There is an "opportunity" in the crisis, analysis and judgment of the current round of gold market

2023-03-20

2023-03-20

1157

1157

Summary and analysis of gold news in March, insights into opportunities usher in key opportunities!

Directory

1. Recent news and market review

2. The real reason affecting the fluctuation of gold price

3. Coping strategies

4. Summary

1. Recent news and market review

At the beginning of March, Federal Reserve Chairman Powell gave a hawk in the Senate testimony, saying that if necessary, the Fed is ready to accelerate the pace of interest rate hikes, the terminal interest rate may be higher than expected, and use more substantial interest rate hikes to control inflation.

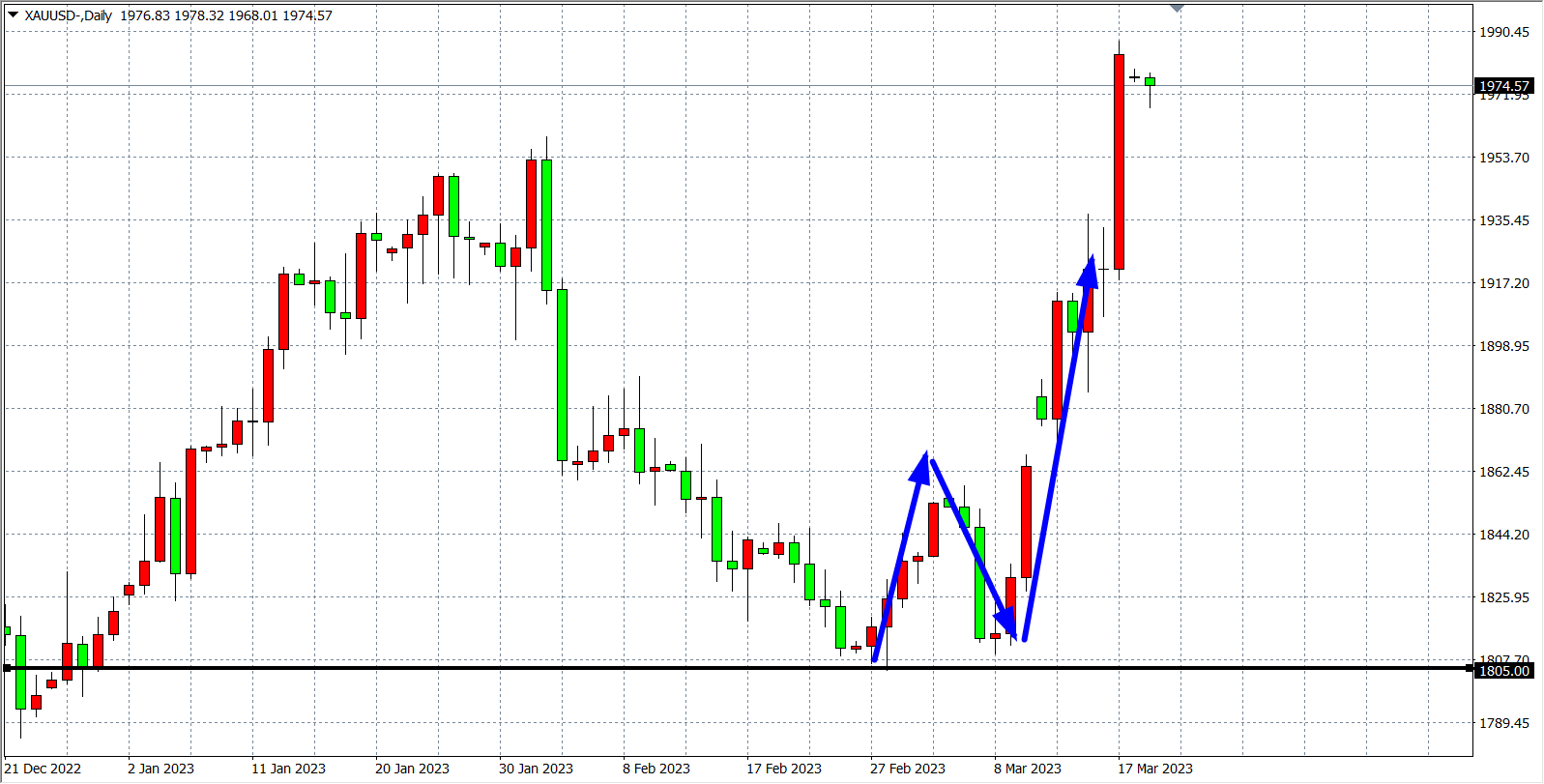

Affected by this, gold closed sharply down by more than $30 on March 7. Powell’s speech exacerbated concerns about interest rate hikes and strengthened the U.S. dollar, causing most commodities and currencies to fall. Gold is no exception, but it is also It is because of this wave of accelerated decline that gold ushered in the opportunity to build a bottom.

This sharp drop is also a correction following the rising wave of gold in the previous stage (February 27-March 3), and finally gained support at the 1805 line, starting a strong rebound and ushering in the "third wave" ; The upside mainly rises in the market.

The current round of gold price rise stems from the "Silicon Valley Bank crisis incident". Just as Powell was hawking his hawks, the share price of Silicon Valley Bank closed down by more than 60% on March 10. The reason was that Silicon Valley Bank sought to replenish capital after suffering investment losses, which triggered a sharp drop in US bank stocks across the board.

Subsequently, the Silicon Valley Bank incident fermented, the agency suggested withdrawing funds, Standard & Poor's downgraded the rating, the KBW Bank Index hit the largest drop since June 2020, and led to investment losses in Silicon Valley Bank. The liquidity crisis highlighted the Fed's Huge risk under rising interest rates. As the Federal Reserve raises rates aggressively, and interest rates rise sharply, the assets of banks that increased credit and made other investments when interest rates were low have shrunk, while banks have to work harder to retain depositors, which means banks need Pay more to retain customers, or in some cases sell some low-yielding assets at steep discounts to meet depositor withdrawals. For smaller regional and community banks, the loss of deposits can be severe and severely impact profitability.

The Fed's benchmark interest rate has risen from near zero in March last year to 4.75% today. Although the economy seems to have avoided a recession, the crisis at Silicon Valley Bank is the first sign of an economic recession and has a huge impact on the market. . In this sense, the thunderstorm at Silicon Valley Bank spread panic quickly.

Coincidentally, after Silicon Valley Bank, several banks experienced liquidity crises. The stock price of Credit Suisse, the second largest bank in Switzerland, plummeted. publication of the annual report. The move sparked concern after the bank last month announced a second straight year of losses and warned of further annual losses in 2023.

Subsequently, Credit Suisse's crisis was confirmed by the market. The 2022 financial report released by Credit Suisse Group showed that Credit Suisse found "major flaws" in its reporting procedures for fiscal years 2022 and 2021, and is taking remedial measures. The stock price of Credit Suisse fell to a record low and the banking crisis spread. Investors continued to avoid riskier assets such as stocks and oil in favor of safe haven assets. Gold soared all the way driven by safe-haven buying. It has risen by more than 6% in a single week, and has risen by more than 10% since the banking crisis, making it the most dazzling asset in March.

2. Reasons affecting gold price fluctuations

Since Silicon Valley Bank, Credit Suisse and other financial institutions have suffered consecutive "thunderstorms", the governments of all countries have been caught in a "dilemma". crisis. At the same time, after the banking crisis fermented, the Federal Reserve released about US$300 billion in liquidity through the discount window, and the expansion of its balance sheet exceeded market expectations. ) The Federal Reserve is tentatively raising interest rates on its interest rate resolution.

Because the bankruptcy of Silicon Valley Bank in the United States has greatly weakened the Fed's interest rate hike expectations, the US dollar has fallen sharply in recent days, almost returning to the level it was a month ago. The surge in safe-haven demand combined with the positive monetary environment has led market investors to abandon risky assets such as stocks and commodities, and thus pour into safe-haven assets. The central banks of various countries have huge buying opportunities for gold, which is endorsed by natural credit, and its value is highly valued by market investors. recognized.

Gold is an international hard currency, and the price of gold and the U.S. dollar index show a negative correlation. Therefore, when the economy is in recession, the U.S. dollar or the U.S. stock market is bleak, funds will enter the gold market, and buying gold at this time can be a hedge. Not only individuals will buy gold as a hedge, but the national central bank will also buy gold as a hedge. When the credit value of the US dollar declines, the central bank will hoard gold.

At the same time, the stability of a single country's currency will change with the country's turmoil or war. At this time, the currency as a means of circulation will no longer have deterministic value, and the world-recognized gold will come in handy . In addition, the financial market itself is also unstable. If a financial crisis breaks out in the financial market and the currency depreciates sharply, gold can also be used as a fixed asset to offset the depreciation of the currency.

The current price of gold is approaching the $2,000 mark, which is within easy reach of its all-time high two years ago. Last week, the rise in risk aversion made safe-haven assets such as precious metals rise sharply. In addition, the central bank’s increase in gold holdings is one of the most effective indicators of rising gold prices. Global central bank gold purchases hit a record high in 2022. At the same time, gold exchange ETF positions have risen for four consecutive days and are currently at a three-week high. The world's largest gold-backed ETF, SPDR Gold Shares, is set to record its biggest weekly inflow in a year. Superimposed on the above factors, the price of gold is expected to maintain an upward trend, and the current round of price highs is expected to break through the highs before 2020.

3. Coping strategy

Basic Judgment:

From the two events of the banking crisis and the slowdown of the Federal Reserve’s interest rate hike, we can roughly see that the key to affecting the price of gold at present is risk aversion. It is supported by the influx of safe-haven funds and the increase in holdings of major institutions.

The main reason for the change in interest rate hike expectations is the collapse of Silicon Valley Bank (and the subsequent fermentation of market sentiment). After Silicon Valley Bank announced its bankruptcy on March 10, just one weekend later, the Federal Reserve Bank of the United States fully guaranteed the funds of depositors, calming the crisis in Silicon Valley Bank. It is worth noting that the Federal Reserve only guaranteed depositor funds this time, and did not bail out banks as a whole. This is not only due to the amount of funds, but also the moral hazard behind the bailout.

Silicon Valley Bank's crisis is resolved, but the potential crisis in the banking industry caused by the Federal Reserve's aggressive interest rate hikes for more than a year has not subsided. Although most banks do not hold as many long-term MBS securities as Silicon Valley Bank, the unprecedented pace of rate hikes still puts the US banking industry under pressure.

Given that the Fed’s interest rate hike is to suppress inflation, and the recent turmoil in the banking industry has made the monetary policy authorities cautious about raising interest rates sharply, how the interest rate decision in March will strike a balance between the two has become the market’s concern focus. Fortunately, the latest US CPI data released last week continued to fall from the previous value, which makes curbing inflation less urgent. However, core inflation remained high at 5.5% in February, which means the Fed still needs to do more to fight inflation. For the market, the Fed's movements are still confusing.

In terms of fundamentals, the environment is still relatively strong for gold. Even if the Fed chooses to take risks in order to curb inflation and maintain interest rate hikes, under the concentrated outbreak of the banking crisis, interest rate hikes will exacerbate concerns about economic recession. Gold's hedging Value is brought into play. And once the Fed stops raising interest rates or starts cutting interest rates, the dollar and U.S. bond yields will lose momentum to continue rising, which is also good for gold. No matter which level is concerned, the price of gold has the momentum to continue to rise, and continuing to rise will be a high probability event.

Technical judgment

- Medium and long-term analysis:

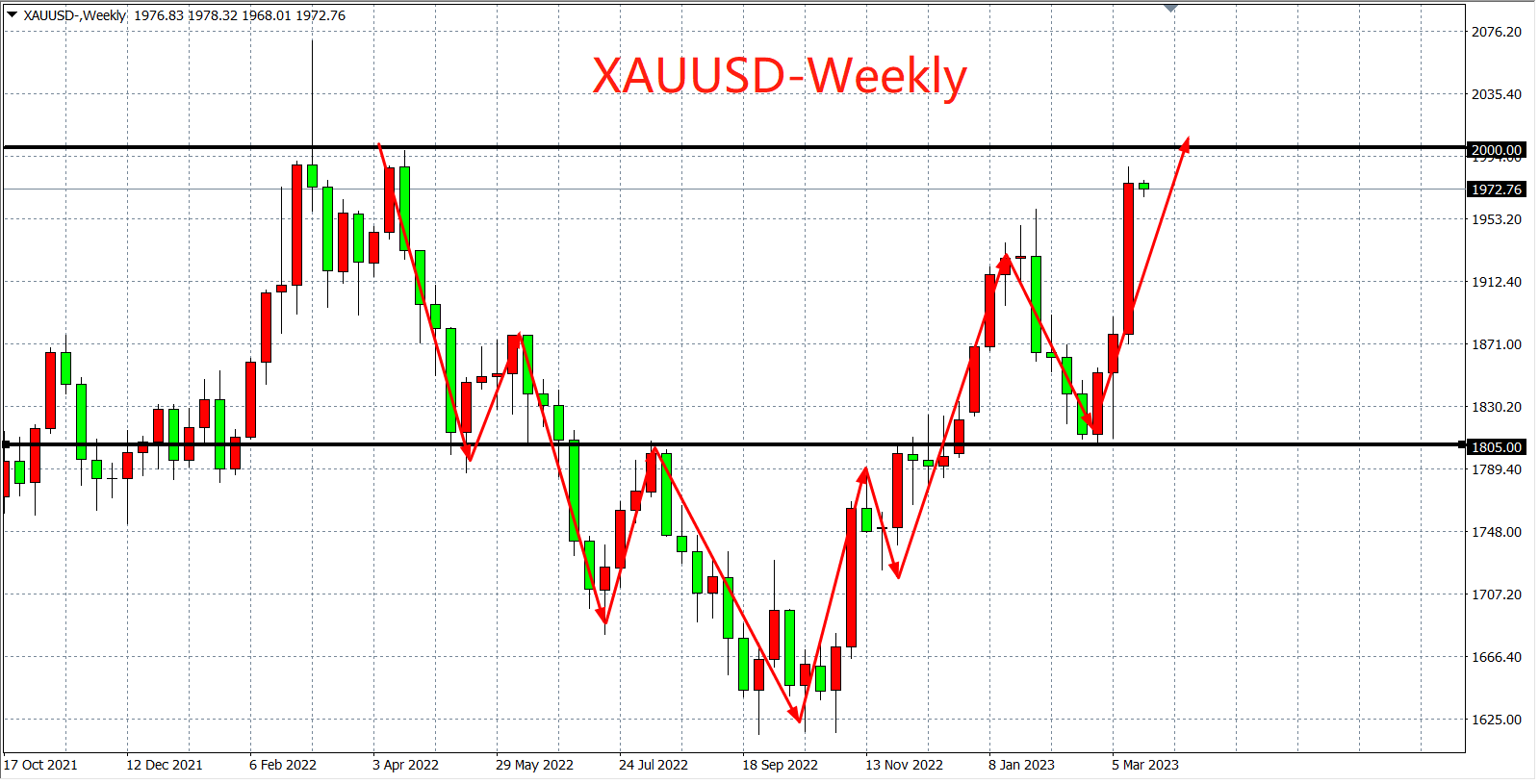

Analyzing the weekly chart, we can judge from the [symmetry] of the market structure that the decline in 2022 has almost been covered, and the structure of the decline is very close to the structure of the current wave of rises, forming a perfect pattern symmetry. In the rest of this month, the gold price will challenge the 2000 mark. If it breaks through the 2000 mark, the gold price will complete tonight's KPI ahead of schedule. In the rest of this year, it is expected to return to the historical high above 2070. However, if the 2000 point cannot be attacked, or rise and fall, and the high level will eventually be blocked. In view of the rising speed and intensity of this wave of the market, it is stronger than the structure of the previous wave of decline.

4. Summary

The pattern of international gold has been broken, the Federal Reserve's interest rate hike is coming to an end, and the global monetary policy pattern will usher in variables. Since the Federal Reserve has aggressively tightened liquidity for nearly a year, gold has not seen a big drop, and this wave of interest rate hike expectations has slowed down, but it immediately made up for all the losses caused by the rate hike. The resilience of gold is quite obvious. Looking forward to the market outlook, factors in the general environment are conducive to the continued strength of gold, and the preferred strategy is still bullish and long, but it cannot be ruled out that there will be repeated interest rate hikes by the Federal Reserve and other central banks, even if the Fed is still raising interest rates in the short term, the impact on gold has been relatively limited, but such "tests" are of great importance to gold bulls It will be a precious opportunity to gain momentum again. Investors seize the bargain and buy up, and their personal wealth will rise with the appreciation of the gold price.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia