Bank of England's rate hikes put pressure on pound

2023-02-04

2023-02-04

1148

1148

The pound fell against the dollar this week. The Bank of England raised interest rates by 50 basis points as scheduled, but the slowdown in future interest rate hikes and the negative economic outlook put pressure on the pound. The Bank of England raised interest rates for the 10th time in a row, reaching the highest level in 14 years, trying to curb the local double-digit inflation rate.

Sterling fell 1.39 percent to $1.20550, its lowest since Jan. 6 and its worst one-day performance since Dec. 15. On Thursday local time, the Monetary Policy Committee of the Bank of England raised the key interest rate by 50 basis points to 4% with a vote of 7 to 2, and passed the decision to raise interest rates to counter the 40-year crisis brought about by the explosive rebound of the world economy and the conflict between Russia and Ukraine. highest inflation. It also played down forecasts for a recession this year. The Bank of England's relatively dovish statement on the direction of future interest rate policy has put pressure on the pound.

The Bank of England said that successive interest rate hikes since December 2021 could have an increasing impact on the economy, and that the rate hikes would help bring UK inflation down to 4% by the end of the year about. The Bank of England had previously forecast that inflation would stabilize at around 5% in 2023.

The Bank of England's monetary policy report was "a big change from the rather dire forecasts a few weeks ago," suggesting the BoE now expects a shorter and shallower recession; The central bank raised the bank rate by 50 basis points to 4%, but the Monetary Policy Committee was divided again, with two members voting for no change in rates and one member voting for a 75 basis point hike. At present, the market is eager for the Bank of England to send a signal that its interest rate is close to or at peak water.

Weaker UK economic outlook weighed on sterling. This week, the IMF issued a relatively negative forecast for the UK's economy, predicting that its gross domestic product will contract by 0.6% in 2023. The Bank of England also believes that the country's economy is heading for a recession, but it may be ""minor"" and not too worrying at all.

Over a decade of quantitative easing, the Bank of England has built up a £895 billion portfolio of government and corporate bonds. Now, the central bank is gradually shrinking its balance sheet by allowing bonds to mature and direct sales. At the end of January, there were £828bn of gilts and £12bn of corporate bonds on the books. After the rate decision, the Bank of England is expected to explain its view on the expected pace of bond sales this year. At the same time, the British Treasury also plans to auction more bonds to make up for the growing budget deficit.

Credit Agricole analyst Valentin Marinov commented on the Bank of England's interest rate decision, saying that the language of the policy statement further suggested that the intensity of future interest rate hikes will be weakened; the risk for the pound is that Thursday's decision will be seen as dovish Interest rate hikes, thus weakening the support for the pound.

Vivek Paul, UK chief investment strategist at BlackRock Investment Institute, said: “We think the pain will be felt more in the UK than in other countries. “We are not done yet,” he said in response to the Bank of England raising its benchmark interest rate to 4%. Paul urged equity investors to look elsewhere for returns for now, adding that he remained "cautious" on gilts. “The damage to the UK real economy is only just beginning to be felt,” said Paul. “The impact of rate hikes is lagged, so near-term growth should not be speculated to be resilient. "Inflationary pressures will ease, but remain above the Bank of England's target rate due to widespread supply shortages."

Data released by the UK National Bureau of Statistics last month showed that the gross domestic product (GDP) in November 2022 will rise by 0.1% month-on-month, which is better than market expectations. Darren Morgan, head of economic statistics at the National Bureau of Statistics of the United Kingdom, pointed out that only when the British economy shrank by more than 0.6% in December last year, the United Kingdom may enter a technical recession of growth. Despite this, in December last year, the UK's manufacturing and services purchasing managers' indexes (PMI) were both below 50, in a state of continuous contraction.

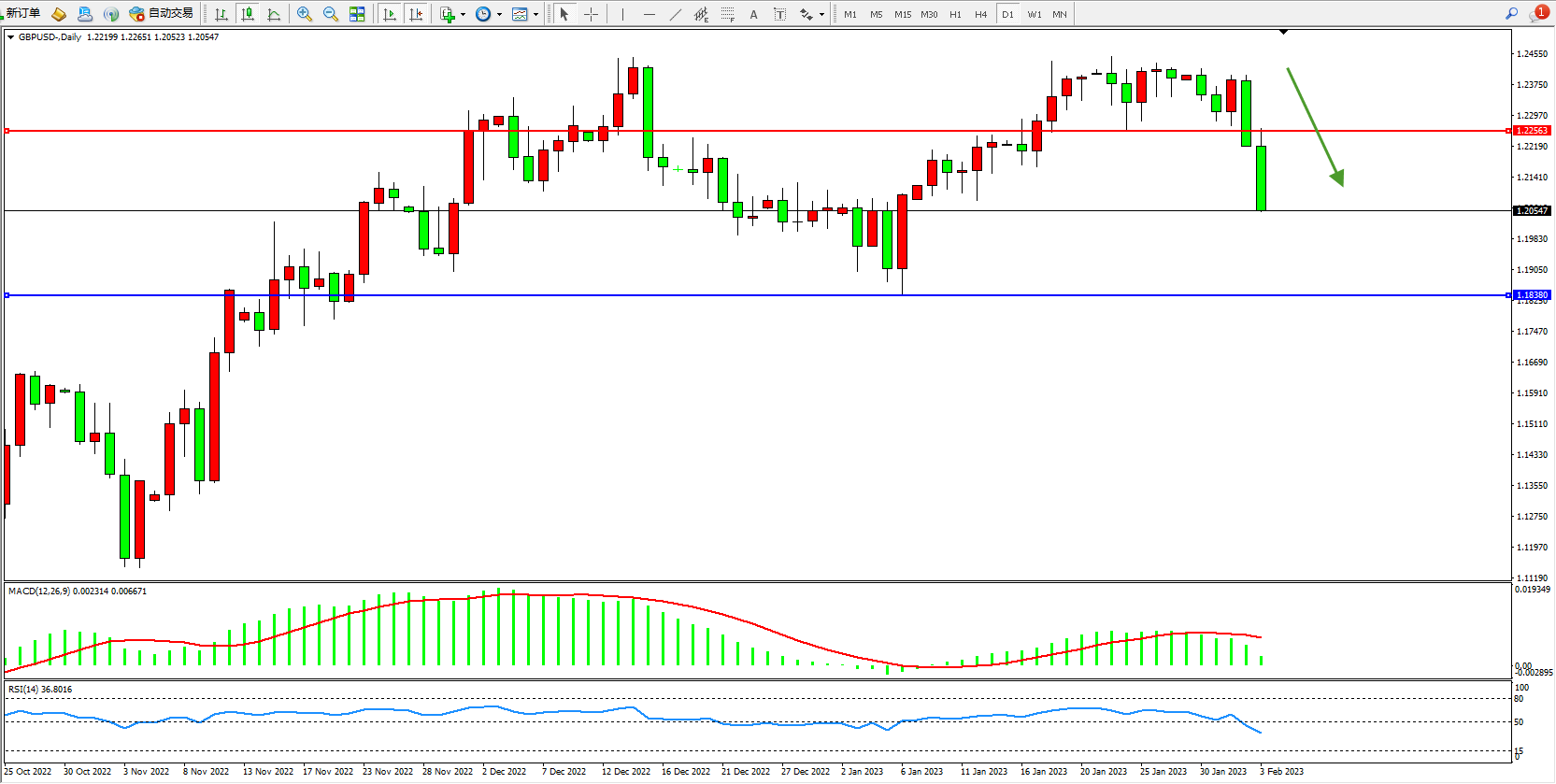

The daily K-line chart of GBP/USD shows:

The high-level short-term momentum has fallen rapidly, and there is no sign of stopping the short-term decline. The short-term momentum continues to decline. The upper side is suppressed and focused on around 1.22563, and the low-level support is focused on around 1.18380. The MACD indicator is in the bullish area. The indicator is below the 50 balance line and moves downward, as shown in the figure:

[Disclaimer] This article only represents the author's own opinion, and does not provide any express or implied guarantee for the accuracy, reliability or completeness of the content contained, and does not constitute any investment advice. assumes all risk and responsibility.

The above information is provided by special analysts and is for reference only. CM Trade does not guarantee the accuracy, timeliness and completeness of the information content, so you should not place too much reliance on the information provided. CM Trade is not a company that provides financial advice, and only provides services of the nature of execution of orders. Readers are advised to seek relevant investment advice on their own. Please see our full disclaimer.

CM Trade

As a world leading financial trading platform, CMtrade Provides comprehensive one-stop trading services and opportunities for traders.

[Products]

The platform provides over 32 kinds of popular financial products such as forex, precious metals, crude oil, indices, cryptocurrencies and more.

[System]

2 top trading systems CM Trade MT4 / CM Trade APP, powerful and easy to operate

[Service]

Comprehensive market news, professional market analysis, 7*24 hours online customer service

[Advantage]

Low cost, high leverage, flexible one-stop all day two-way trading.

[Authority]

Licensed and strictly regulated by authorities. Traders deposits are independently kept by the bank. Fast deposit and withdrawal. Fair, efficient and transparent trading environment.

CM Trade Mobile Application

Economics Calendar

MoreYou May Also Like

简体中文

简体中文

ภาษาไทย

ภาษาไทย

繁體中文

繁體中文

Indonesia

Indonesia