The recovery of the world's two largest economies is imminent, and the oil market has a good outlook

2023-01-23

2023-01-23

1040

1040

Oil prices were also supported by expectations that the Federal Reserve would end its tightening cycle sooner, driven by an improving economic outlook in China. The world's two largest economies need more crude. The oil market has been falling on global recession fears, but there are still signs it can stay tight for longer.

U.S. Commodity Futures Trading Commission (CFTC): Last week, speculators' net long position in NYMEX WTI crude oil increased by 25,867 contracts to 182,052 contracts, a three-week high. U.S. crude oil futures settled at $81.31 a barrel, up 1.2%; oil prices closed up about $1 a barrel on Friday, rising for the second week in a row, boosted by a brighter outlook for China, the world's second largest economy. Anticipation of fuel demand.

Oil prices rose to their highest since mid-November, rising for a second straight week. The settlement price of WTI crude oil rose above US$81 a barrel, a weekly increase of 1.8%; the settlement price of WTI crude oil futures for February delivery was at US$81.31 a barrel. Brent crude futures for March delivery rose $1.47 to settle at $87.63 a barrel. Factors driving crude oil's rise this week include Wall Street's expectations for oil consumption and Unipec's heavy purchases.

The U.S. and its allies will conduct a joint review of the price cap for Russian oil in March to determine whether it complies with current market conditions, the U.S. Treasury Department said. The current $60/barrel seaborne oil price cap was only implemented in December last year. Deputy ministers reportedly agreed to review the oil price cap in March. This will allow the alliance to take into account developments in the global market.

The agreement was negotiated by officials of the Price Cap Coalition. In addition to the crude oil price cap, representatives agreed to two different caps on refined products: one for products that typically command a premium to crude oil, such as diesel, and another For products that are at a discount to crude oil, such as fuel oil.

The evidence for a ""soft landing"" for the U.S. economy appears to be mounting, Federal Reserve Vice Chairman Brainard said on Thursday. For the upcoming Fed meeting, he did not give any clear policy preference in his speech, but pointed to signs of slowing economic growth. A soft landing is when inflation falls back without any major job losses.

Inflation has been falling against a backdrop of modest growth over the past few months, manufacturing has weakened markedly, consumer spending has slowed, and other data now point to subdued growth in 2023, Brainard said. ;. The full impact of the Fed's aggressive rate hikes last year has yet to be felt. The Fed raised its target range for its benchmark overnight rate by 425 basis points to 4.25%-4.50% in 2022 to fight inflation that has climbed to 40-year highs. The full impact on demand, employment and inflation of the cumulative tightening that has not yet been fully felt is likely to be yet to come.

According to people familiar with the matter, the Biden administration is inclined to oppose any move to reduce the price cap of Russian crude oil exports, even as some European countries push to further squeeze Russia's oil revenue. Urals crude is trading well below international prices, while the $60/barrel cap has come into effect on Dec. 5, 2022. The EU agreed to review price ceilings every two months starting in mid-January, with the aim of keeping the threshold at least 5 percent below the market average. The United States wants to wait until the G7 imposes additional price caps on Russian refined fuels such as diesel next month before reassessing crude prices, according to a person close to the United States. The United States believes that these caps will interact. The U.S. stance increases the likelihood that crude oil prices will remain at $60 a barrel, as changes to the threshold require the unanimous approval of all member states.

The market sees a 4.89% terminal rate hit in June and has largely priced in the possibility that the Fed will raise interest rates by 25 basis points in February and cut rates in the second half of the year; Rising demand combined with the drop in Saudi crude oil exports to the lowest in five months supported the bullish view on oil prices; while the French strike posed a threat to the supply of refined oil in the short term and also provided impetus for oil prices to rise.

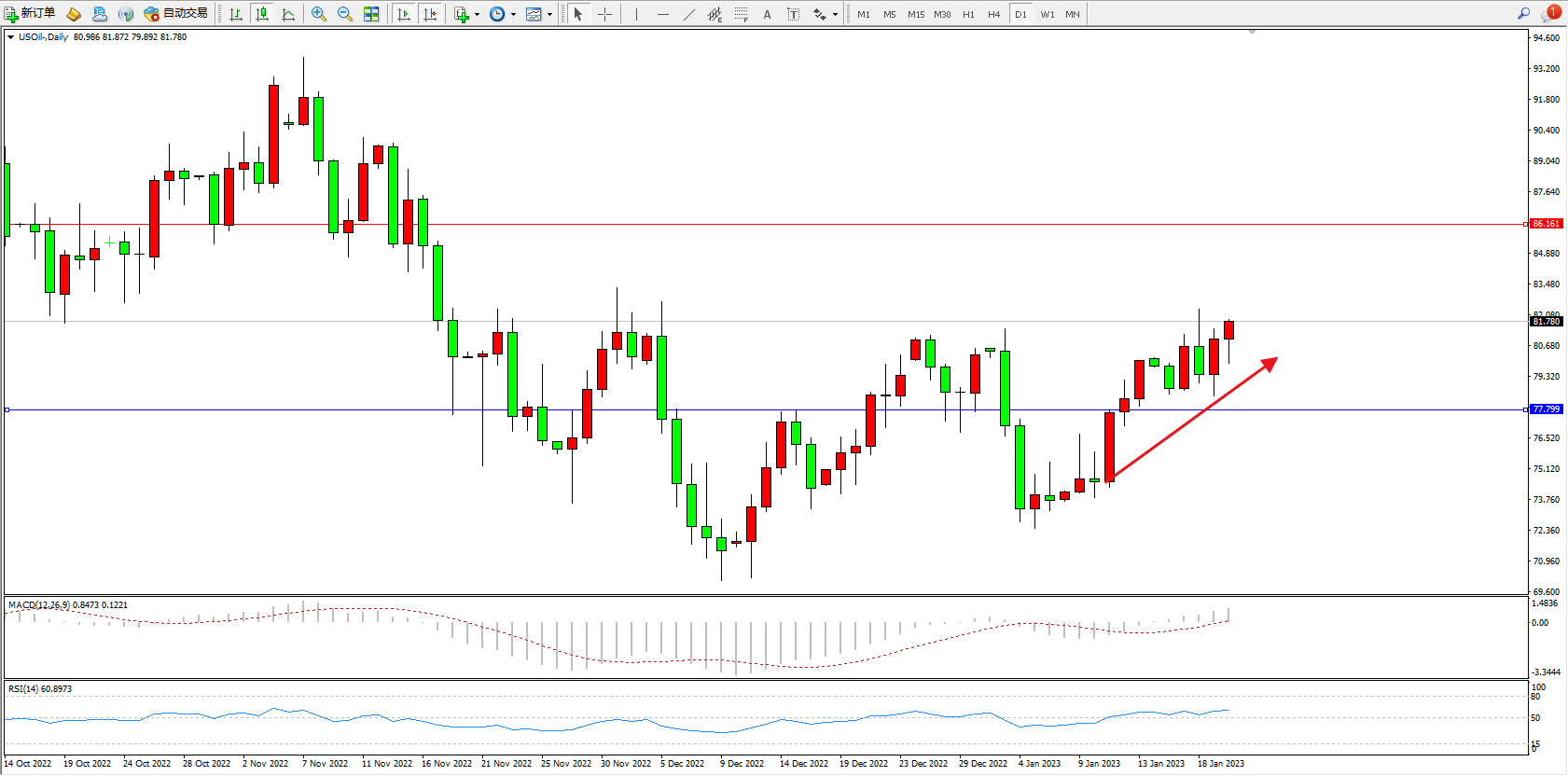

The daily K-line chart of US crude oil shows:

The momentum of the low bulls remains volatile and upwards, the short-term bullish sentiment is shrouded, the market bulls continue to rise, the upper suppression focuses on around 86, the low support focuses on around 77, the market is still in a bullish mood, and the MACD indicator is slowly on the upper side of the 0 axis On the upside, the RSI indicator is in a weak position above the 50 balance line; as shown in the figure:

[Disclaimer] This article only represents the author's own views and does not constitute any investment advice.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia