the Truss government has launched a massive energy support package, which is expected to cost more than £100 billion over two years.

Markets were strongly affected by these new measures, with UK bonds falling and GBP plunging to an all-time low of 1.0356 on Monday before paring losses but remaining subdued. Britain's new government's "mini-budget" announced on Friday is a "new way to focus on growth in a new era," according to Britain's finance minister Quatten Those earning more than £150,000 ($160,000) are levied a 45% income tax bracket, reducing the top rate to 40%.

免費開通賬戶> > 入金最高送 $88

British media reported that the IMF's harsh rebuke reflected similar concerns among the world's major financial institutions that the brewing economic crisis in Britain could lead to a slowdown in the global economy. A massive unfunded tax cut package in the UK is not creditworthy for the government, which is not expected to regain its growth potential until 2026.

Bank of England Governor Bailey said in a statement that he is closely monitoring the situation in financial markets. Policymakers will assess the fall in sterling and the impact of the UK government's fiscal plan at the next monetary policy meeting in November, and will not hesitate to change interest rates if needed to bring inflation back to a sustainable level over the medium term. to the 2% target. Bailey's remarks quelled speculation that the Bank of England would take a related emergency move, disappointing traders.

Marinoff, a foreign exchange strategist at Credit Agricole, believes that if the market continues to sell sterling, such as the pound and the dollar approaching parity, then the Bank of England has no choice but to support the pound. Some Conservative MPs have issued a motion of no confidence in the leadership of Prime Minister Truss, fearing she will "broke the economy," a former British minister has claimed, according to The Independent.

免費開通賬戶> > 入金最高送 $88

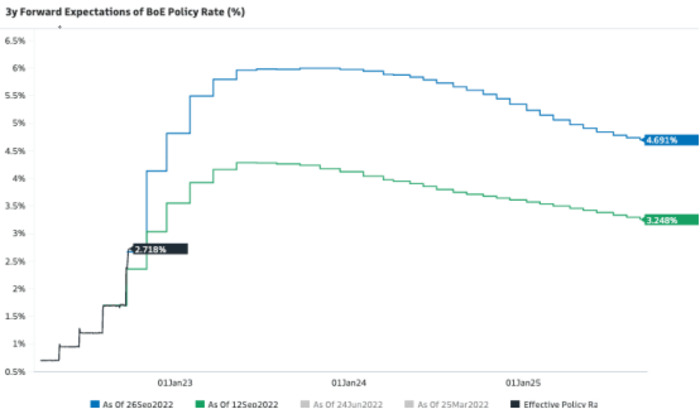

Economists say an energy price cap will lower Britain's peak inflation expectations in 2022, but inflation will remain stubbornly high for longer due to fiscal stimulus. Given rising inflation expectations, markets are now pricing in 200 basis points of rate hikes for the remainder of 2022, equivalent to 100 basis points each in November and December.

The biggest risk is that the market disappoints again on November 03, leading to a new low at the end of the year. Another risk is that the market refuses to wait until November, with the pound constantly punished in a policy vacuum. Rising interest rates raise the cost of capital globally, reducing lending and economic activity. Falling stock and commodity prices, as well as a surging U.S. dollar, are evidence of this slowdown. This unfavorable backdrop is likely to weigh on UK assets, as well as the pound, with further declines likely.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia