The Bank of Japan faces a new governor, and the US and Japan bulls make a comeback

2023-02-15

2023-02-15

1008

1008

Strong U.S. economic data pushes up Fed rate hike expectations

The U.S. non-agricultural and ISM non-manufacturing PMIs released on February 3 far exceeded expectations. The data proves that the U.S. labor market has recovered strongly, business activities have picked up significantly, and the U.S. economy remains resilient. Economic performance suggests that the future inflation situation is still tight, and supports the Fed to continue to raise interest rates, the dollar is raining.

From November last year to the present, U.S. inflation data including CPI, PPI, retail sales and PCE personal consumption expenditures have continued to cool down. The market has reason to believe that the downward trend of U.S. inflation has completed, and it is getting closer to stopping interest rate hikes. The data at the beginning of this month undoubtedly dampened the excessive optimism of investors, and the market re-examined the US economy and monetary policy. The dollar has thus been short-covered.

Combined with the recent frequent hawkish rhetoric by Fed officials, if the U.S. CPI in January and subsequent inflation data rise compared with previous months, the market may refocus on the Fed’s interest rate hike, and dollar bulls are expected to continue to rise. On the contrary, it will slow down market concerns, and the dollar may turn down again.

The U.S. January CPI data on Tuesday not only guides the short-term market situation, but also has a great impact on the direction of the Federal Reserve's monetary policy in March, and it will affect the whole body.

Rising hawkish expectations of the Federal Reserve support the rise of the US and Japan

Although whether inflation will rise again remains to be verified by the data, since the release of the US non-agricultural data on February 3, the market's dovish expectations have been significantly reversed. Words are fundamental benefits.

According to the CME Federal Reserve Watch tool, the market expects the central bank's interest rate peak will reach around 5.25% in July, which is an unprecedented level because it has surpassed the highest level before betting on a policy turnaround in October last year . With the market's hawkish expectations heating up, the US dollar index has rebounded by more than 2% in the past two weeks, and the US dollar has continued to rebound against the yen during this period, despite the interference of the central bank governor's candidate in the middle.

The widening of the yield spread between the U.S. and Japan ten-year treasury bonds reflects the divergence of the policy outlook in favor of the U.S. dollar against the yen. The data showed that the yield spread between the U.S. and Japan 10-year Treasury bonds returned to above 3%, up 30 basis points from the low of 2.9% at the beginning of this month.

The expectation of the governor candidate will stimulate the yen to fall

Recently, speculation surrounding the next governor of the Bank of Japan is one of the important factors affecting the trend of USD/JPY. Markets initially bet the government would nominate a less dovish governor in preparation for a change in the stance of monetary policy as Japanese inflation rose to multi-decade highs.

However, whether it is Masaka Amamiya, the most popular candidate at the beginning, or Kazuo Ueda, the latest favorite, they all show a dovish stance to the outside world. According to the latest report, Kazuo Ueda, who may be nominated as the next governor of the Bank of Japan, said in an interview that "the monetary policy of the Bank of Japan is appropriate and needs to continue to maintain an accommodative policy."

Although the governor's doves and hawks ultimately serve economic goals, if high inflation becomes a prominent problem, even the dovish governor will turn hawkish. However, in the short term, the dovish governor's expectations will still provide support for the rise of the dollar against the yen.

U.S. and Japan future risks: yield control

USD/JPY also faces an unfavorable potential risk that the Bank of Japan may be forced to raise the upper limit of the 10-year government bond yield target again. Since the Bank of Japan unexpectedly raised the upper limit of the 10-year yield target to 0.5% on December 20 last year, the market has not given up betting that the central bank will continue to raise the upper limit of the target.

Judging from the current market situation, the yield of Japan's 10-year government bonds is frequently breaking the upper limit of 0.5%. hit hard.

Outlook

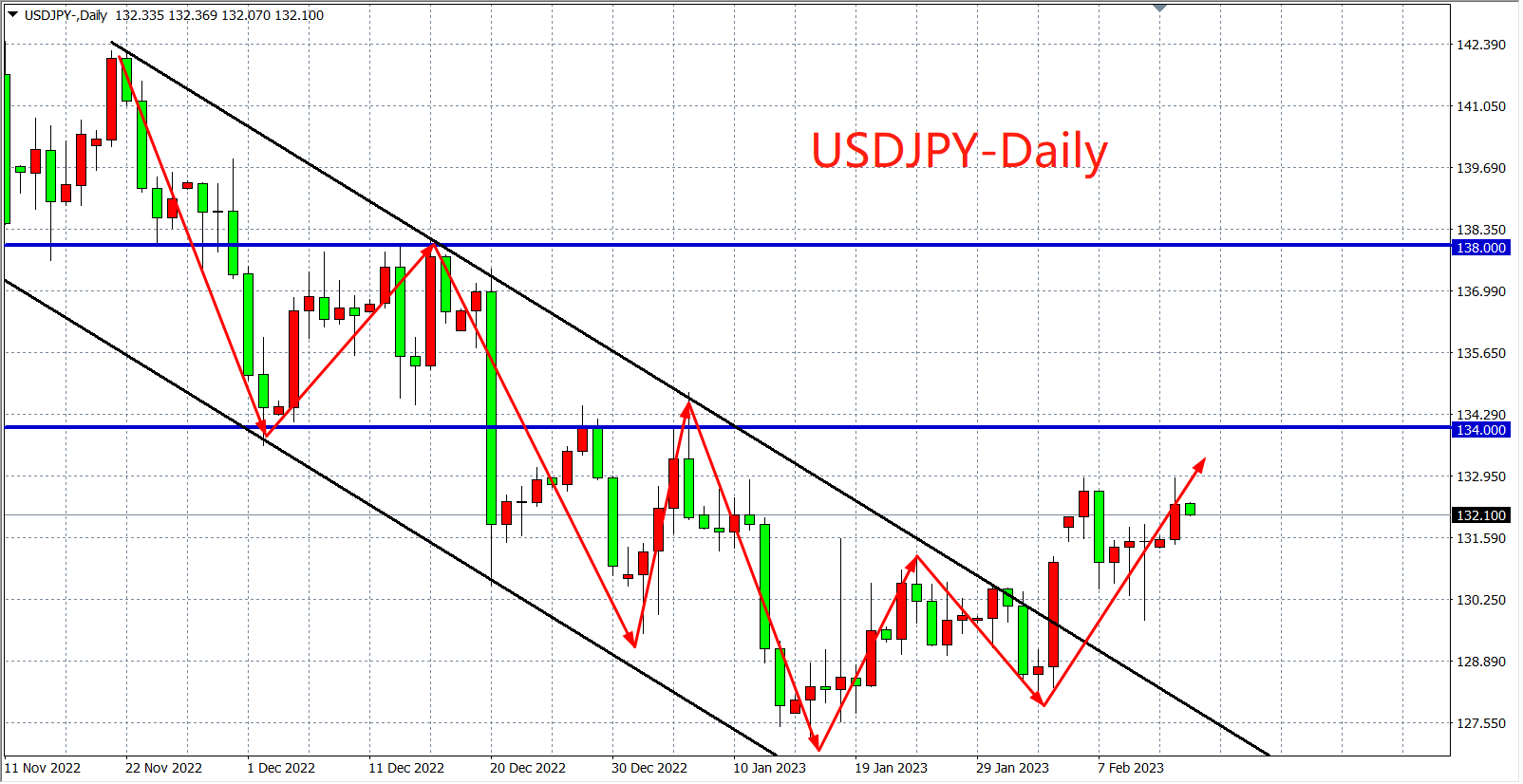

The daily chart of USD/JPY shows that the trend has broken through the suppression of the downward trend channel. It has broken through the 130 mark and appeared a double-bottom pattern. The trend is expected to further break out of the "N-shaped structure" and continue to hit new highs in the near future. Around -138-140, if the adjustment continues in the short term, look at the first-line support at the 130 mark.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia