Gloomy UK economic outlook weighs on pound

2022-12-12

2022-12-12

1226

1226

Sterling rose to a four-day high, up 0.3% to $1.2273, as the British government announced reforms to maintain London's status as one of the world's most competitive financial centres. The bleak outlook for the UK economy weighed on the pound.

The U.S. Commodity Futures Trading Commission CFTC foreign exchange commercial position report shows that as of 2022-12-06, the long position of the pound (hand) decreased by 3,361 hands to 168,838 hands; the key decision of the Bank of England should provide a new direction for the pound against the dollar power.

The British Retail Consortium (BRC) reported that UK food price inflation hit a new high of 12.4%. Food inflation will gain more strength and could accelerate headline inflation going forward, as labor shortages and food supply crises soar amid skyrocketing input costs. The soaring food supply crisis has raised expectations of food inflation.

The UK economy is "probably" already in recession and the pessimistic outlook from labor shortages, wage inflation, Brexit fears and weak investment could weigh on sterling gains. New Prime Minister Sunak has put in place a responsible budget, and the political drama of Truss tenure appears to have subsided so far.

Britain's finance ministry on Friday unveiled plans to overhaul the financial sector, including a review of rules that hold bankers accountable for their decisions and easing capital requirements for smaller lenders. Britain's government is under pressure to relax rules as Amsterdam overtakes London as Europe's biggest stock trading hub. Also included in Britain's financial reform plan is a review of short-selling rules, an overhaul of the prospectuses companies issue when they go public, and the repeal and reform of rules introduced during Britain's time in the European Union.

Economists at HSBC said that due to the fragile risk appetite and the Bank of England's expected 50 basis point rate hike at the meeting on December 15, we expect the pound to decline in the short term. The structural concerns that tipped GBP/USD lower in October have been less pronounced. The autumn budget has restored confidence in the UK's finances, and the UK's external imbalances have shown some signs of improvement, especially in terms of visible trade. All things considered, we expect a downside correction in GBP/USD in the short-term, but a sharp drop is unlikely.

Analysts at ING Bank said in a note that the Bank of England's Dec. 15 meeting may not have much impact on the pound, as the market has priced in a 50 basis point rate hike and the pound will struggle to move ahead in 2023. Continuation of recent recovery momentum. Despite the looming recession, the Fed continues to fight inflation in the first quarter of 2023, the dollar looks set to strengthen, GBP/USD is unlikely to sustain above 1.23, and EUR/GBP may return to the 0.87-0.88 range. With central banks raising interest rates or triggering a recession, the investment environment is challenging, and the pound may underperform given its high sensitivity to global equities.

Sterling has fully recovered from the mini-budget crisis. Still, economists at Commerzbank expect more pressure on sterling. Currently, it is widely believed that the mini-budget crisis is under control, and there is no evidence that the energy crisis will escalate further. But in the view of the bank's economists, this can only give the pound a temporary respite. The sluggish economic outlook, relatively cautious monetary policy and persistent high inflation will continue to put heavy pressure on the pound.

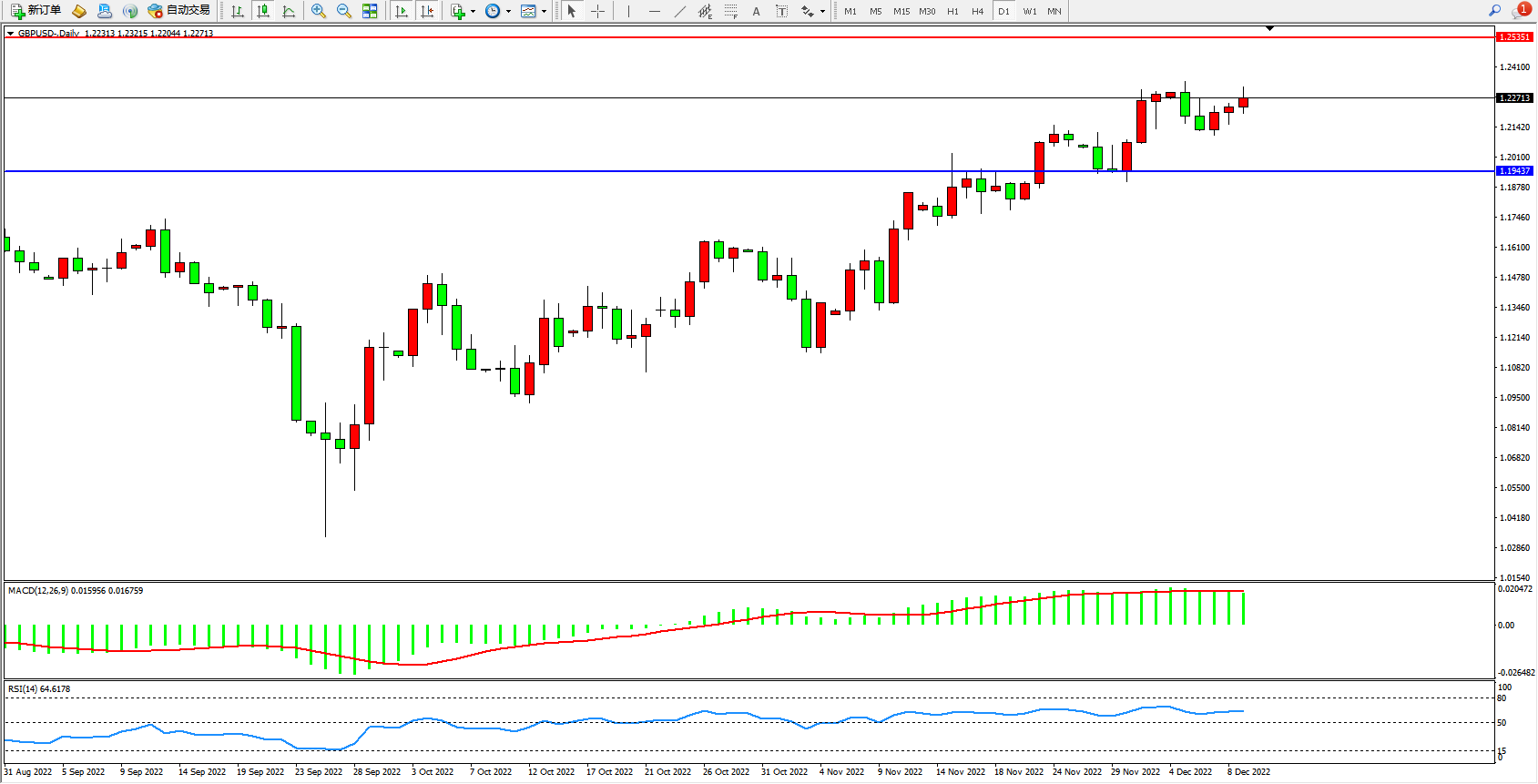

The daily K-line chart of GBP/USD shows:

The bullish dynamics are showing an upward trend and the channel continues to climb. The short-term bullish trend is good, and the bullish sentiment in the market is panting. The upper suppression focuses on around 1.25351, and the low support focuses on around 1.19437. The MACD indicator is in the bullish zone, and the RSI indicator is in the bullish zone.

[Disclaimer] This article only represents the author's own opinion, and is neutral to the statements and opinion judgments in the article. It does not provide any express or implied guarantee for the accuracy, reliability, or completeness of the content contained, and does not constitute any investment advice. Please read For reference only, and all risks and responsibilities are assumed by oneself.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia