Yesterday, the situation in Russia and Ukraine regenerated variables, which disturbed the volatility of various assets in the market. The NATO secretary-general said the Russian army was redeploying troops in Ukraine to launch a new offensive in the Donbas region, while Putin also signed a decree requiring companies from non-friendly countries to buy gas only in rubles. Market worries that the situation will further turmoil, risk aversion began to rise, gold rose, while crude oil extended losses due to the suppression of the US oil reserve release plan.

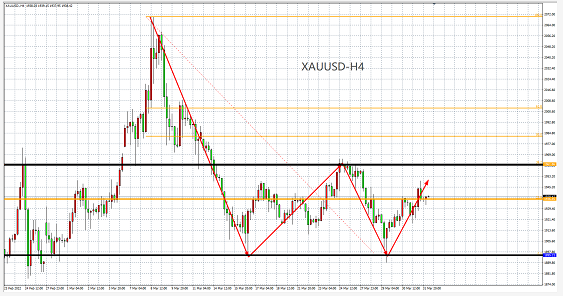

The situation of geopolitical war and the expectation of high inflation pressure combined with tightening liquidity are the three main lines affecting the recent gold price, which dominate the trend in the later period. Driven by the continued rise in inflation and the turmoil in Russia and Ukraine, gold regained support and rebounded at the $1,895 line, and tonight's non-agricultural data will be crucial to the Fed's interest rate hike plan in May, and it is expected to play a decisive role in the current downturn. effect. From a technical point of view, the price of gold is currently in a wide range of fluctuations, and the box is at 1895-1960 US dollars. No matter how the data goes tonight, the next stage of the trend can only be determined after the interval breaks.

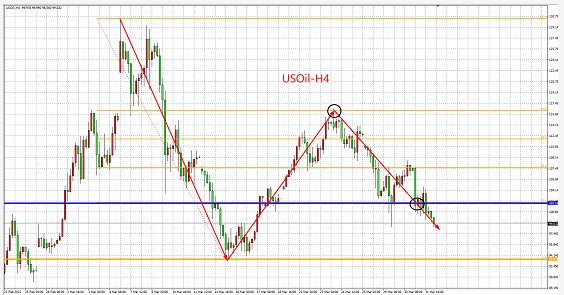

In terms of crude oil, affected by the largest sell-off of oil reserves in the history of the United States, panic quickly overwhelmed the disk, but this countermeasure also suggests that the United States may think that the conflict between Russia and Ukraine will be difficult to solve in the short term. At the same time, Putin only accepts ruble settlement in response to the sanctions from Europe and the United States, and OPEC also adheres to the strategy of increasing production slightly. The long-term supply gap caused by Russia to the market has not yet been made up, and oil prices are still expected to rise again after the correction and digestion. From a technical point of view, U.S. oil rebounded to $116 in this wave and was blocked and continued to decline. The current support has been broken one after another. It remains bearish below $102 within days, and the strong support below is near $94. Low open positions and more orders.

The above content is for reference only and does not constitute the basis for order construction. Investment is risky, and transactions should be cautious.

2022-04-04

2022-04-04

809

809

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia