Bank of England's slowdown in rate hikes caps pound

2023-03-06

2023-03-06

1169

1169

Sterling edged higher against the dollar this week, but a slowdown in BoE rate hikes capped sterling. Traders reduced bets on further rate hikes from the BoE, with markets pricing in a 25-point hike on March 23 basis points, but the market's expectation of another 50 basis points of interest rate seems too aggressive.

Markets continue to signal expectations for an extended policy cycle, with three 25bp rate hikes expected by September; a reduction in hawkish bets (while the Fed and ECB remain relatively hawkish) will weigh on sterling. Since the end of 2021, the Bank of England has raised its benchmark interest rate by 390 basis points to 4%, the highest level since 2008. Investors have almost fully priced in a quarter-point rate hike at policymakers' next meeting on March 23 and a further hike to 4.75% by the end of September.

BoE Governor Bailey compared current conditions in Britain to the 1970s, suggesting further interest rate hikes may be needed to curb inflation. Bailey said that while the UK economy was broadly in line with policymakers' expectations in February, the labor market remained tight, adding to price pressures.

UK Prime Minister Rishi Sunak signed a new trade deal with the European Union on Monday aimed at remedying problems caused by the Northern Ireland Protocol. Shortly after the announcement, Sunak described the new agreement, known as the Windsor Framework, as the "beginning of a new chapter" in the UK-EU relationship.

The exact details of the new agreement are unclear, but the two leaders said the agreement has three main components, which include safeguarding the flow of trade within the UK, protecting Northern Ireland's status within the UK, and a Stormont brakes", giving the Stormont Regional Council a say on new EU rules.

The Sunak government seeks to amend the agreement signed by former prime minister Johnson. Unlike his predecessors Jansen and Truss, Sunak has taken a less combative approach to approaching the EU, hoping to reach a solution to key issues surrounding Northern Ireland by easing checks on goods crossing the Irish Sea.

Sunak also said that the British parliament will vote on the new agreement, and he is betting that the return of better terms with the EU will be worthwhile compared with the previous divisions in the party over the matter. The agreement aims to defuse tensions over the arrangements governing the province of Northern Ireland and its open border with EU member Ireland after Brexit in 2020.

The European Central Bank sounds more decisive in raising interest rates than the BoE, making sterling more vulnerable to the euro, ING said. Firms now expect to raise prices and wages at a slower pace, favoring a more cautious monetary policy, according to a survey of corporate CFOs by the Bank of England's policymaker group. The Bank of England is still seen as raising interest rates by 25 basis points on March 23, but market expectations for another 50 basis points after that appear to be too aggressive. Shaky risk sentiment could also hit the pound harder than the euro.

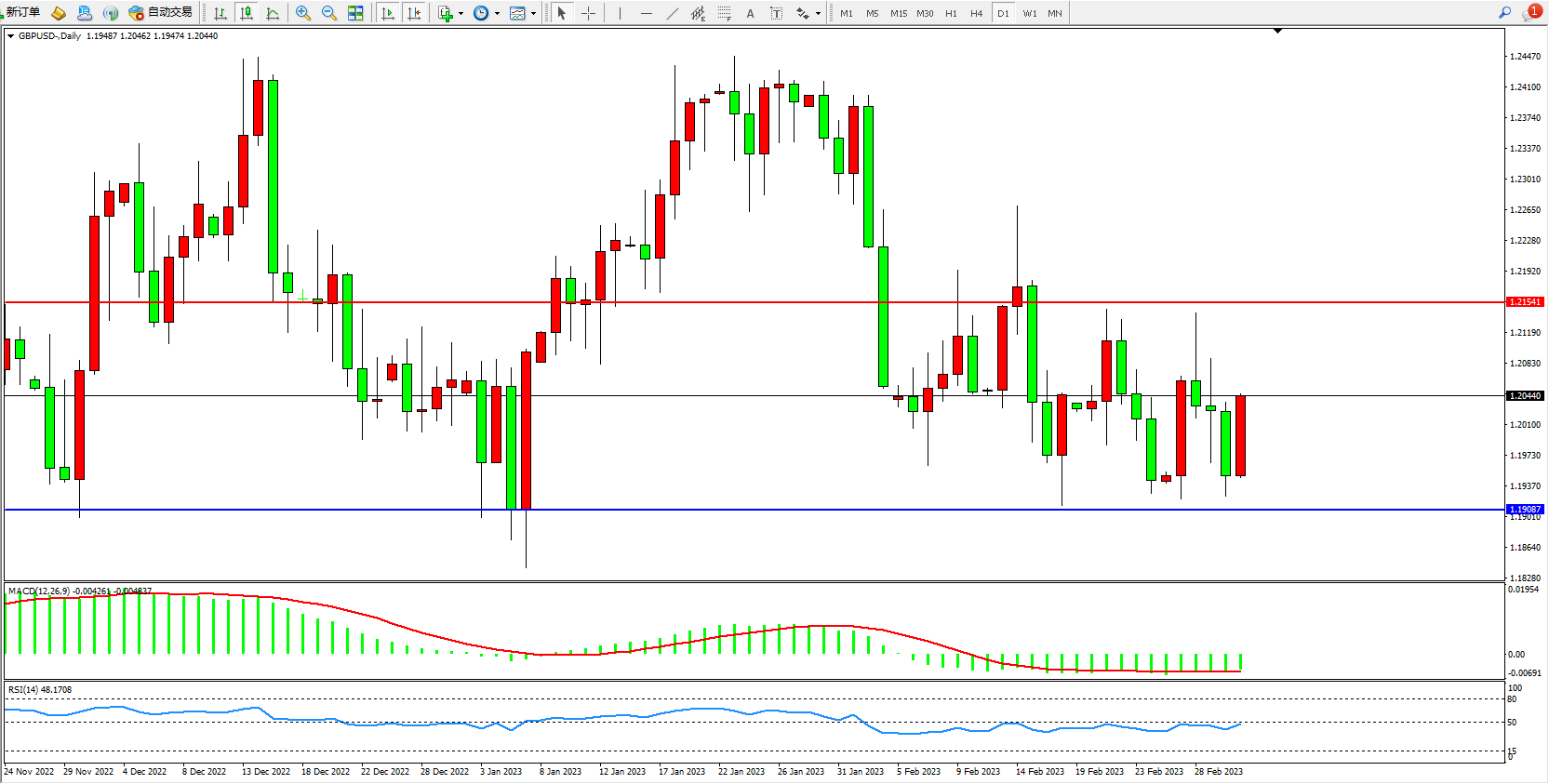

The daily K-line chart of GBP/USD shows:

The short-term volatility space is gradually narrowing, and the market as a whole is in a narrow range. The upper suppression focuses on around 1.21541, and the lower support focuses on around 1.19087. The MACD indicator is in the bearish area to maintain consolidation, and the RSI indicator is hovering around the 50 equilibrium line, as shown in the figure:

[Disclaimer] This article only represents the author's own opinion, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained, and does not constitute any investment advice. assumes all risk and responsibility.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia