Poor UK data weighs on pound

2022-12-26

2022-12-26

1111

1111

GBP/USD started the week higher, but has since been dragged down by poor economic data and is currently down 0.78% at 1.2055. In the third quarter of this year, the British economy contracted more than the initial value, making it the bottom of the Group of Seven (G7). The economic situation in 2023 will be dismal.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange commercial position report shows that as of 2022-12-20, the (hand) long position in the pound decreased by 35,311 hands to 123,375 hands; the downside risks of the pound are mostly, and the economic recession environment and market instability Sensitivity to that could lead GBP/USD back to the 1.15-1.18 range.

Two of the nine members of the Bank of England's Monetary Policy Committee voted to keep interest rates unchanged, suggesting the Bank of England is moving closer to ending its current policy tightening cycle. The UK is likely to continue to underperform. Markets expect the U.K. to suffer the worst recession among major advanced economies in 2023, as headwinds from both monetary and fiscal policies are severe.

Investors are betting the Fed is approaching a tipping point in its rate-hike cycle. Now, as the Fed and the European Central Bank continue to maintain high-profile interest rate hikes, which embarrass the Bank of England, the pound has been sold in cross trading. Therefore, in the near future, the trend of GBP/USD may face a more critical choice.

A new report from the House of Lords confirms that the UK labor market has changed at a structural level since Brexit, albeit in a more dysfunctional direction. Sterling could benefit if the UK government finds a solution, or if the labor market starts to adjust itself from the recent shock.

Another potential boost for sterling could come from more resilient consumers, either by drawing on excess savings or a fresh round of wage increases. British consumers continue to accumulate their excess savings, which they have been using to stimulate consumption over the past two years. While this is not expected to happen, especially as high living costs erode purchasing power, consumers using savings to spend on fuel could be an underlying driver of a more resilient growth outlook in 2023.

Sterling has room to weaken further against the euro as the European Central Bank is likely to tighten monetary policy more aggressively than the Bank of England next year. Sterling remains the third-worst performer among G10 currencies so far. On the other hand, the euro has been the top performer among the G10 currencies so far this year, with only the US dollar and the Swiss franc outperforming the euro. Considering the Russia-Ukraine conflict and the current possible recession in the euro zone, the euro is doing quite well among the G10 currencies.

Nomura released an analysis of the outlook for the world's major economies and major markets in 2023, pointing out that as the long-term recession in the United States and Europe continues to spread to Asia, Asia will face various challenges in the first half of 2023. Six quarters of recession - three markets with GDP growth rates of -0.8%, -1.4% and -1.5% in 2023, respectively. However, Australia, Canada, and South Korea have shorter recessions and will be affected by the downturn in the real estate market.

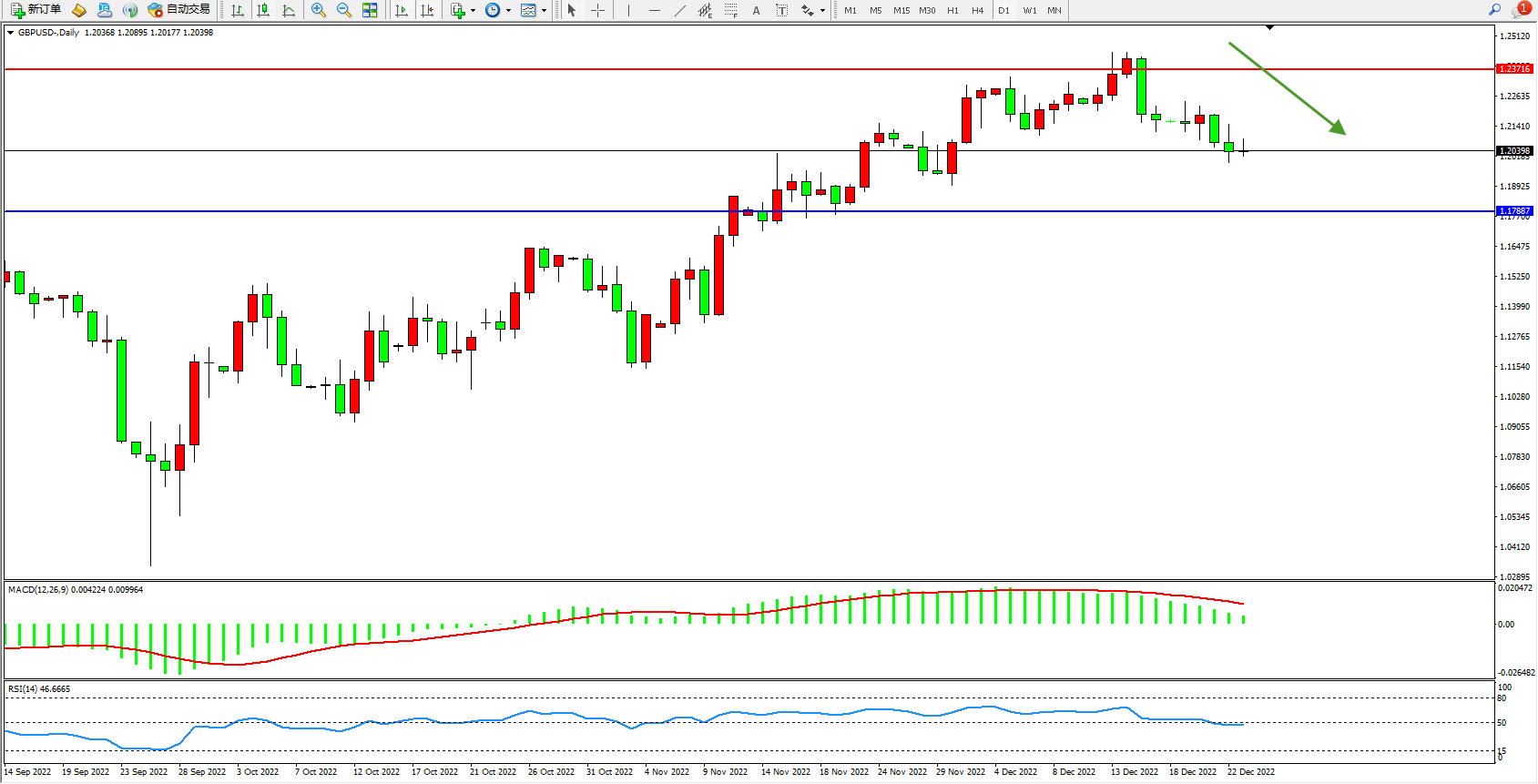

The daily K-line chart of GBP/USD shows:

The high-level short-term dynamics will continue to fluctuate and move down, and the short-term decline may continue. The market as a whole will start to move down slowly. The upper side is suppressed and focused on around 1.23716, and the low-level support is focused on around 1.17887. The MACD indicator is on the upper side of the 0 axis and moves down weakly. Weakness on the offline side;

[Disclaimer] This article only represents the author's own opinion, and is neutral to the statements and opinion judgments in the article. It does not provide any express or implied guarantee for the accuracy, reliability, or completeness of the content contained, and does not constitute any investment advice. Please read For reference only, and all risks and responsibilities are assumed by oneself.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia