Crude oil stabilizes and underpins inflation, and interest rate hikes continue to be under pressure

2023-02-19

2023-02-19

1040

1040

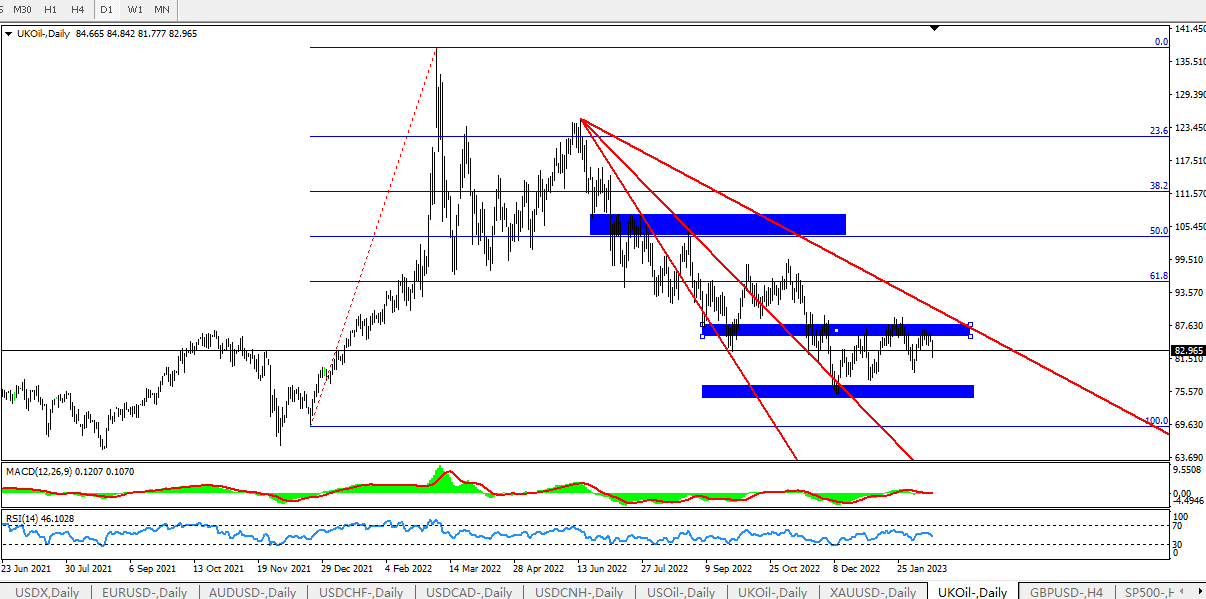

1. Price performance: On Friday (February 17), international oil prices fell to a new low in more than a week, as strong U.S. economic data exacerbated concerns that the Federal Reserve will further tighten monetary policy to deal with inflation. The move may hit fuel demand. The Saudi oil minister said that although there are many positive signals, OPEC+ will stick to the 2 million barrels per day production reduction policy within this year.

2. financial attributes are under pressure again:

- The U.S. inflation data was released on Tuesday. Inflation rebounded month-on-month in January, and the year-on-year increase was higher than expected. After that, several Fed officials expressed their support for continuing to raise interest rates to curb inflation, and did not rule out the possibility that the final interest rate will be higher than expected.

- Since December, the Federal Reserve has slowed down the expectation of raising interest rates, which has given a good boost to financial sentiment, causing the U.S. stocks to rise and the U.S. dollar to fall. If high inflation persists and the Fed keeps tightening, it will put financial sentiment under pressure again.

- Crude oil prices and US inflation have a relatively positive relationship, and the inflection points of the two are basically the same. Oil prices peaked in June last year while U.S. inflation peaked, and the stoppage of oil prices in January this year may make it more difficult for inflation to maintain the previous rapid decline.

- If bullish factors push up oil prices, causing inflation to pick up again: the Fed may expand interest rate hikes, curb inflation and put pressure on the economy and demand at the same time, causing oil prices to fall again,

- At the same time, the geopolitical aspect will also trigger Biden to suppress oil prices. For example, last Friday, after Russia announced a production cut of 500,000 barrels per day in March, this week Biden immediately announced that the sale of strategic reserve stocks would resume in March.

- Therefore, the negative feedback effect of financial attributes and geopolitical attributes may become an important pressure factor limiting the space above oil prices

3. Supply and demand expectations are gradually improving:

- The supply side is the strongest support factor for crude oil prices. Russia announced that it will take the initiative to cut production in March. OPEC announced again this week that the production cuts are expected to last throughout the year. U.S. production continued to grow slowly. Once Russia or OPEC expands production cuts or there is no short-term supply increase, the gap can be quickly filled.

- Demand expectations are gradually improving from the worst. China's road traffic has risen rapidly to a three-year high, which has definitely boosted gasoline consumption demand. Pay attention to the Chinese economy's demand for diesel industry. The demand for oil products in the United States and Europe remains weak for the time being, but the economy shows signs of stabilization, and there is a possibility of upward adjustment in demand expectations. Pay attention to the impact of monetary policy adjustments on overseas economies.

4. oil price outlook - long-short rotation drives oil price shocks

- In the fourth quarter, the price of Brent crude oil fluctuated in a wide range of 75-95 US dollars / barrel, and the range narrowed to 80-90 US dollars / barrel in January. In February, it fluctuated within a narrow range around the center of $85/barrel.

- In the short term, oil prices are expected to be supported by improving supply and demand, but the accumulation of inventories limits the upper space. If the upward speed is too fast, or face the reality and lead to a fall.

- In the medium term, the fundamental drivers in the first half of the year will be weak at first and then strong. After demand expectations are fulfilled and oil products are shifted from accumulation to destocking, the center of crude oil prices is expected to rise.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia